Investors generally believe that the Federal Reserve will cut interest rates by 25 basis points at the December 17-18 meeting and focus more attention on the new economic forecasts released by policymakers at the same time as making decisions.

The Zhitong Finance App learned that investors generally believe that the Federal Reserve will cut interest rates by 25 basis points at the December 17-18 meeting and focus more attention on the new economic forecasts released by policymakers at the same time as making decisions.

These predictions will include the latest views of Federal Reserve officials that they will cut interest rates further in 2025 or even 2026. This work must also take into account data showing higher than expected inflation, labor market health, US election results that may change global trade and immigration patterns, and ongoing geopolitical risks.

Faced with so many assessments, so many new risks, and so much uncertainty, many analysts expect that all the information conveyed by the Federal Reserve's policy statement next Wednesday, the Fed Chairman Powell's post-meeting press conference, and the latest forecast will be hawkish — compared to a few months ago, the Fed may be closer to the point of temporarily cutting interest rates, or at least very unwilling to commit to further lower borrowing costs.

Faced with so many assessments, so many new risks, and so much uncertainty, many analysts expect that all the information conveyed by the Federal Reserve's policy statement next Wednesday, the Fed Chairman Powell's post-meeting press conference, and the latest forecast will be hawkish — compared to a few months ago, the Fed may be closer to the point of temporarily cutting interest rates, or at least very unwilling to commit to further lower borrowing costs.

The following may be some of the data that Fed policymakers will consider:

Inflation remains stubborn

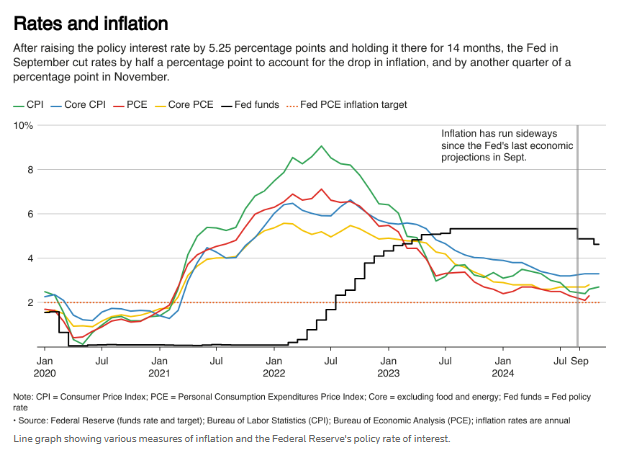

Overall inflation has not improved much since the last economic forecast released by the Federal Reserve in September or the November 6-7 policy meeting. But some of these components have changed, convincing policymakers that price pressure is gradually easing, the so-called anti-inflation. The rise in housing costs has slowed, and the personal consumer spending price index (PCE), which the Federal Reserve uses to measure progress towards its 2% inflation target, is expected to slow down when November data is released next week. However, this will not be known until two days after the end of the Federal Reserve meeting.

Employment remains stable

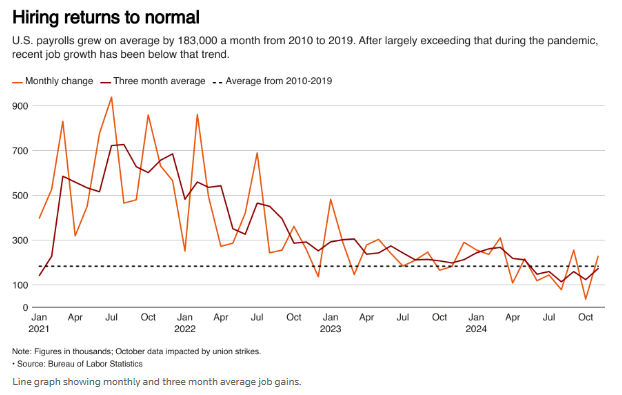

The job market remains one of the Federal Reserve's biggest surprises. Since the Federal Reserve began raising interest rates sharply in March 2022, the unemployment rate has risen slightly, but it is still 4.2%, below the long-term average, just at the median level that Federal Reserve officials think roughly represents full employment. Had there been no surprises in December, the year-end unemployment rate could be lower than the 4.4% forecast by policymakers in September.

Meanwhile, job creation has slowed from the frenzy of recent years, and has led some policymakers to believe that the labor market is currently operating at a sustainable pace.

However, this flexibility is one reason policymakers say they want to be cautious about future interest rate cuts because they are concerned that the current economy is actually close to potential levels. Lowering the policy interest rate currently set in the 4.50%-4.75% range too much may boost demand, expand the economy's ability to meet demand, and drive up inflation.

Wages are offset by productivity

Another surprise in recent data is that workers' productivity continues to increase over time, and this improvement is enough to slow wage growth.

As a result, companies' unit labor costs have been rising at a more moderate rate. The cost of labor per unit is a key factor in measuring whether a tight job market will cause price pressure.

Demand won't stop

Another sign of economic resilience is consumer spending. Apart from returning from rising levels of COVID-19 to a trend more similar to pre-pandemic trends, consumer spending has not shown much sign of cooling down.

As long as people have jobs and income, they will spend. This is one of the important conditions for the impending “soft landing” of inflation by Federal Reserve officials.

面对如此多的评估、众多新风险和诸多不确定性,许多分析师预计,美联储下周三的政策声明、美联储主席鲍威尔的会后新闻发布会和最新预测所传递的所有信息都将偏向鹰派——与几个月前相比,美联储可能更接近暂时降息的时间点,或者至少非常不愿意承诺进一步降低借贷成本。

面对如此多的评估、众多新风险和诸多不确定性,许多分析师预计,美联储下周三的政策声明、美联储主席鲍威尔的会后新闻发布会和最新预测所传递的所有信息都将偏向鹰派——与几个月前相比,美联储可能更接近暂时降息的时间点,或者至少非常不愿意承诺进一步降低借贷成本。