Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Hunan Silver Co.,Ltd. (SZSE:002716) does carry debt. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

What Is Hunan SilverLtd's Net Debt?

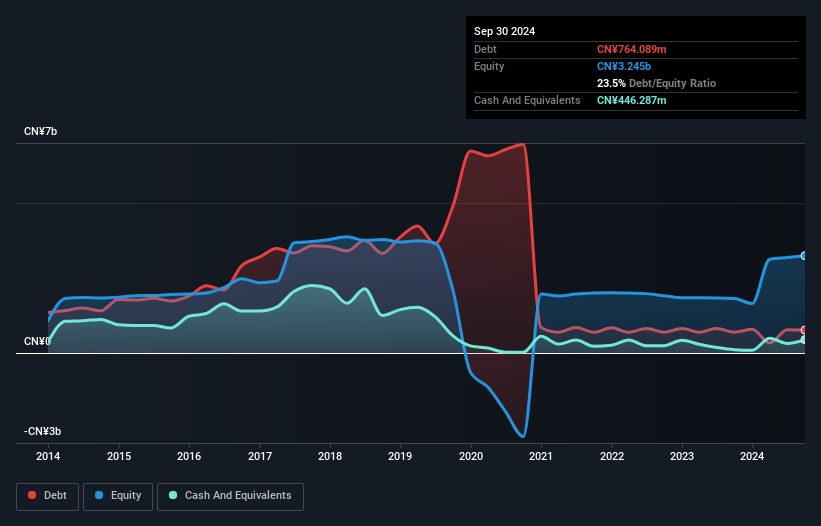

You can click the graphic below for the historical numbers, but it shows that as of September 2024 Hunan SilverLtd had CN¥764.1m of debt, an increase on CN¥691.8m, over one year. However, it does have CN¥446.3m in cash offsetting this, leading to net debt of about CN¥317.8m.

A Look At Hunan SilverLtd's Liabilities

According to the last reported balance sheet, Hunan SilverLtd had liabilities of CN¥1.91b due within 12 months, and liabilities of CN¥950.0m due beyond 12 months. On the other hand, it had cash of CN¥446.3m and CN¥28.3m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥2.39b.

According to the last reported balance sheet, Hunan SilverLtd had liabilities of CN¥1.91b due within 12 months, and liabilities of CN¥950.0m due beyond 12 months. On the other hand, it had cash of CN¥446.3m and CN¥28.3m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥2.39b.

This deficit isn't so bad because Hunan SilverLtd is worth CN¥11.4b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While Hunan SilverLtd has a quite reasonable net debt to EBITDA multiple of 1.9, its interest cover seems weak, at 0.61. In large part that's it has so much depreciation and amortisation. These charges may be non-cash, so they could be excluded when it comes to paying down debt. But the accounting charges are there for a reason -- some assets are seen to be losing value. Either way there's no doubt the stock is using meaningful leverage. Pleasingly, Hunan SilverLtd is growing its EBIT faster than former Australian PM Bob Hawke downs a yard glass, boasting a 372% gain in the last twelve months. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Hunan SilverLtd will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. Happily for any shareholders, Hunan SilverLtd actually produced more free cash flow than EBIT over the last two years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

The good news is that Hunan SilverLtd's demonstrated ability to convert EBIT to free cash flow delights us like a fluffy puppy does a toddler. But the stark truth is that we are concerned by its interest cover. When we consider the range of factors above, it looks like Hunan SilverLtd is pretty sensible with its use of debt. That means they are taking on a bit more risk, in the hope of boosting shareholder returns. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should be aware of the 1 warning sign we've spotted with Hunan SilverLtd .

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.