Broadcom, the absolute leader in AI ASIC and Ethernet Switch Chip fields, has attracted global investment influx into the AI ASIC-related investment sector with its strong performance and outlook.

According to the Zhito Finance APP, Broadcom (AVGO.US), a core supplier of AI ASIC chips in the AI hardware field and Ethernet switch chips for large global AI datacenters, has become the focal point of an unprecedented investment wave around AI since 2023, with its investment heat only trailing NVIDIA (NVDA.US), the dominant player in AI chips. After announcing strong growth results and an extremely optimistic outlook for the AI ASIC chip market last Friday morning Beijing time, its stock price in US trading soared over 20% in a single day, pushing its Market Cap beyond the significant milestone of one trillion dollars, with further surges continuing in after-hours trading on Monday.

AI ASICs are also known within the industry as 'Custom AI Chips', 'Dedicated AI Chips', or 'AI Application-Specific Integrated Circuits'. Unlike traditional general-purpose processors (such as CPUs and GPUs), AI ASICs are deeply customized to efficiently perform specific AI tasks (like deep learning, AI inference, and training systems), aiming to enhance AI computing efficiency, reduce power consumption, and improve performance, especially showcasing tremendous energy efficiency advantages during large-scale AI parallel computations. For instance, the TPU (Tensor Processing Unit) developed in collaboration with Google and Broadcom is a typical AI ASIC primarily used for deep learning inference and training, optimizing critical computational operations like matrix multiplication to enhance AI computational effectiveness.

The earnings report released by Broadcom last Friday showed that Broadcom's AI-related revenue (datacenter Ethernet chips + AI ASICs) surged 220% year-on-year, accumulating to 12.2 billion USD for the entire fiscal year. Even more significantly, Broadcom's CEO Hock Tan stated during the earnings call that revenue from AI products is expected to grow by 65% year-over-year in the first quarter of the 2025 fiscal year, far exceeding the company's overall semiconductor business growth rate of around 10%, and it is anticipated that by the 2027 fiscal year, the potential market size for AI components (Ethernet chips + AI ASICs) designed for global datacenter operators could reach 90 billion USD. Hock Tan emphasized during the call: 'In the next three years, the related opportunities for AI chips are immense.'

The earnings report released by Broadcom last Friday showed that Broadcom's AI-related revenue (datacenter Ethernet chips + AI ASICs) surged 220% year-on-year, accumulating to 12.2 billion USD for the entire fiscal year. Even more significantly, Broadcom's CEO Hock Tan stated during the earnings call that revenue from AI products is expected to grow by 65% year-over-year in the first quarter of the 2025 fiscal year, far exceeding the company's overall semiconductor business growth rate of around 10%, and it is anticipated that by the 2027 fiscal year, the potential market size for AI components (Ethernet chips + AI ASICs) designed for global datacenter operators could reach 90 billion USD. Hock Tan emphasized during the call: 'In the next three years, the related opportunities for AI chips are immense.'

If significant players in the customized AI chip field like Marvell Technology (MRVL.US) attract collective investment flows into its stock and Broadcom after announcing explosive growth in AI business forecasts, then Broadcom, as the absolute leader in AI ASIC and Ethernet switch chip markets, has attracted global investment influx into AI ASIC-related investment sectors—with stocks in the A-share market that are highly correlated to the AI ASIC concept, and publicly listed companies involved in the AI ASIC chip industry chain of either Broadcom or Marvell—such as Taiwan Semiconductor, known as the 'King of Chip Foundries', and Advantest, a Japan-based AI ASIC chip testing equipment manufacturer, along with BE Semiconductor, a supplier of equipment crucial for advanced packaging in the chiplet Hybrid Bonding field.

Broadcom's Market Cap has first surpassed the super milestone of one trillion dollars.

Broadcom's stock price surged over 24% at last Friday's closing, with its Market Cap first exceeding one trillion USD, marking the best single-day performance for this chip giant. The logic behind this milestone is that Broadcom's fourth fiscal quarter earnings report exceeded Wall Street expectations, and management showcased an incredibly strong outlook for AI-related revenue.

Recently, the world's richest person and Tesla CEO Elon Musk announced plans to expand the Colossus AI supercomputer under his newly established AI startup xAI from the current 0.1 million GPUs to 1 million. This undoubtedly sparked widespread attention in the chip and AI industry. However, xAI is not the only company with such grand plans, and the AI chip leader NVIDIA is not the only beneficiary. Custom AI chip leaders such as Broadcom and Marvell Technology will also greatly benefit.

The strong demand for Ethernet Switch chips and ASIC custom AI chips closely related to AI is clearly reflected in Broadcom's significantly better-than-expected earnings data for fiscal year 2023 and 2024 to date. In particular, customized AI chips have become an increasingly important source of revenue for Broadcom. Market news shows that U.S. tech giants Apple and Meta, the parent company of Facebook, will choose Broadcom as the core partner for their self-developed AI chip technology, as Meta has previously collaborated with Broadcom to design its first and second generation AI training acceleration processors, and Broadcom is expected to accelerate the research and development of Meta’s next-generation AI chip MTIA 3 in the latter half of 2024 and in 2025.

With the strong demand from major global data centers for Broadcom's Ethernet Switch chips and its absolute technological leadership in inter-chip communication and high-speed data transfer between chips, Broadcom has become the most significant participant in the custom AI chip field in recent years. For instance, for Google's self-developed server AI chip—the TPU AI acceleration chip—Broadcom plays a core role, having collaborated closely with the Google team in its development and the AI training/inference acceleration library. In addition to chip design, Broadcom has also provided Google with critical inter-chip communication intellectual property and is responsible for manufacturing, testing, and packaging new chips, thereby supporting Google in expanding its new AI datacenters.

Broadcom's Ethernet Switch chips are primarily used in data center and server cluster devices, efficiently and quickly processing and transmitting data streams. Broadcom chips are essential for building the AI hardware infrastructure, as they ensure high-speed data transfer between GPU processors, storage systems, and networks, which is particularly crucial for generative AIs like ChatGPT, especially for applications needing to handle large amounts of data input and real-time processing capabilities, such as Dall-E transforming text into images and Sora generating video from text.

Even more importantly, based on Broadcom’s unique inter-chip communication technology and numerous patents in the field of data transfer, Broadcom has currently become the most influential participant in the AI hardware field's AI ASIC chip market. Not only has Google chosen to collaborate with Broadcom in the design and research of custom AI chips, but giants such as Apple and Meta, along with more datacenter service providers, are expected to engage in long-term partnerships with Broadcom to build high-performance ASICs.

The company is working with large cloud computing clients to develop customized AI chips. Currently, there are three giant cloud clients who have established their multi-generational ‘AI XPU’ roadmap and plan to deploy at different speeds over the next three years. It is believed that by 2027, each of them plans to deploy a 1 million XPU cluster within a single architecture. Here, XPU refers to a processor architecture with strong scalability, typically referring to AI ASICs, FPGAs, and other custom AI accelerator hardware, aside from NVIDIA’s AI GPUs.

Broadcom may be the first 'disruptor' to break NVIDIA's AI monopoly! The highest target price on Wall Street is as high as $260.

Large data center operators like Google, Meta, and Apple are choosing to collaborate with Broadcom, Marvell Technology, and other custom AI chip companies to launch AI ASIC chips, primarily to gain greater autonomy in optimization concerning performance, power consumption, cost, scalability, and technological independence. Customized AI ASICs can provide hardware acceleration for specific tasks and perform better in large-scale AI training and inference tasks, boasting higher efficiency and cost-effectiveness compared to general-purpose NVIDIA GPUs.

For example, the strong AI computing power demand of deep learning as well as AI inference and training systems, along with specific complex algorithms and computing tasks associated with AI tasks such as computer vision and natural language processing, have different power requirements and computing models. Customized AI ASICs can provide targeted performance and energy optimizations for specific tasks while increasing throughput, achieving more efficient AI computing performance. This is an advantage of ASICs over general processors such as NVIDIA AI GPUs.

Combining ASICs and GPUs will make AI ASICs more focused on normalized AI tasks or structurally fixed AI applications, such as common operations in deep neural networks like matrix operations and convolution operations, while NVIDIA AI GPUs focus on more complex AI computing tasks that require significantly more computing power, such as self-attention mechanisms and neural network structures composed of generators and discriminators, which generate adversarial networks (GANs), as well as broader and larger general computing tasks. GPUs have very powerful floating-point computing capabilities and higher memory bandwidth, making them suitable for tasks that require large amounts of data and complex algorithms. In addition, customized AI chips can also alleviate the severe shortage of AI computing resources caused by the insufficient supply of NVIDIA Blackwell and Hopper architecture AI GPUs (GB200/B200/H100/H200) in major datacenters.

With its leading position in the AI ASIC market, Broadcom is expected to soon break NVIDIA's monopoly position in the AI chip market. Analyst Jordan Klein from Mizuho pointed out that Wall Street is paying attention to the demand for ASICs from large cloud computing companies like Google, which may be one of the reasons for NVIDIA's stock unexpectedly dropping on Friday. 'In my view, customized AI chips will continue to capture a share from NVIDIA AI GPUs every year, although NVIDIA GPUs still dominate for AI training purposes.'

Morgan Stanley analyst Joseph Moore wrote in a report: 'Compared to market concerns about Google's transformation, Broadcom's in-line quarterly results and exceedingly strong outlook may provide positive catalysts, and long-term AI commentary will increase long-term investment enthusiasm. Momentum is expected to start building from here during the 2025 period.'

Evercore ISI analyst Mark Lipacis also expressed extreme excitement about Broadcom's guidance for the AI hardware market, which could reach as high as 90 billion dollars, and noted that investors may be underestimating the growth opportunities for Broadcom's customized AI chips.

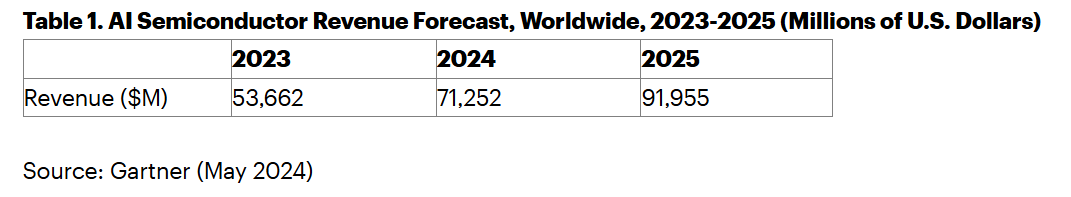

According to Gartner's latest forecast report, the widespread adoption of generative artificial intelligence (GenAI) applications is driving demand for high-performance AI chips, especially customized AI chips for datacenter AI inference systems, which is expected to see significant growth. Therefore, the agency forecasts that the global AI semiconductor revenue will reach 71 billion dollars in 2024, an increase of 33% from 2023, with expected revenue in 2025 potentially reaching 92 billion dollars.

On Wall Street, investment institutions have significantly raised their target price expectations for Broadcom after its earnings were released. The highest target price on Wall Street has already reached 260 dollars, with a consensus rating of 'Strong Buy' and no analysts giving 'Sell'. Financial giant JPMorgan has raised Broadcom's target price from 210 dollars to 250 dollars while maintaining the highest rating of 'Shareholding', indicating that, in the view of JPMorgan analysts, the total market cap has already surpassed one trillion dollars, and Broadcom, with its latest stock price of 224 dollars, can continue to rise. Another well-known institution, Benchmark, has raised its target price from 210 dollars to 255 dollars, while KeyBan has significantly raised Broadcom's target price from 210 dollars to the highest target price of 260 dollars on Wall Street.

博通上周五公布的业绩报告显示,博通的AI相关营收(数据中心以太网芯片+AI ASIC)同比猛增220%,全财年累计达到122亿美元。更重磅的是,博通首席执行官陈福阳(Hock Tan)在业绩电话会议上表示,

博通上周五公布的业绩报告显示,博通的AI相关营收(数据中心以太网芯片+AI ASIC)同比猛增220%,全财年累计达到122亿美元。更重磅的是,博通首席执行官陈福阳(Hock Tan)在业绩电话会议上表示,