Fulcrum Therapeutics, Inc. (NASDAQ:FULC) shares have had a really impressive month, gaining 32% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 27% over that time.

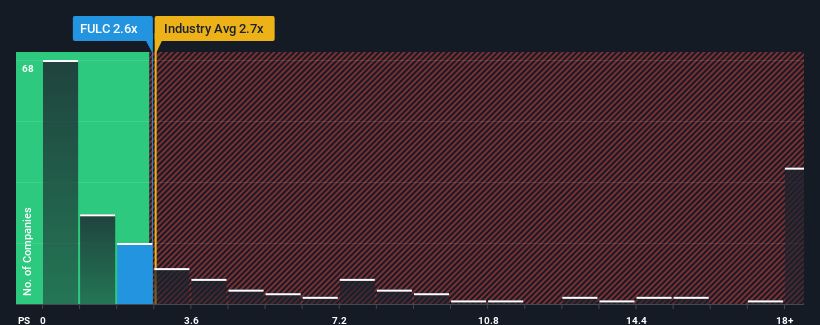

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Fulcrum Therapeutics' P/S ratio of 2.6x, since the median price-to-sales (or "P/S") ratio for the Pharmaceuticals industry in the United States is also close to 2.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

How Has Fulcrum Therapeutics Performed Recently?

Recent times have been advantageous for Fulcrum Therapeutics as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think Fulcrum Therapeutics' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Fulcrum Therapeutics' to be considered reasonable.

There's an inherent assumption that a company should be matching the industry for P/S ratios like Fulcrum Therapeutics' to be considered reasonable.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. Spectacularly, three year revenue growth has also set the world alight, thanks to the last 12 months of incredible growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 100% per year as estimated by the seven analysts watching the company. That's not great when the rest of the industry is expected to grow by 20% per year.

With this information, we find it concerning that Fulcrum Therapeutics is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Final Word

Fulcrum Therapeutics' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our check of Fulcrum Therapeutics' analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

You need to take note of risks, for example - Fulcrum Therapeutics has 3 warning signs (and 1 which is concerning) we think you should know about.

If these risks are making you reconsider your opinion on Fulcrum Therapeutics, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.