The competition is intense.

This week, the A-share market experienced a dramatic weekly fluctuation of over a hundred points, with the 3400-point level facing another test, while the adjacent bond market was exceptionally hot, frequently showcasing epic market movements, with the 10Y Treasury bond yield smoothly dropping to 1.77% and the 30Y Treasury bond yield briefly falling below 2%.

As a result, the market began to worry that this might be a new round of asset scarcity. If you closely examine the stock market on Thursday and Friday, you'll find that the former saw a strong surge, while the latter underwent a significant correction; what caused such drastically different market performances in just one day's time?

Benjamin Graham believed that "the market is not based on natural laws, but rather on the unpredictable psychology of investors". In the short term, the market acts as a voting machine, while in the long term, it functions as a weighing machine.

Benjamin Graham believed that "the market is not based on natural laws, but rather on the unpredictable psychology of investors". In the short term, the market acts as a voting machine, while in the long term, it functions as a weighing machine.

The fluctuations in the market over a day or two do not need to be overly magnified; what is important is to grasp the main trend.

1

Foreign capital is genuinely entering the market.

In December, two major meetings called for the implementation of "more proactive macro policies", including "more aggressive fiscal policies" and "moderately loose monetary policies".

The latest speech from high-level officials today states:

“Implementing a more proactive and effective macro policy means adopting a more aggressive fiscal policy and moderately easing monetary policy. This represents a significant change in terminology compared to previous years. Behind these new terms associated with policies, there is substantial value.”

Against the backdrop of synchronized easing in fiscal and monetary policy, the fundamentals are still in a cautious wait-and-see phase, opening up space for a downward trend in bond market yields.

In a low-interest-rate environment, the cost-effectiveness of equity assets is rising, especially under the historical first mention of 'stabilizing the real estate and stock markets', coupled with the new personal pension policy, the stock market is increasingly likely to become a new reservoir for residents' wealth.

The evolution of ETFs has been mentioned in yesterday's article, where last week, nearly one billion RMB worth of Call Options on the Direxion Daily FTSE China Bull 3X Shares ETF (YINN) and Direxion Daily CSI 300 China A Share Bull 2X Shares ETF (CHAU) were bought by a major player, and the holding scale has surged without closing their positions.

Foreign capital continues to flow in, accelerating purchases of Chinese stocks over the past week.

Bank of America cited EPFR Global data stating that for the week ending Wednesday, China Stock Funds received approximately $5.6 billion in funds, marking the largest inflow in nearly nine weeks. Last week, foreign passive funds have shifted to positive inflows, ending a trend of five consecutive weeks of net outflows.

2

New characteristics of the current A-share market.

Regarding the ongoing concerns about the relationship between fundamentals and the stock market, Xinda Securities today published a research report on the stock market outlook for 2025, mentioning that referencing the stock market performance during the downturns in Real Estate in the USA, Hong Kong, and Japan, the stock market rebounds faster than the economy stabilizes and recovers. In the history of A-shares, only one of the three major bull markets relied on profits, but all three had the impact of policies on improving the micro-investor structure in the stock market.

The research report points out that historically, most of the time, A-shares have been a financing market, and only occasionally has there been a situation where the scale of equity financing was lower than the dividends of listed companies (in 1995, 2005, 2013). After these instances, regardless of whether the economy improved, the stock market would see large-scale bull markets.

Xinda Securities has found that the policies since September have changed the supply and demand structure of the stock market.

The scale of dividends and buybacks in the first 11 months of this year has reached historically high levels (dividend amount: 1815.7 billion yuan, buyback amount: 485.2 billion yuan). During the same period, the scale of equity financing was: 272.2 billion yuan, and the net shareholding reduction was 19.965 billion yuan, both close to the lowest levels since 2007.

The team believes that the current stock market is likely at the beginning of a new bull market, and future attention should focus on two new characteristics that have emerged in this round of the stock market:

First, whether the scale of equity financing being lower than dividends can become a long-term phenomenon;

Second, ETFs may become the core force for residents to flow into the stock market, but considering that the current growth rate of ETFs is not as fast as the growth of actively managed equity products in 2020, the impact on styles remains uncertain.

3

Latest dynamics of ETF funds

As usual, let's continue to look at the latest dynamics of ETF funds this week, with a net inflow of 28 billion yuan, including Bond ETFs, Broad-based ETFs, and Dividend Strategy ETFs.

Specifically, Bosera CSI Convertible Bond And Exchangeable Bond ETF, E Fund Government Bond ETF, and HFT SSE Investment Grade Convertible Bond and Exchangeable Bond ETF saw net inflows of 4.704 billion yuan, 1.022 billion yuan, and 776 million yuan respectively this week.

Huatai-PB CSI 300 ETF and Jiashi 300 ETF had a combined net inflow of 5.715 billion yuan. A total of 6 China A500 ETFs, including E Fund A500 ETF, Hua Xia A500 ETF, and Wanjia A500 ETF, saw a net inflow of 11.15 billion yuan.

Huatai-PB Dividend ETF, ICBC Credit Suisse Shenzhen Dividend ETF, E Fund CSI Dividend ETF, Invesco Great Wall CSI Dividend Low Volatility 100 ETF, and Huatai-PB CSI Dividend Low Volatility ETF had a combined net inflow of 5.34 billion yuan.

(The content of this article consists of objective data information listing and does not constitute any investment advice.)

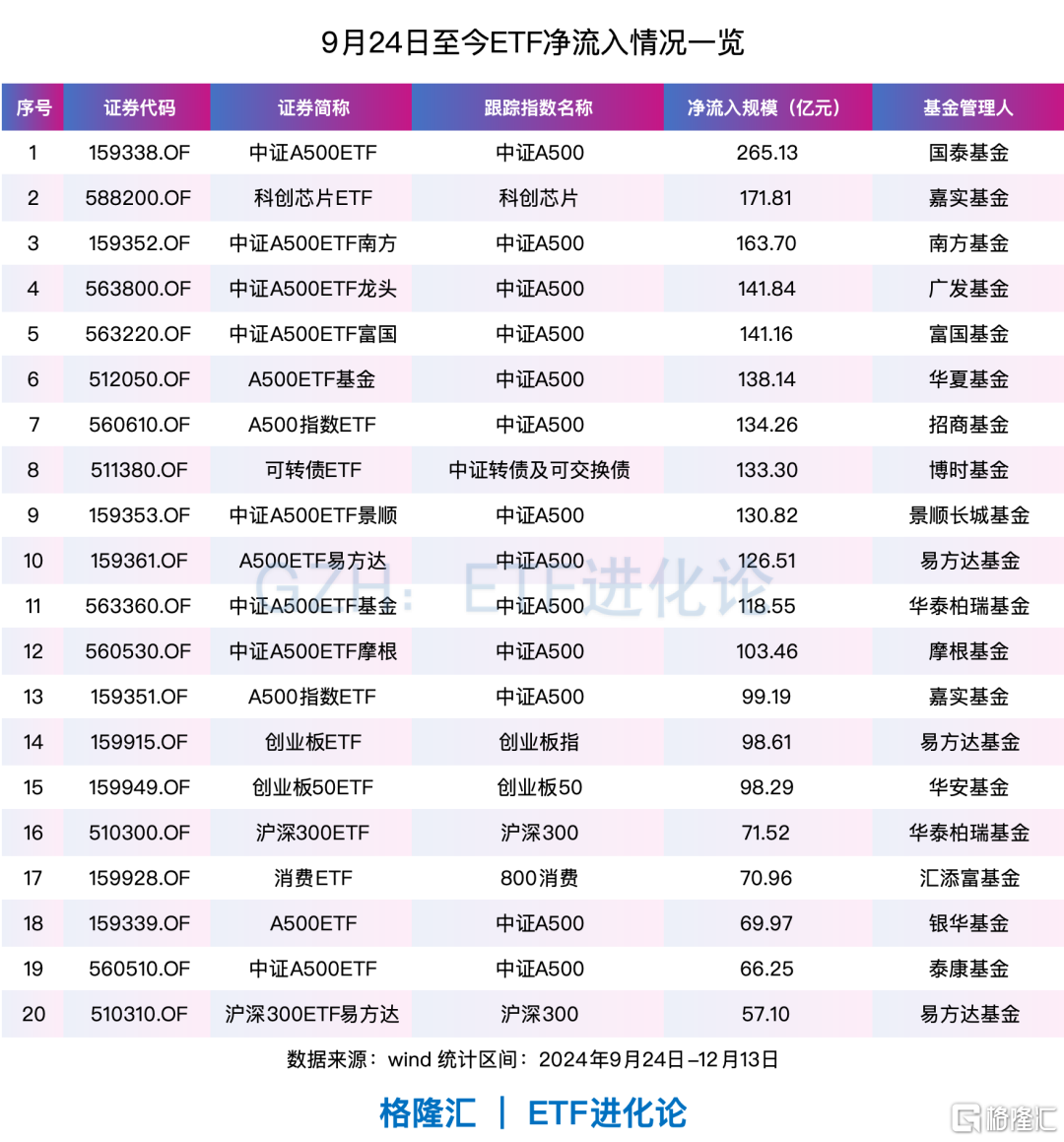

From September 24 to December 13, the CSI A500 ETF is undoubtedly the "king of capital inflow." The total net inflow scale for 16 ETFs, including the Cathay CSI A500 ETF, Southern CSI A500 ETF, and GF CSI A500 ETF, reached an astonishing 169.896 billion yuan, undeniably becoming the new ballast for the A-share market.

Additionally, during the same period, the Jiashi Sci-tech Chip ETF, Bosera Convertible Bond ETF, E Fund GEM ETF, Huashan Chinext 50 ETF, and Huitianfu Consumption ETF saw net inflows of 17.181 billion yuan, 13.33 billion yuan, 9.861 billion yuan, 9.829 billion yuan, and 7.096 billion yuan respectively.

Investment master John Templeton said: "Markets are born out of despair, rise in uncertainty, and die in madness."

Whether in life or investments, it is important to remain optimistic about the future; pessimism only adds trouble. To share a quote from Elon Musk:

"I would rather choose optimism, even if it is wrong, rather than choose pessimism, even if it is right."

本杰明·格雷厄姆认为“市场不是建立在自然法则之上,而是建立在投资者心理的变幻莫测之上”。短期来看,市场是投票器,长期是称重机。

本杰明·格雷厄姆认为“市场不是建立在自然法则之上,而是建立在投资者心理的变幻莫测之上”。短期来看,市场是投票器,长期是称重机。