While not a mind-blowing move, it is good to see that the Jiangsu Yangnong Chemical Co., Ltd. (SHSE:600486) share price has gained 16% in the last three months. But that doesn't change the fact that the returns over the last three years have been less than pleasing. Truth be told the share price declined 48% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the unfortunate three years of share price decline, Jiangsu Yangnong Chemical actually saw its earnings per share (EPS) improve by 0.5% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Alternatively, growth expectations may have been unreasonable in the past.

During the unfortunate three years of share price decline, Jiangsu Yangnong Chemical actually saw its earnings per share (EPS) improve by 0.5% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Alternatively, growth expectations may have been unreasonable in the past.

It's pretty reasonable to suspect the market was previously to bullish on the stock, and has since moderated expectations. However, taking a look at other business metrics might shed a bit more light on the share price action.

The modest 1.6% dividend yield is unlikely to be guiding the market view of the stock. Arguably the revenue decline of 8.1% per year has people thinking Jiangsu Yangnong Chemical is shrinking. And that's not surprising, since it seems unlikely that EPS growth can continue for long in the absence of revenue growth.

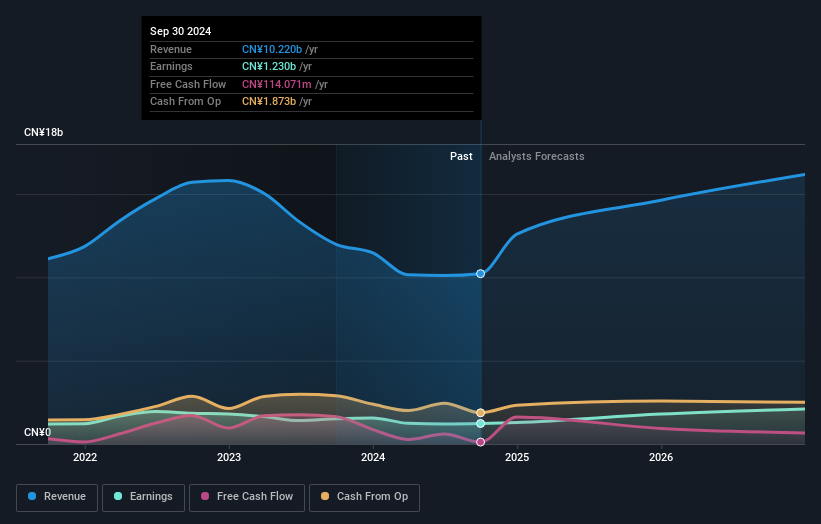

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Jiangsu Yangnong Chemical is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Investors in Jiangsu Yangnong Chemical had a tough year, with a total loss of 11% (including dividends), against a market gain of about 15%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 4% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Jiangsu Yangnong Chemical better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Jiangsu Yangnong Chemical , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.