SmartRent, Inc. (NYSE:SMRT) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 44% in the last twelve months.

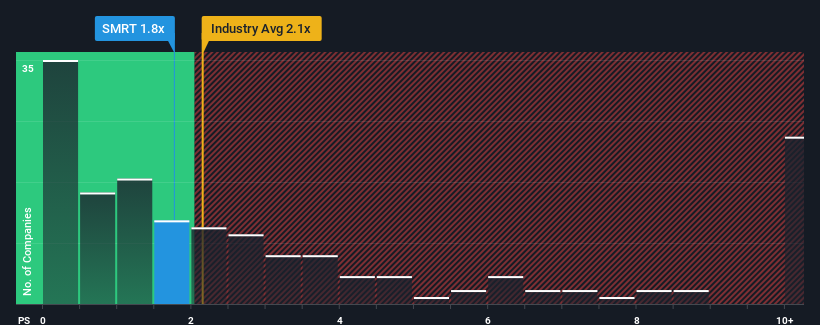

Although its price has surged higher, you could still be forgiven for feeling indifferent about SmartRent's P/S ratio of 1.8x, since the median price-to-sales (or "P/S") ratio for the Electronic industry in the United States is also close to 2.1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

How SmartRent Has Been Performing

SmartRent hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think SmartRent's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For SmartRent?

In order to justify its P/S ratio, SmartRent would need to produce growth that's similar to the industry.

In order to justify its P/S ratio, SmartRent would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 8.0% decrease to the company's top line. Still, the latest three year period has seen an excellent 123% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the four analysts covering the company suggest revenue growth is heading into negative territory, declining 8.9% over the next year. That's not great when the rest of the industry is expected to grow by 9.1%.

With this information, we find it concerning that SmartRent is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Bottom Line On SmartRent's P/S

SmartRent appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our check of SmartRent's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

You should always think about risks. Case in point, we've spotted 1 warning sign for SmartRent you should be aware of.

If you're unsure about the strength of SmartRent's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.