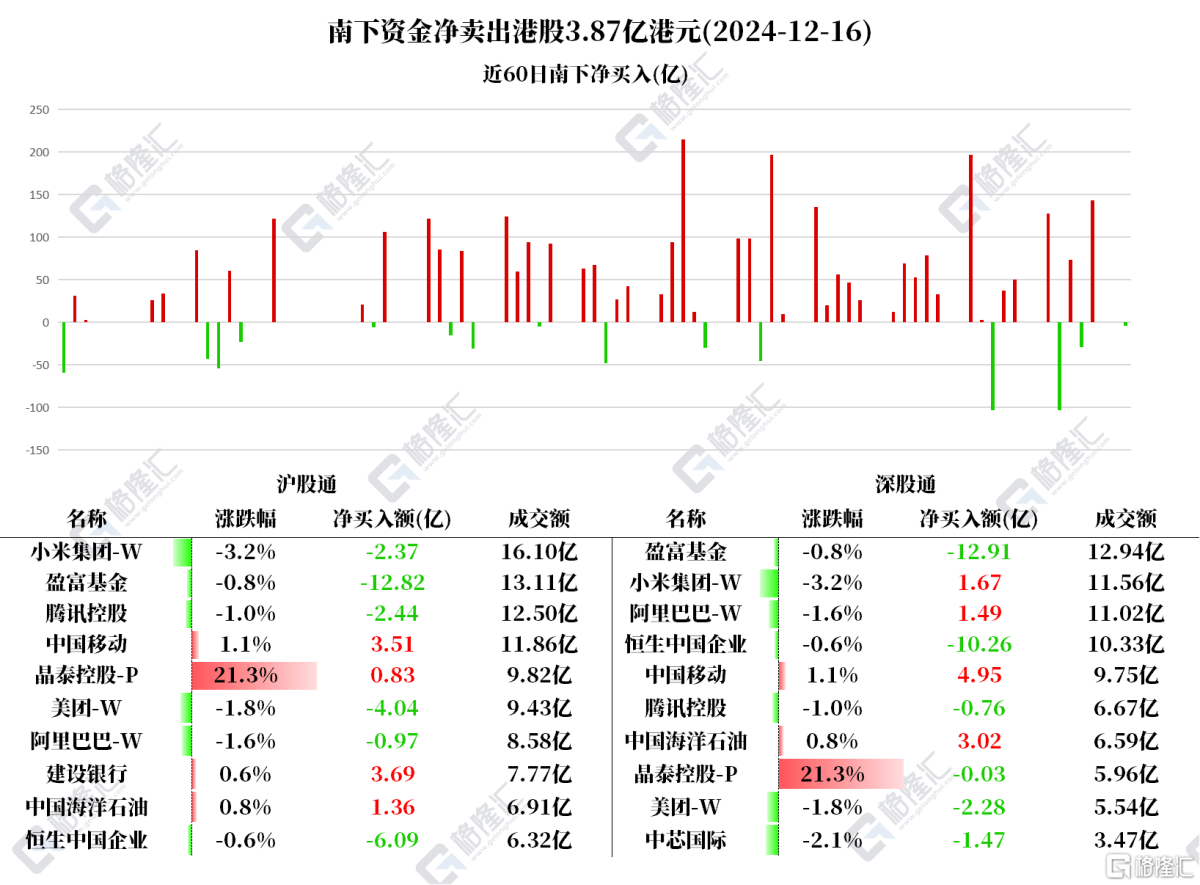

Southside Capital sold Hong Kong stocks net HK$0.387 billion.

Today, Southside Capital sold Hong Kong stocks net of HK$0.387 billion.

Among them, net purchases of China Mobile HK$0.845 billion, CNOOC HK$0.437 billion, CCB HK$0.369 billion, and Alibaba HK$0.052 billion;

Net sales of Yingfu Fund HK$2.573 billion, Hang Seng China Enterprises HK$1.635 billion, Meituan HK$0.632 billion, Tencent HK$0.32 billion, and SMIC HK$0.147 billion.

Net sales of Yingfu Fund HK$2.573 billion, Hang Seng China Enterprises HK$1.635 billion, Meituan HK$0.632 billion, Tencent HK$0.32 billion, and SMIC HK$0.147 billion.

According to statistics, Southbound has net sold Meituan for 5 consecutive days, totaling HK$2.408 billion; net sold SMIC for 3 consecutive days, totaling HK$0.0.30872 billion; and bought China Mobile for 5 consecutive days, totaling HK$2.29,851 billion.

In the 61 trading days since it was included in the Hong Kong Stock Connect, Southwest Capital has accumulated a net purchase of HK$82.31,116 billion on Alibaba.

Beishui focuses on individual stocks

China Mobile is up 1.08% today. Bank of China International believes that as state-owned enterprises and local governments “move to the cloud” one after another, it will support the development of end-to-end proprietary cloud infrastructure services for telecom companies for a long time to improve security and regulatory requirements. At the same time, Chinese telecommunications stocks can provide attractive valuations and dividend returns to support their long-term performance. Therefore, it reaffirms its “buy” rating for Chinese telecommunications stocks, preferring China Telecom, followed by China Unicom and China Mobile.

Meituan dropped 1.85% today. I learned from several independent sources that the Meituan front warehouse business “Little Elephant Supermarket” has begun the process of going overseas. The first stop still landed in Saudi Arabia, led by “old Meituan native” Liu Wei.

Tencent fell 1.02% today. Tencent Holdings bought back 1.72 million shares on December 16 at a total cost of about HK$0.7 billion, at a price of HK$403.8-410.8 per share.

净卖出盈富基金25.73亿

净卖出盈富基金25.73亿