Wingtech Technology Co.,Ltd (SHSE:600745) shareholders will doubtless be very grateful to see the share price up 46% in the last quarter. But that is meagre solace in the face of the shocking decline over three years. In that time the share price has melted like a snowball in the desert, down 73%. Arguably, the recent bounce is to be expected after such a bad drop. The thing to think about is whether the business has really turned around.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

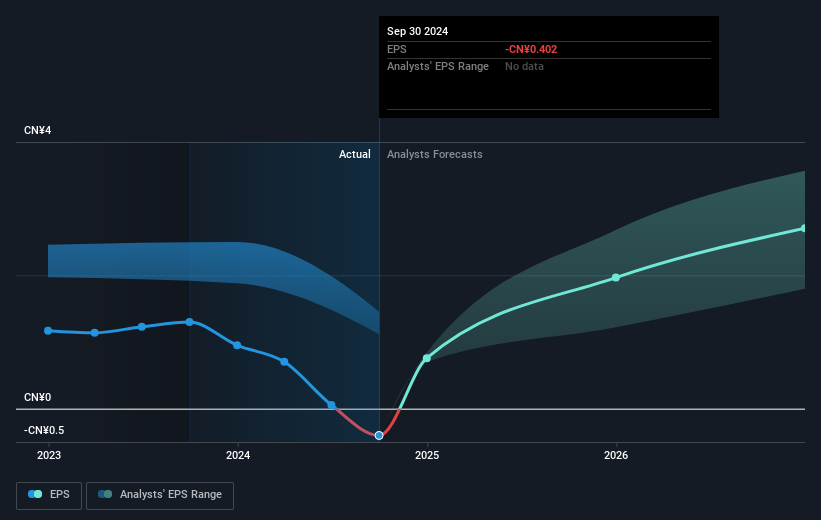

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over the three years that the share price declined, Wingtech TechnologyLtd's earnings per share (EPS) dropped significantly, falling to a loss. This was, in part, due to extraordinary items impacting earnings. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. But it's safe to say we'd generally expect the share price to be lower as a result!

Over the three years that the share price declined, Wingtech TechnologyLtd's earnings per share (EPS) dropped significantly, falling to a loss. This was, in part, due to extraordinary items impacting earnings. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. But it's safe to say we'd generally expect the share price to be lower as a result!

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Wingtech TechnologyLtd's key metrics by checking this interactive graph of Wingtech TechnologyLtd's earnings, revenue and cash flow.

A Different Perspective

While the broader market gained around 13% in the last year, Wingtech TechnologyLtd shareholders lost 17% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. However, the loss over the last year isn't as bad as the 10% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. You could get a better understanding of Wingtech TechnologyLtd's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course Wingtech TechnologyLtd may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.