David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Teva Pharmaceutical Industries Limited (NYSE:TEVA) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

What Is Teva Pharmaceutical Industries's Debt?

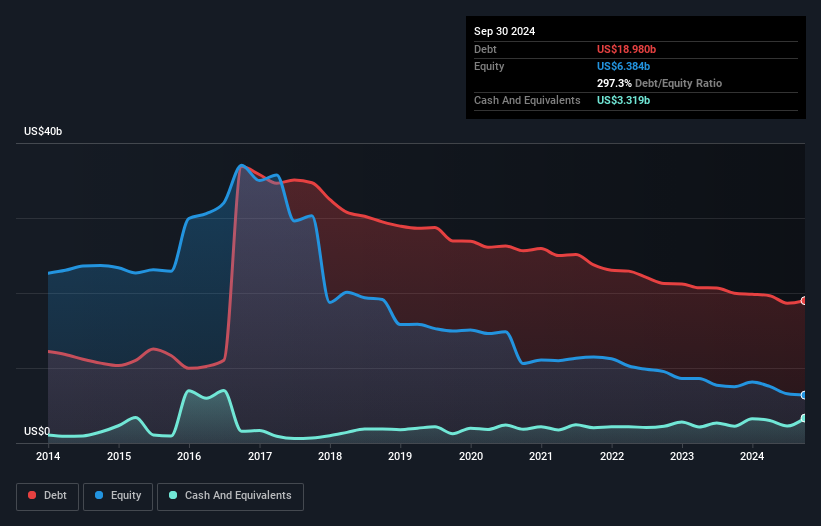

The image below, which you can click on for greater detail, shows that Teva Pharmaceutical Industries had debt of US$19.0b at the end of September 2024, a reduction from US$20.0b over a year. However, because it has a cash reserve of US$3.32b, its net debt is less, at about US$15.7b.

A Look At Teva Pharmaceutical Industries' Liabilities

Zooming in on the latest balance sheet data, we can see that Teva Pharmaceutical Industries had liabilities of US$13.8b due within 12 months and liabilities of US$21.6b due beyond that. Offsetting these obligations, it had cash of US$3.32b as well as receivables valued at US$3.46b due within 12 months. So it has liabilities totalling US$28.6b more than its cash and near-term receivables, combined.

Zooming in on the latest balance sheet data, we can see that Teva Pharmaceutical Industries had liabilities of US$13.8b due within 12 months and liabilities of US$21.6b due beyond that. Offsetting these obligations, it had cash of US$3.32b as well as receivables valued at US$3.46b due within 12 months. So it has liabilities totalling US$28.6b more than its cash and near-term receivables, combined.

When you consider that this deficiency exceeds the company's huge US$19.1b market capitalization, you might well be inclined to review the balance sheet intently. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Teva Pharmaceutical Industries's debt is 3.3 times its EBITDA, and its EBIT cover its interest expense 4.0 times over. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. The good news is that Teva Pharmaceutical Industries grew its EBIT a smooth 45% over the last twelve months. Like the milk of human kindness that sort of growth increases resilience, making the company more capable of managing debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Teva Pharmaceutical Industries can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. In the last three years, Teva Pharmaceutical Industries's free cash flow amounted to 27% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

Mulling over Teva Pharmaceutical Industries's attempt at staying on top of its total liabilities, we're certainly not enthusiastic. But at least it's pretty decent at growing its EBIT; that's encouraging. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making Teva Pharmaceutical Industries stock a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. Even though Teva Pharmaceutical Industries lost money on the bottom line, its positive EBIT suggests the business itself has potential. So you might want to check out how earnings have been trending over the last few years.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.