Whether it's Wall Street funds or small short-term traders, as long as they dare to bet heavily on Elon Musk's business empire, they can be expected to make a lot of money at the end of this year, as Donald Trump's victory in the US election strongly boosted the wealth of the world's richest man.

Musk's support for Trump during the election campaign and his appointment to head the newly established Ministry of Government Efficiency made his businesses, including Tesla and unlisted unicorn companies SpaceX and XAI, a popular asset. The market capitalization of these companies soared this year, driving Musk's own personal wealth above $40 billion.

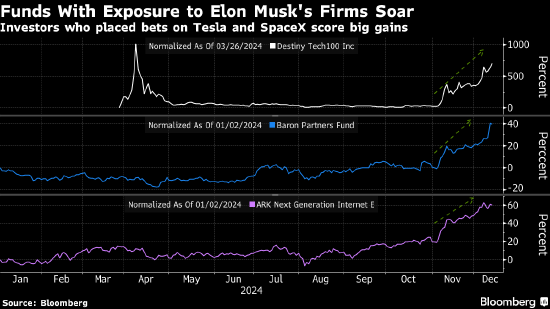

Closed End Fund Destiny Tech100 Inc. (DXYZ) is one such fund that has taken advantage of Musk's trading career. Since the November 5 election, the fund has soared by more than 500%. The fund invests in shares of unlisted unicorn companies, and its latest filing shows that by the end of September, bets on SpaceX accounted for more than one-third of its holdings. Trump's victory prompted a large influx of retail investors into the fund, driving its transaction price far beyond the valuation of its underlying assets, and rising the premium level to an astonishingly high level.

“The election is a major catalyst for these 'Trump derivatives',” said Todd Sohn, ETF strategist at Strategas'. “Musk is clearly involved in the government, so investors are pouring into these funds to quickly gain exposure to Musk.”

“The election is a major catalyst for these 'Trump derivatives',” said Todd Sohn, ETF strategist at Strategas'. “Musk is clearly involved in the government, so investors are pouring into these funds to quickly gain exposure to Musk.”

Old-fashioned equity funds, such as Baron Partners Fund, have also been winners. The fund's annual return rate is close to 40% — far exceeding the NASDAQ 100 index — and just before the election, the fund was still in a state of loss. Ron Baron, a fund manager in his 80s, used Tesla as the largest holding. As of November, it accounted for 40% of its assets, while SpaceX accounted for 10%.

Musk's deal also enabled another fund to turn a loss into a profit this year. Cathie Wood's $7 billion flagship ETF ARK Innovation ETF. ARKK's annual returns up to October have remained negative since this year, but they have soared more than 25% since the US election.

Furthermore, ARK Next Generation Internet ETFs that invest in Tesla, Bitcoin, and digital asset companies are expected to increase by more than 50% this year. Strategas' Sohn sees these as direct beneficiaries of Musk's deal.

However, the facts may prove that some high-rise investment instruments are quite risky, as they tend to trade at much higher prices than the underlying asset. For example, DXYZ's market capitalization of $0.8 billion was the highest since April, and the transaction price reached more than 10 times its newly disclosed net asset value, ranking among the highest premium levels among similar closed-end funds.

“大选对这些‘特朗普衍生品’构成一大催化剂,”Strategas的ETF策略师Todd Sohn表示,“马斯克显然涉足政府,因此投资者涌入这些基金,以快速获得对马斯克公司的敞口。”

“大选对这些‘特朗普衍生品’构成一大催化剂,”Strategas的ETF策略师Todd Sohn表示,“马斯克显然涉足政府,因此投资者涌入这些基金,以快速获得对马斯克公司的敞口。”