Dashan Education Holdings Limited (HKG:9986) shares have retraced a considerable 36% in the last month, reversing a fair amount of their solid recent performance. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

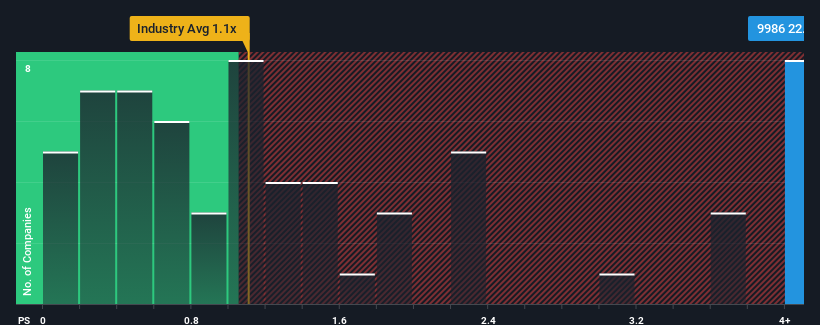

Although its price has dipped substantially, you could still be forgiven for thinking Dashan Education Holdings is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 22.7x, considering almost half the companies in Hong Kong's Consumer Services industry have P/S ratios below 1.1x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

What Does Dashan Education Holdings' Recent Performance Look Like?

Recent times have been quite advantageous for Dashan Education Holdings as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Dashan Education Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Dashan Education Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Dashan Education Holdings would need to produce outstanding growth that's well in excess of the industry.

In order to justify its P/S ratio, Dashan Education Holdings would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 113% gain to the company's top line. However, this wasn't enough as the latest three year period has seen the company endure a nasty 81% drop in revenue in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to deliver 20% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this information, we find it concerning that Dashan Education Holdings is trading at a P/S higher than the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Dashan Education Holdings' P/S?

Dashan Education Holdings' shares may have suffered, but its P/S remains high. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Dashan Education Holdings revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Dashan Education Holdings (at least 1 which is a bit unpleasant), and understanding these should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.