Ambarella, Inc. (NASDAQ:AMBA) shares have continued their recent momentum with a 27% gain in the last month alone. Taking a wider view, although not as strong as the last month, the full year gain of 13% is also fairly reasonable.

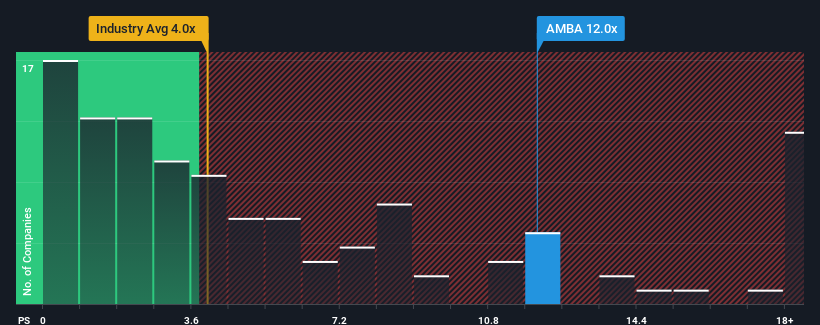

After such a large jump in price, Ambarella's price-to-sales (or "P/S") ratio of 12x might make it look like a strong sell right now compared to other companies in the Semiconductor industry in the United States, where around half of the companies have P/S ratios below 4x and even P/S below 1.7x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

What Does Ambarella's Recent Performance Look Like?

Ambarella could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ambarella.How Is Ambarella's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Ambarella's to be considered reasonable.

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Ambarella's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 2.2%. As a result, revenue from three years ago have also fallen 17% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 21% per year as estimated by the analysts watching the company. With the industry predicted to deliver 25% growth per year, the company is positioned for a weaker revenue result.

With this information, we find it concerning that Ambarella is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What Does Ambarella's P/S Mean For Investors?

Shares in Ambarella have seen a strong upwards swing lately, which has really helped boost its P/S figure. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've concluded that Ambarella currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Ambarella, and understanding these should be part of your investment process.

If you're unsure about the strength of Ambarella's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.