Investors with a lot of money to spend have taken a bullish stance on Serve Robotics (NASDAQ:SERV).

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with SERV, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with SERV, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 8 options trades for Serve Robotics.

This isn't normal.

The overall sentiment of these big-money traders is split between 62% bullish and 37%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $46,000, and 7, calls, for a total amount of $225,040.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $9.0 to $20.0 for Serve Robotics during the past quarter.

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Serve Robotics's options for a given strike price.

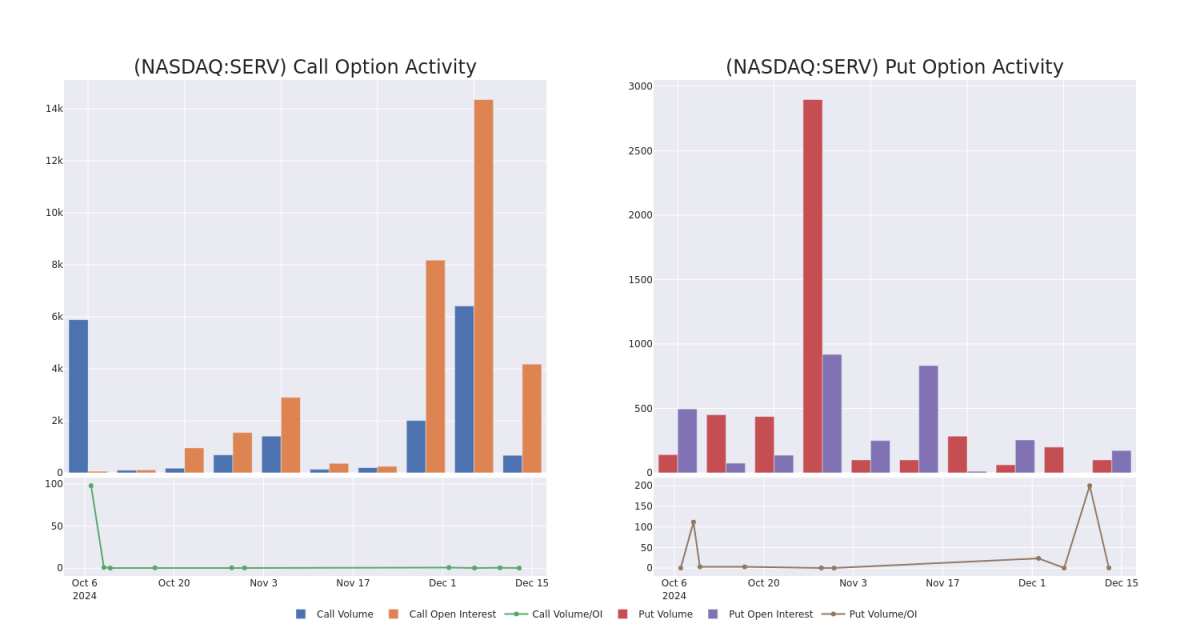

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Serve Robotics's whale activity within a strike price range from $9.0 to $20.0 in the last 30 days.

Serve Robotics Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SERV | PUT | TRADE | BULLISH | 01/16/26 | $4.7 | $4.6 | $4.6 | $10.00 | $45.9K | 173 | 100 |

| SERV | CALL | TRADE | BEARISH | 06/20/25 | $4.3 | $4.0 | $4.0 | $9.00 | $40.0K | 622 | 0 |

| SERV | CALL | TRADE | BULLISH | 06/20/25 | $3.8 | $3.7 | $3.8 | $10.00 | $37.2K | 538 | 99 |

| SERV | CALL | TRADE | BEARISH | 01/16/26 | $4.2 | $3.6 | $3.6 | $20.00 | $36.0K | 539 | 25 |

| SERV | CALL | SWEEP | BEARISH | 06/20/25 | $4.5 | $4.2 | $4.2 | $9.00 | $33.6K | 622 | 190 |

About Serve Robotics

Serve Robotics Inc is developing next-generation robots for last-mile delivery services. Its first product is a zero-emission robot that serves people in public areas, Starting with food delivery. It has developed an advanced, AI-robotics mobility platform, with last-mile delivery in cities as its first application.

Following our analysis of the options activities associated with Serve Robotics, we pivot to a closer look at the company's own performance.

Current Position of Serve Robotics

- With a volume of 3,699,359, the price of SERV is up 5.25% at $11.94.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 64 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Serve Robotics with Benzinga Pro for real-time alerts.