Top 3 Energy Stocks That May Rocket Higher In Q4

Top 3 Energy Stocks That May Rocket Higher In Q4

The most oversold stocks in the energy sector presents an opportunity to buy into undervalued companies.

能源板块中被过度抛售的股票为低估公司提供了买入机会。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

相对强弱指数(RSI)是一个动量指标,它比较股票在价格上涨天数的强度与价格下跌天数的强度。与股票的价格走势相比,它可以让交易者更好地了解股票在开空期的表现。当RSI低于30时,通常认为资产被超卖,依据Benzinga Pro的说法。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是该板块中最新的主要被低估的股票名单,它们的RSI接近或低于30。

International Seaways Inc (NYSE:INSW)

International Seaways Inc (纽交所:INSW)

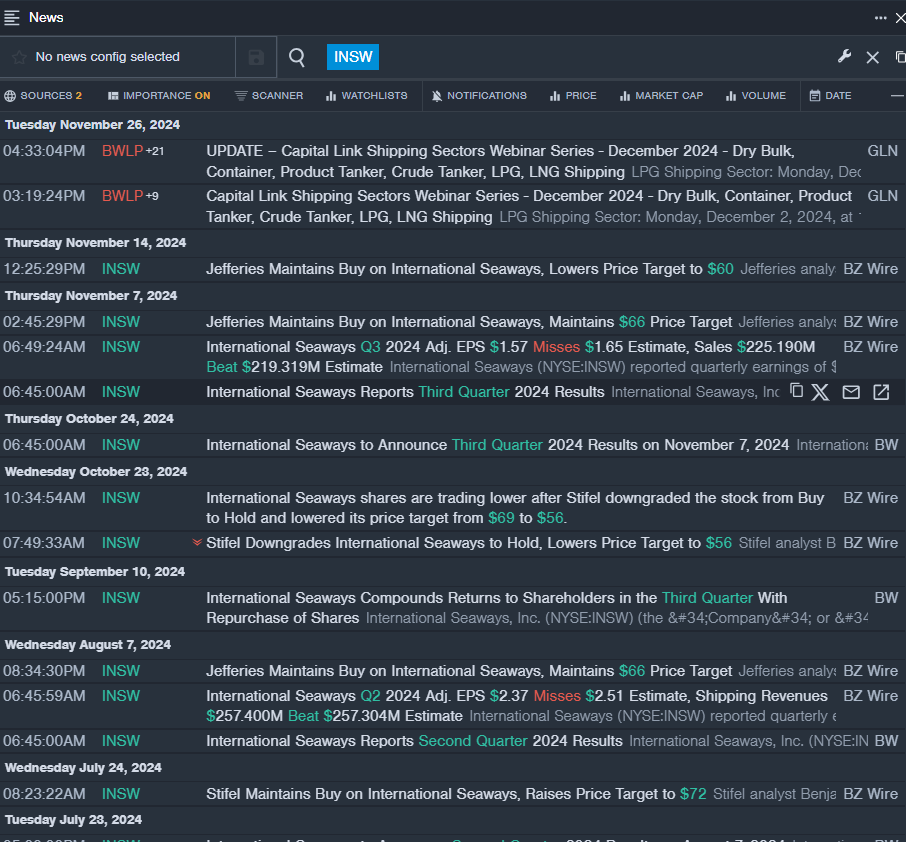

- On Nov. 7, International Seaways posted weaker-than-expected quarterly earnings. "We continue to execute on our balanced capital allocation strategy, utilizing our strong cash generation in third quarter to deliver double-digit returns to our shareholders," said Lois K. Zabrocky, International Seaways President and CEO. The company's stock fell around 17% over the past month and has a 52-week low of $34.32.

- RSI Value: 22.87

- INSW Price Action: Shares of International Seaways closed at $34.97 on Friday.

- Benzinga Pro's real-time newsfeed alerted to latest INSW news.

- 11月7日,International Seaways公布的季度收益低于预期。"我们继续执行我们的平衡资本配置策略,利用我们在第三季度强劲的现金生成,为我们的股东带来双位数的收益,"International Seaways总裁兼首席执行官Lois k. Zabrocky说道。该公司的股票在过去一个月下跌了约17%,并且52周低点为34.32美元。

- RSI值: 22.87

- INSW价格动态: International Seaways的股票在周五收于34.97美元。

- Benzinga Pro的实时资讯提醒有最新的INSW资讯。

HF Sinclair Corp (NYSE:DINO)

HF Sinclair CORP (纽交所:DINO)

- On Dec. 9, Wells Fargo analyst Roger Read downgraded HF Sinclair from Overweight to Equal-Weight and lowered the price target from $53 to $45. The company's stock fell around 13% over the past month and has a 52-week low of $37.34.

- RSI Value: 27.20

- DINO Price Action: Shares of HF Sinclair closed at $37.45 on Friday.

- Benzinga Pro's charting tool helped identify the trend in DINO stock.

- 12月9日,富国银行分析师罗杰·里德将HF Sinclair的评级从“超重”下调至“中立”,并将目标价格从53美元降低至45美元。该公司的股票在过去一个月下跌了约13%,并且有52周低点为37.34美元。

- RSI值:27.20

- DINO价格走势:HF Sinclair的股票在周五收于37.45美元。

- Benzinga Pro的图表工具帮助识别了DINO股票的趋势。

Exxon Mobil Corp (NYSE:XOM)

埃克森美孚CORP (纽交所:XOM)

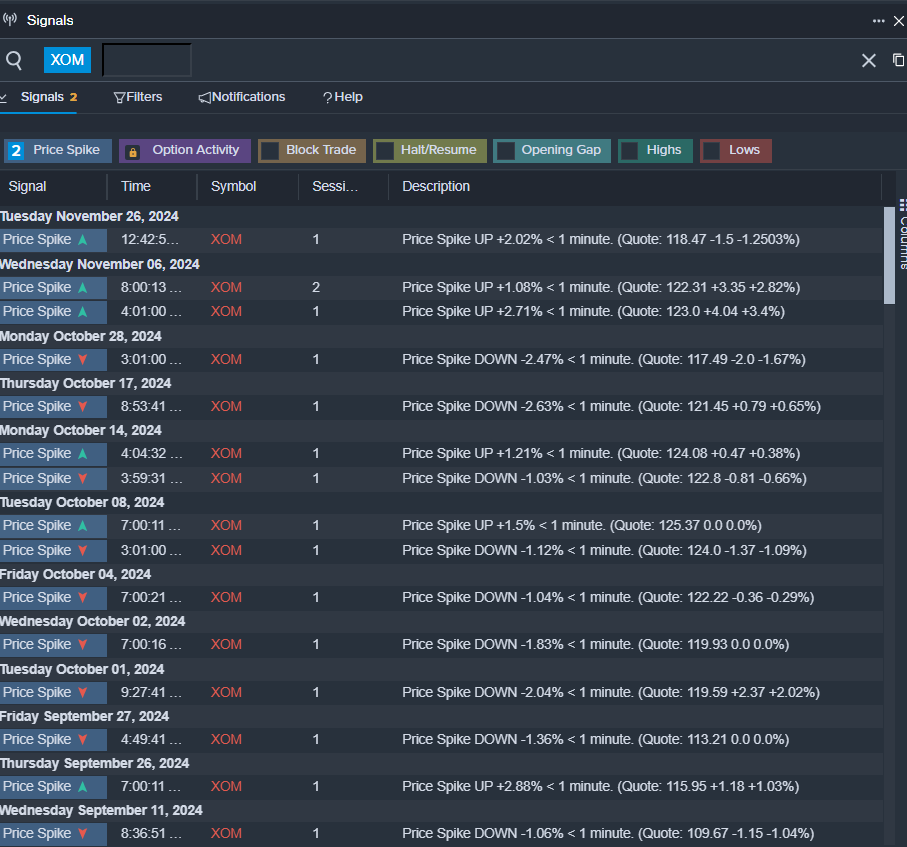

- On Dec. 16, Mizuho analyst Nitin Kumar maintained Exxon Mobil with a Neutral and lowered the price target from $137 to $134.. The company's stock fell around 8% over the past month and has a 52-week low of $95.77.

- RSI Value: 24.30

- XOM Price Action: Shares of Exxon Mobil closed at $110.84 on Friday.

- Benzinga Pro's signals feature notified of a potential breakout in XOM shares.

- 12月16日,瑞穗分析师尼廷·库马尔维持对埃克森美孚的中立评级,并将目标价从137美元下调至134美元。该公司的股票在过去一个月下跌了约8%,并且52周最低价为95.77美元。

- 相对强弱指数值:24.30

- XOm价格走势:埃克森美孚的股票周五收于110.84美元。

- Benzinga Pro的信号特征通知了XOm股票可能出现的突破。

Read This Next:

接下来请阅读:

- Wall Street's Most Accurate Analysts Give Their Take On 3 Energy Stocks With Over 6% Dividend Yields

- 华尔街最准确的分析师对3只收益率超过6%的能源股票发表看法