Despite an already strong run, Shanying International Holdings Co.,Ltd (SHSE:600567) shares have been powering on, with a gain of 26% in the last thirty days. Taking a wider view, although not as strong as the last month, the full year gain of 12% is also fairly reasonable.

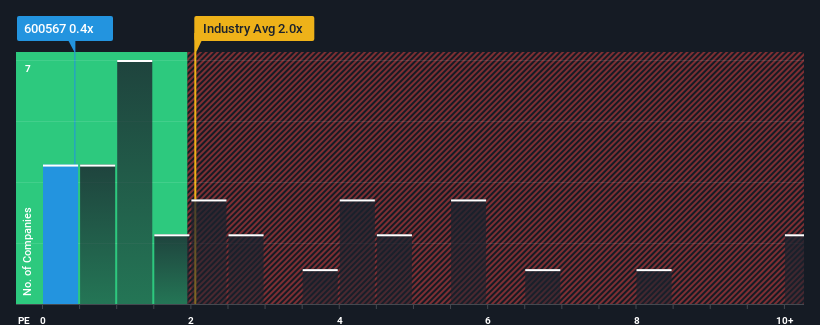

In spite of the firm bounce in price, Shanying International HoldingsLtd may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.4x, since almost half of all companies in the Forestry industry in China have P/S ratios greater than 2x and even P/S higher than 5x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

What Does Shanying International HoldingsLtd's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Shanying International HoldingsLtd's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Shanying International HoldingsLtd's future stacks up against the industry? In that case, our free report is a great place to start.How Is Shanying International HoldingsLtd's Revenue Growth Trending?

In order to justify its P/S ratio, Shanying International HoldingsLtd would need to produce sluggish growth that's trailing the industry.

In order to justify its P/S ratio, Shanying International HoldingsLtd would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. This isn't what shareholders were looking for as it means they've been left with a 7.4% decline in revenue over the last three years in total. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 15% as estimated by the six analysts watching the company. With the industry predicted to deliver 16% growth , the company is positioned for a comparable revenue result.

In light of this, it's peculiar that Shanying International HoldingsLtd's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Final Word

Shanying International HoldingsLtd's stock price has surged recently, but its but its P/S still remains modest. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It looks to us like the P/S figures for Shanying International HoldingsLtd remain low despite growth that is expected to be in line with other companies in the industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

Having said that, be aware Shanying International HoldingsLtd is showing 3 warning signs in our investment analysis, and 1 of those makes us a bit uncomfortable.

If you're unsure about the strength of Shanying International HoldingsLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.