Markets Weekly Update (December 13) : Tesla's Stock Price Hits a New High

Markets Weekly Update (December 13) : Tesla's Stock Price Hits a New High

Macro Matters

宏观问题

The U.S. November CPI was on target with what was expected

美国11月CPI符合预期

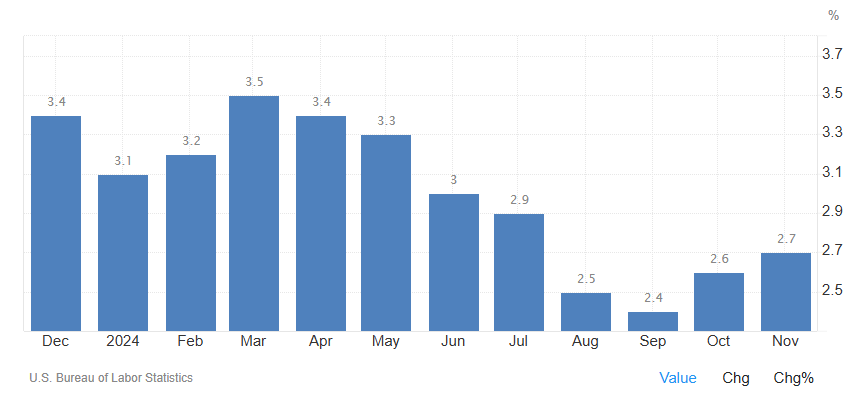

The annual inflation rate in the US rose for a 2nd consecutive month to 2.7% in November 2024 from 2.6% in October, in line with expectations. The rise is partly influenced by low base effects from last year. Energy costs declined less (-3.2% vs -4.9% in October), mainly due to gasoline (-8.1% vs -12.2%) and fuel oil (-19.5% vs -20.8%) while natural gas prices rose 1.8%, compared to 2%. Also, inflation accelerated for food (2.4% vs 2.1%) and prices fell much less for new vehicles (-0.7% vs -1.3%). On the other hand, inflation slowed for shelter (4.7% vs 4.9%) and transportation (7.1% vs 8.2%) and prices continued to decline for used cars and trucks (-3.4%, the same as in October). On a monthly basis, the CPI rose by 0.3%, the most since April, slightly above October's 0.2%, and also matching forecasts. The index for shelter rose 0.3%, accounting for nearly 40% of increase. The core CPI rose 3.3% on the year and 0.3% on the month, the same as in October and in line with forecasts.

美国的年度通胀率在2024年11月连续第二个月上升至2.7%,高于10月的2.6%,符合预期。这一上升部分受到去年的低基数效应影响。能源成本下降幅度较小(-3.2% 对比10月的-4.9%),主要是由于汽油(-8.1% 对比-12.2%)和燃料油(-19.5% 对比-20.8%),而天然气价格上涨了1.8%,相比之下之前是2%。与此同时,食品的通胀加速(2.4% 对比2.1%),而新车的价格下降幅度较小(-0.7% 对比-1.3%)。另一方面,住房的通胀放缓(4.7% 对比4.9%)和运输(7.1% 对比8.2%),二手车和卡车的价格继续下降(-3.4%,与10月持平)。按月计算,CPI上升了0.3%,是自4月以来的最大增幅,略高于10月的0.2%,也符合预期。住房指数上升了0.3%,占总增长的近40%。核心CPI同比上涨3.3%,环比上涨0.3%,与10月持平,符合预期。

The U.S. November PPI exceeded forecasts

美国11月PPI超出预期

Producer prices in the US increased 3% year-on-year in November 2024, the biggest rise since February 2023, compared to an upwardly revised 2.6% gain in October and above forecasts of 2.6%. Producer Prices Change in the United States averaged 3.07 percent from 1950 until 2024, reaching an all-time high of 19.57 percent in November of 1974 and a record low of -6.86 percent in July of 2009.

美国的生产者价格在2024年11月同比上涨3%,是自2023年2月以来的最大涨幅,较10月修正后的2.6%增幅有所上升,并高于2.6%的预期。美国生产者价格变动自1950年至2024年平均为3.07%,在1974年11月达到历史最高19.57%,而在2009年7月则达到历史最低-6.86%。

The Chinese government announced a more proactive fiscal policy and a "moderately loose" monetary policy.

中国政府宣布采取更加积极的财政政策和“适度宽松”的货币政策。

The meeting proposed an even more proactive fiscal policy than the moderately enhanced proactive fiscal policy put forward at the 2023 Politburo meeting, indicating a higher stance and greater intensity. This suggests that, based on the introduction of "incremental fiscal policies," there is considerable room for anticipation regarding the intensity of fiscal policy in 2025, particularly in terms of the scale and ratio of the deficit.

会议提出的财政政策比2023年政治局会议提出的适度增强型积极财政政策更加积极,表明立场更加高位、力度更大。这表明,基于引入“增量财政政策”的基础上,2025年财政政策力度的预期空间相当大,特别是在赤字的规模和比例方面。

The monetary policy statement is the most straightforward. Following the 2008 financial tsunami, the Political Bureau of the CPC Central Committee announced the promotion of a "moderately loose" monetary policy, which was then changed to prudent in 2010. Now, after a 14-year interval, the policy has shifted back to a moderately loose monetary policy.

货币政策声明是最简单明了的。2008年金融风暴后,中国共产党中央政治局宣布实施“适度宽松”的货币政策,并于2010年改为审慎政策。现在,在14年后,这一政策再次转向适度宽松的货币政策。

Smart Money Flow

智能资金流动

U.S. Equity ETFs saw an inflow of $149 Billion in November, the largest monthly inflow in history.

美国股票ETF在11月份流入了1490亿,是历史上最大的月度流入。

The S&P 500 has made new highs in December, but every day of the month so far has seen more stocks down than up.

S&P 500在12月份创下新高,但到目前为止,这个月的每一天跌的股票数量都超过上涨的股票数量。

China bought the dip in gold for the first time since April, China increased its Gold Reserves.

中国在4月份以来首次买入黄金,并且中国增加了黄金储备。

Top Corporate News

头条公司新闻

Google has launched the Willow quantum chip, sparking a surge in quantum computing stocks!

谷歌推出了Willow量子芯片,带动了量子计算股票的激增!

On Wednesday, Alphabet shares (GOOGL) closed up 5.46%, with the stock price rising to $196.71. The company has unveiled its latest quantum computing chip, Willow, which is causing a significant stir in the global tech community. According to Google, this tiny chip can perform calculations that would take supercomputers billions of years to complete in just five minutes! An increasing number of tech giants are joining in the commercialization of quantum computing chips, vying for future market share in areas such as artificial intelligence, drug development, energy, and the acceleration of Bitcoin mining. IonQ predicts that the quantum computing market will grow to $65 billion by 2030 and soar to $850 billion by 2040. However, the market remains volatile because many quantum computing applications are still in the developmental stage. Given the emerging nature of this technology and the market's unpredictability, investing in quantum computing stocks involves inherent risks.

周三,字母表公司(GOOGL)的股价上涨了5.46%,股价达到196.71美元。该公司推出了其最新的量子计算芯片Willow,在全球科技社区引发了重大轰动。据谷歌介绍,这个微小的芯片可以在五分钟内完成超级计算机需要数十亿年才能完成的计算!越来越多的科技巨头正在参与量子计算芯片的商业化,争夺未来在人工智能、药物开发、能源和比特币挖矿加速等领域的市场份额。IonQ预测,到2030年量子计算市场将增长到650亿,到2040年将飙升至8500亿。然而,由于许多量子计算应用仍处于开发阶段,市场仍然波动。考虑到这一技术的新兴性质和市场的不确定性,投资量子计算股票涉及内在风险。

Tesla Stock Hits Record High, Affordable Model Expected in 2025, Analysts Raise Targets

特斯拉股票创下新高,预计2025年推出经济型车型,分析师提高目标价

On Wednesday, Tesla's stock price soared to a three-year high, closing at $424.77. Prior to this, Chief Investor Relations Officer Travis Axelrod announced plans to launch an affordable model, the Model Q, next year. It is expected that after subsidies, the price will be below $30,000. The overseas price is estimated to be around $25,000, and the models produced at the Shanghai factory may be priced at approximately 140,000 yuan, which is nearly 40% lower than the current starting price of China's "entry-level" Model 3, which is 231,900 yuan. Several major banks have also raised their target prices for Tesla.

周三,特斯拉股价飙升至三年来的新高,收盘价为424.77美元。在此之前,首席投资关系官特拉维斯·阿克斯罗德宣布计划在明年推出一款经济型车型——Model Q。预计在补贴后,价格将低于30,000美元。境外价格预计在25,000美元左右,而在上海工厂生产的车型价格可能约为14万元,相较于当前中国"入门级" Model 3的起售价231,900元,降幅接近40%。几家主要银行也提高了对特斯拉的目标价。

Morgan Stanley analyst Adam Jonas recently raised Tesla's price target from $310 to $400, calling it a "top pick." According to Jonas, this adjustment reflects excitement about Tesla's role in emerging industries like artificial intelligence (AI), renewable energy, robotics, and on-shoring production. These sectors are key drivers for the company's growth in a world increasingly focused on green energy and advanced technology.

摩根士丹利分析师亚当·乔纳斯最近将特斯拉的目标价从310美元上调至400美元,称其为"顶级推荐"。根据乔纳斯的说法,这一调整反映了对特斯拉在人工智能(AI)、可再生能源、机器人和在岸生产等新兴产业中角色的兴奋。这些领域是公司在日益关注绿色能源和爱文思控股科技背景下增长的关键驱动因素。

This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors' financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal.

本次演示仅供信息和教育用途,不能作为任何特定投资或投资策略的推荐或认可。此内容中提供的投资信息仅具有一般性质,仅用于说明目的,可能不适合所有投资者。在提供信息时未考虑个别投资者的财务复杂性、财务状况、投资目标、投资时间框架或风险承受能力。在做出任何投资决策之前,您应考虑此信息的适用性,并根据您相关的个人情况进行评估。过去的投资表现并不表明或保证未来的成功。收益将有所不同,所有投资都存在风险,包括本金损失。

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

moomoo是由moomoo科技公司提供的金融信息和交易应用。在美国,moomoo提供的投资产品和服务由moomoo金融公司提供,成员为FINRA/SIPC。

Producer prices in the US increased 3% year-on-year in November 2024, the biggest rise since February 2023, compared to an upwardly revised 2.6% gain in October and above forecasts of 2.6%. Producer Prices Change in the United States averaged 3.07 percent from 1950 until 2024, reaching an all-time high of 19.57 percent in November of 1974 and a record low of -6.86 percent in July of 2009.

Producer prices in the US increased 3% year-on-year in November 2024, the biggest rise since February 2023, compared to an upwardly revised 2.6% gain in October and above forecasts of 2.6%. Producer Prices Change in the United States averaged 3.07 percent from 1950 until 2024, reaching an all-time high of 19.57 percent in November of 1974 and a record low of -6.86 percent in July of 2009.