From 4.2 Million Thanksgiving Pies To Record Pizza Sales: Costco Hits 4 Major Milestones In Q1, Beating Earnings Estimates

From 4.2 Million Thanksgiving Pies To Record Pizza Sales: Costco Hits 4 Major Milestones In Q1, Beating Earnings Estimates

Costco Wholesale Corporation's (NASDAQ:COST) first-quarter revenue and earnings per share beat analyst estimates. The management highlighted four new milestones achieved by the company during the said quarter.

好市多公司(納斯達克:COST)第一季度的營業收入和每股收益均超出分析師預期。管理層強調了公司在該季度取得的四個新里程碑。

What Happened: According to the president and CEO of the company Ron Vachris, "Costco Logistics completed nearly 1 million deliveries in Q1 and over 196,000 deliveries last week alone." He said that Costco continued to gain market share within the e-commerce space, during the analyst earnings call held on Thursday.

發生了什麼:根據公司總裁兼首席執行官Ron Vachris的說法,"好市多物流在第一季度完成了近100萬次交付,僅上週就完成了超過196,000次交付。"他表示,在週四舉行的分析師業績會上,好市多在電子商務領域持續獲得市場份額。

Secondly, Costco's U.S. bakery division, "Reached new records of 4.2 million pies being sold the three days prior to Thanksgiving," said Vachris.

其次,Vachris表示,好市多在美國的烘焙部門,"在感恩節前三天售出了420萬份派,創下新紀錄。"

Talking about the pharmacy business Vachris added, "Our U.S. pharmacy business has prescription growth exceeding 19% for the first quarter, setting new volume records for that business." And lastly, on Halloween Day, Costco, in its food courts, "set a new record of 274,000 whole pizzas being sold."

談到藥房業務時,Vachris補充道,"我們美國的藥房業務在第一季度的處方增長超過了19%,爲該業務設定了新的成交量記錄。"最後,在萬聖節那天,好市多在其美食廣場,"創下了售出274,000個整比薩的新紀錄。"

"All of these milestones reflect the continued strength of our business across the membership offering," said Vachris.

"所有這些里程碑都反映了我們的業務在會員服務方面的持續強勁," Vachris表示。

Why It Matters: Costco reported first-quarter revenue of $62.15 billion, beating the consensus estimate of $62.08 billion. The membership-based retailer reported first-quarter adjusted earnings of $3.82 per share, beating analyst estimates of $3.79 per share, according to Benzinga Pro.

爲何這很重要:好市多報告第一季度營業收入爲$621.5億,超過了市場共識預期的$620.8億。這家基於會員的零售商報告的第一季度調整後每股收益爲$3.82,超出分析師預期的$3.79,依據Benzinga Pro的報道。

Costco noted its earnings results included a tax benefit of $100 million or 22 cents per diluted share, related to stock-based compensation. Membership fees came in at $1.17 billion, up from $1.08 billion in the prior year's quarter. Earlier this year, Costco announced it was raising the price of its annual store membership by $5. The membership fee increase went into effect on Sept. 1.

好市多指出,其收益結果包括$10000萬的稅收利益,或者每攤薄股22美分,涉及股本補償。會員費用達到$11.7億,高於去年同期的$10.8億。今年早些時候,好市多宣佈將其年度店面會員費提高$5。會員費的增幅於9月1日生效。

Net sales for the first quarter were up 7.5% year-over-year. Comparable sales in the first quarter were up 5.2% in the U.S., up 5.8% in Canada and up 4.7% in the Other International segment. Total comps climbed by 5.2%, and total e-commerce sales increased by 13%.

第一季度的淨銷售額同比增長7.5%。第一季度的可比銷售在美國增長了5.2%,在加拿大增長了5.8%,在其他國際板塊增長了4.7%。總體可比銷售增長了5.2%,總體電子商務銷售增長了13%。

Price Action: The stock rose 0.29% to $991.30 apiece in premarket trade on Friday. On a year-to-date basis, the stock has risen 51.91%, outperforming the Nasdaq 100 index, which rose by 30.65% in the same period.

價格動態:該股票在週五的盤前交易中上漲了0.29%,每股價格爲991.30美元。在年初至今的基礎上,該股票上漲了51.91%,表現優於納斯達克100指數,該指數在同期上漲了30.65%。

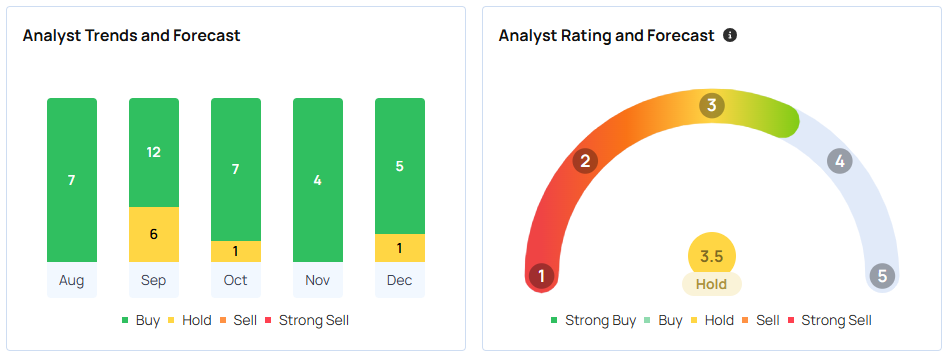

What Are Analysts Saying: According to Benzinga, Costco has a consensus price target of $954.38 based on the ratings of 26 analysts. The highest price target out of all the analysts tracked by Benzinga is $1145 issued by Jefferies as of Dec. 5, 2024. The lowest target price is $700 issued by Barclays on March 11, 2024.

分析師的看法:根據Benzinga,好市多的共識目標價爲954.38美元,基於26位分析師的評級。Benzinga跟蹤的所有分析師中,最高目標價爲1145美元,由傑富瑞於2024年12月5日發佈。最低目標價爲700美元,由巴克萊銀行於2024年3月11日發佈。

The average price target of $1073.33 between Telsey Advisory Group, Oppenheimer, and Jefferies implies a 10.10% side for Costco.

Telsey諮詢集團、Oppenheimer和傑富瑞的平均目標價爲1073.33美元,暗示好市多的上漲空間爲10.10%。

- SMCI Stock Receives Harshest Price Target Among 17 Tracked Analysts As JPMorgan Maintains Underweight Rating On Super Micro: 'No Significant Movement Of Orders'

- SMCI股票在17位分析師中獲得了最嚴厲的目標價,摩根大通維持對超微的減持評級:'訂單沒有顯著變化'

Image via Flickr

圖片來源於Flickr

Talking about the pharmacy business Vachris added, "Our U.S. pharmacy business has prescription growth exceeding 19% for the first quarter, setting new volume records for that business." And lastly, on Halloween Day, Costco, in its food courts, "set a new record of 274,000 whole pizzas being sold."

Talking about the pharmacy business Vachris added, "Our U.S. pharmacy business has prescription growth exceeding 19% for the first quarter, setting new volume records for that business." And lastly, on Halloween Day, Costco, in its food courts, "set a new record of 274,000 whole pizzas being sold."