Q Technology (Group) Company Limited (HKG:1478) shares have continued their recent momentum with a 30% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 42% in the last year.

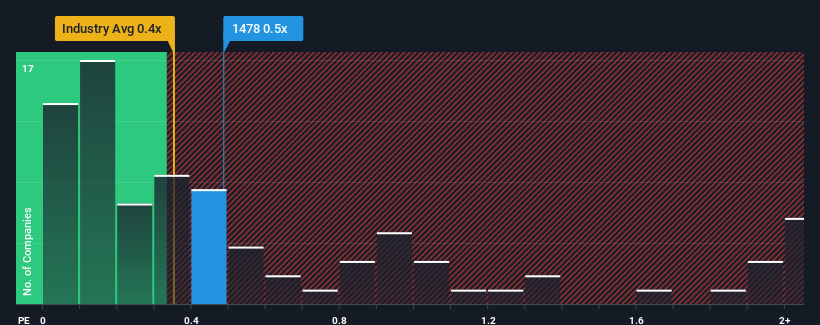

Although its price has surged higher, you could still be forgiven for feeling indifferent about Q Technology (Group)'s P/S ratio of 0.5x, since the median price-to-sales (or "P/S") ratio for the Electronic industry in Hong Kong is also close to 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

What Does Q Technology (Group)'s Recent Performance Look Like?

Recent times have been advantageous for Q Technology (Group) as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think Q Technology (Group)'s future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Q Technology (Group)'s to be considered reasonable.

There's an inherent assumption that a company should be matching the industry for P/S ratios like Q Technology (Group)'s to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 21%. However, this wasn't enough as the latest three year period has seen the company endure a nasty 18% drop in revenue in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 7.5% per year during the coming three years according to the analysts following the company. With the industry predicted to deliver 24% growth each year, the company is positioned for a weaker revenue result.

With this information, we find it interesting that Q Technology (Group) is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Q Technology (Group)'s P/S Mean For Investors?

Q Technology (Group)'s stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

When you consider that Q Technology (Group)'s revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Q Technology (Group) with six simple checks will allow you to discover any risks that could be an issue.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.