Current market hotspots remain in the CSI Consumer 360 index sector. Deputy Minister of Commerce Sheng Qiuping: Accelerate the introduction of policy documents to promote the inaugural economy. The inaugural economy essentially falls under the category of new consumption, with expectations that the market will continue to explore it.

[Editor-in-Chief Observes Market]

The two major meetings last week were undoubtedly key factors in driving the Hang Seng Index rebound; however, after the meetings end, market disappointment returns to normal.

Over the weekend, several ministries issued concentrated statements. The China Securities Regulatory Commission: Firmly implement the important requirements to "stabilize the real estate and stock markets" and effectively maintain the stability of capital markets. Deepen comprehensive reforms of investment and financing in capital markets, focusing on promoting medium and long-term funds to enter the market. Encourage mergers and acquisitions aimed at industrial integration and upgrading; Ministry of Finance: Next year, a more proactive fiscal policy will be implemented to ensure sustained and strengthened fiscal efforts; Wang Xin, Director of the Research Bureau of the People's Bank of China, stated that it is necessary to appropriately increase support for monetary policy, timely cut the reserve requirement ratio and interest rates, and increase monetary credit investment. Observe whether such tone-setting bullish statements can have a substantial impact on Hong Kong stocks.

Over the weekend, several ministries issued concentrated statements. The China Securities Regulatory Commission: Firmly implement the important requirements to "stabilize the real estate and stock markets" and effectively maintain the stability of capital markets. Deepen comprehensive reforms of investment and financing in capital markets, focusing on promoting medium and long-term funds to enter the market. Encourage mergers and acquisitions aimed at industrial integration and upgrading; Ministry of Finance: Next year, a more proactive fiscal policy will be implemented to ensure sustained and strengthened fiscal efforts; Wang Xin, Director of the Research Bureau of the People's Bank of China, stated that it is necessary to appropriately increase support for monetary policy, timely cut the reserve requirement ratio and interest rates, and increase monetary credit investment. Observe whether such tone-setting bullish statements can have a substantial impact on Hong Kong stocks.

This week's market focus is on the Federal Reserve meeting, with a 50 basis point rate cut anticipated, particularly looking at Powell's forward guidance on rate cuts next year.

The current market hotspots are still in the CSI Consumer 360 index sector. Deputy Minister of Commerce Sheng Qiuping: Accelerate the introduction of policy documents to promote the debut economy. The debut economy essentially belongs to the new consumption category and is expected to be continually explored by the market.

Friday evening news, the Ministry of Agriculture and Rural Affairs held a meeting, which mentioned the need to vigorously improve the level of agricultural technology and equipment, which may stimulate the Agricultural Machinery sector. This week marks the 25th anniversary of Macau's return to the motherland, observe whether Macau Casino stocks will have movements.

[This Week's Golden Stock]

JNBY (03306)

Recently, JNBY announced a related transaction, acquiring 100% equity of the Hangzhou Muli Brand Management from Huizhan Technology, where the main brand “B1ock” is a buyer's department store brand that combines contemporary art and lifestyle aesthetics, with a cash consideration of 1.67 million. In the first half of the year, the company's revenue was 5.24 billion yuan, a year-on-year increase of 17.3%, and the net income was 0.85 billion yuan, a nearly 40% increase year-on-year. Gross margin reached 3.47 billion yuan, an increase of about 20% year-on-year, with the gross margin rising from 65.3% to 66.3%.

Comment: The main brand of the target company "B1ock" is a buyer's department store brand that integrates contemporary art and lifestyle aesthetics. With pioneering fashion, art curation, and creative retail capabilities, it can deliver more high-quality art content. After the acquisition, synergistic effects will be generated through cross-selling, offering broader choices for the group's existing customers, aligning with the group's multi-brand scaled development strategy. The company's performance continues to grow. With multi-brand and scaled operation, the company currently operates multiple brands, including the mature brand JNBY, accounting for 56.2% of total revenue; a growing brand portfolio, such as Sketch, jnby by JNBY, and LESS brands, accounting for 41.7% of total revenue; and emerging brand portfolios, such as POMME DE TERRE and onmygame.

This year, JNBY acquired the emerging sports men's wear OMG and its children’s brand onmygame, entering the outdoor sports field. The JNBY + Art concept store in Chengdu's MixC officially opened on November 2, becoming the largest concept store in Southwest China. It is reported that in the past five years, JNBY has adopted a prudent store opening strategy, appropriately increasing the number of physical stores each year to better serve consumers. Currently, the total number of JNBY physical stores has reached 2024. Since its listing, JNBY has adhered to high dividends, with an average payout ratio of 76% over the past five years. The company's dividend yield is high. The company's ROE ranks among the top in the consumer goods industry, with an average ROE of 35.7% over the past three years and an average ROE of 33.4% over the past five years. The company's high ROE and high dividends highlight its investment value, and the multi-brand matrix, design-driven approach, and fan economy drive revenue growth.

[Industry Observation]

The Central Economic Work Conference on December 12 pointed out: "Expand service Consumer, promote the development of cultural tourism. Actively develop the initial economy, ice and snow economy, and silver economy."

On November 17, the General Office of the State Council issued a document, pointing out that with ice and snow sports leading the way, it will drive the development of the ice and snow culture, ice and snow equipment, and ice and snow tourism across the entire industry chain, promoting the ice and snow economy to become a new growth point. The 2023-24 snow season will be the first complete snow season after the Peking Winter Olympics, with the national participation in ice and snow sports reaching 0.264 billion people, a participation rate of 18.7%, and the scale of the ice and snow industry is expected to exceed one trillion in 2025.

Data shows that outdoor clothing is currently the fastest-growing category. According to forecasts from Youke, despite the overall domestic footwear and clothing consumption growth rate of only 3.5% from 2024 to 2028, outdoor footwear/clothing has growth rates as high as 13%/12%, making it the fastest-growing sub-category.

Among them, outdoor brands show impressive growth: in the first half of 2024, DESCENTE and KOLON reported revenue growth of 42%, Saucony and Merrel saw a 72% increase, and X-BIONIC had a 39% revenue rise. Many companies are branching out into outdoor series: for example, BOSIDENG launched a stunning sales of down jackets for outdoor wear, while ZARA and H&M released a ski clothing series.

Stocks to watch in the Hong Kong market:

ANTA SPORTS (02020): Descente as well as Arc'teryx, Peak Performance, Salomon, and Atomic under Amer Sports are all involved in snow sports clothing or equipment, with a 2025 PE of 16 times.

BOSIDENG (03998): In November, a collaboration series 'Erbin & BOSIDENG' was launched with Harbin, combining the classic Extreme Race series with ice and snow culture, FY25 PE 12X, and a dividend yield of 7%.

[Data Monitoring]

The Hong Kong Stock Exchange announced that the total number of open contracts for the Hang Seng Index futures (December) is 103966, with a net open number of 34841 contracts. The settlement date for the Hang Seng Index futures is December 30, 2024.

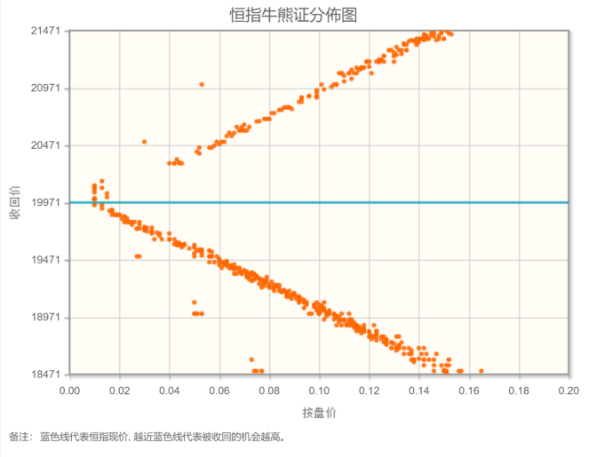

From the distribution of bull and bear certificates at the 19971 points location of the Hang Seng Index, the concentration area of bull certificates is near the central axis, indicating downward pressure on the Hong Kong stock market. The possibility of the Federal Reserve pausing interest rate cuts next year is quite high, but the timing is uncertain. The Hang Seng Index is expected to trend bearish this week.

[Editor's note]

Goldman Sachs' trading desk shows that LOs are gradually entering the Consumer Sector, including Autos and home appliances. The liquor sector is showing a slight improvement in both directions, primarily focused on Sell. The inflow in Consumer Electronics remains light but has improved slightly, primarily focused on Buy. Elsewhere, there is net Outflow in the Semiconductors and Medical sectors. The buy inclination of Goldman Sachs' Hong Kong trading department is 1.4 times (narrowed from 2 times earlier), with Inflows into Banks (China Construction Bank), shipping, Technology (Xiaomi), and Consumer sectors in both directions—this provides a clue that at this time, it is crucial to pay close attention to positioning in the Consumer Sector.

Last week, Mao Geping performed as expected. Currently, among new stocks, the one gaining significant public attention is Yuejiang. Although the company is still in the red, it has a story to tell. Consider subscribing prudently.

周末几大部委密集喊话,证监会:坚决落实“稳住楼市股市”重要要求,切实维护资本市场稳定。深化资本市场投融资综合改革,抓好推动中长期资金入市工作。鼓励以产业整合升级为目的的并购重组;财政部:明年要实施更加积极的财政政策,确保财政政策持续用力、更加给力;中国央行研究局局长王信称,要适度加大货币政策支持力度,将适时降准降息,加大货币信贷投放力度。观察这种喊话式利好能否对港股产生实质性推动。

周末几大部委密集喊话,证监会:坚决落实“稳住楼市股市”重要要求,切实维护资本市场稳定。深化资本市场投融资综合改革,抓好推动中长期资金入市工作。鼓励以产业整合升级为目的的并购重组;财政部:明年要实施更加积极的财政政策,确保财政政策持续用力、更加给力;中国央行研究局局长王信称,要适度加大货币政策支持力度,将适时降准降息,加大货币信贷投放力度。观察这种喊话式利好能否对港股产生实质性推动。