Unpacking the Latest Options Trading Trends in FedEx

Unpacking the Latest Options Trading Trends in FedEx

Financial giants have made a conspicuous bullish move on FedEx. Our analysis of options history for FedEx (NYSE:FDX) revealed 8 unusual trades.

金融巨頭們對聯邦快遞採取了明顯的看好舉動。我們對聯邦快遞(紐交所:FDX)期權歷史的分析顯示了8筆飛凡交易。

Delving into the details, we found 50% of traders were bullish, while 37% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $52,815, and 6 were calls, valued at $368,580.

深入細節,我們發現50%的交易者看好,37%表現出看淡的傾向。在我們發現的所有交易中,有2筆是看跌期權,價值52,815美元,6筆是看漲期權,價值368,580美元。

Expected Price Movements

預期價格變動

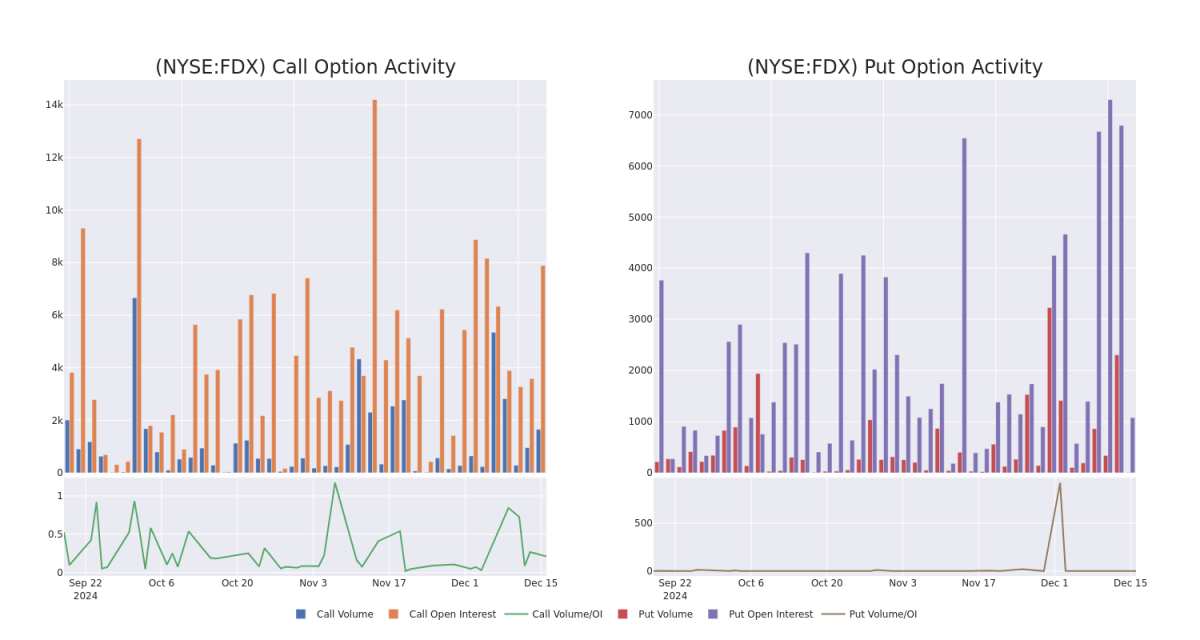

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $270.0 to $335.0 for FedEx during the past quarter.

分析這些合約的成交量和未平倉合約,看來大玩家一直在關注聯邦快遞在過去一個季度內,從270.0美元到335.0美元的價格區間。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

In terms of liquidity and interest, the mean open interest for FedEx options trades today is 1280.86 with a total volume of 1,653.00.

就流動性和興趣而言,今天聯邦快遞期權交易的平均未平倉合約爲1280.86,總成交量爲1,653.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for FedEx's big money trades within a strike price range of $270.0 to $335.0 over the last 30 days.

在下面的圖表中,我們能夠跟蹤聯邦快遞在過去30天內的重倉交易中看漲和看跌期權的成交量和未平倉合約的發展,行權價區間爲270.0美元到335.0美元。

FedEx Option Activity Analysis: Last 30 Days

聯邦快遞期權活動分析:過去30天

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FDX | CALL | SWEEP | BULLISH | 12/20/24 | $2.83 | $2.64 | $2.82 | $320.00 | $164.5K | 1.8K | 730 |

| FDX | CALL | SWEEP | BEARISH | 12/20/24 | $1.15 | $1.0 | $1.09 | $335.00 | $62.1K | 74 | 708 |

| FDX | CALL | SWEEP | BULLISH | 01/17/25 | $25.4 | $25.15 | $25.15 | $270.00 | $43.0K | 1.3K | 0 |

| FDX | CALL | TRADE | BEARISH | 01/15/27 | $54.95 | $53.55 | $53.55 | $290.00 | $37.4K | 51 | 7 |

| FDX | CALL | TRADE | BULLISH | 12/20/24 | $8.0 | $7.35 | $7.8 | $300.00 | $32.7K | 4.5K | 82 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 行權價 | 總交易價格 | 未平倉合約 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 聯邦快遞 | 看漲 | 掃單 | 看好 | 12/20/24 | $2.83 | $2.64 | $2.82 | $320.00 | 164.5K美元 | 1.8K | 730 |

| 聯邦快遞 | 看漲 | 掃單 | 看淡 | 12/20/24 | $1.15 | $1.0 | $1.09 | $335.00 | 62.1K美元 | 74 | 708 |

| 聯邦快遞 | 看漲 | 掃單 | 看好 | 01/17/25 | $25.4 | $25.15 | $25.15 | $270.00 | $43.0K | 1.3K | 0 |

| 聯邦快遞 | 看漲 | 交易 | 看淡 | 01/15/27 | $54.95 | $53.55 | $53.55 | $290.00 | $37.4K | 51 | 7 |

| 聯邦快遞 | 看漲 | 交易 | 看好 | 12/20/24 | $8.0 | $7.35 | $7.8 | $300.00 | 32.7K美元 | 4.5K | 82 |

About FedEx

關於聯邦快遞

FedEx pioneered overnight delivery in 1973 and remains the world's largest express package provider. In its fiscal 2024, which ended in May, FedEx derived 47% of revenue from its express division, 37% from ground, and 10% from freight, its asset-based less-than-truckload shipping segment. The remainder came from other services, including FedEx Office, which provides document production/shipping, and FedEx Logistics, which provides global forwarding. FedEx acquired Dutch parcel delivery firm TNT Express in 2016, boosting its presence across Europe. TNT was previously the fourth-largest global parcel delivery provider.

FedEx pioneered overnight delivery in 1973 and remains the world's largest express package provider. In its fiscal 2024, which ended in May, FedEx derived 47% of revenue from its express division, 37% from ground, and 10% from freight, its asset-based less-than-truckload shipping segment. The remainder came from other services, including FedEx Office, which provides document production/shipping, and FedEx Logistics, which provides global forwarding. FedEx acquired Dutch parcel delivery firm TNt Express in 2016, boosting its presence across Europe. TNt was previously the fourth-largest global parcel delivery provider.

After a thorough review of the options trading surrounding FedEx, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

After a thorough review of the options trading surrounding FedEx, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of FedEx

Present Market Standing of FedEx

- With a trading volume of 65,145, the price of FDX is up by 0.32%, reaching $284.33.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 3 days from now.

- With a trading volume of 65,145, the price of FDX is up by 0.32%, reaching $284.33.

- 當前的相對強弱指標(RSI)值表明,該股票目前在超買和超賣之間處於中立狀態。

- 下一個業績將在3天后發佈。

What Analysts Are Saying About FedEx

分析師對聯邦快遞的看法

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $341.0.

在過去30天內,共有2位專業分析師對這隻股票表達了看法,設定的平均目標價爲341.0美元。

Turn $1000 into $1270 in just 20 days?

在短短20天內將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from JP Morgan persists with their Overweight rating on FedEx, maintaining a target price of $366. * An analyst from Bernstein downgraded its action to Market Perform with a price target of $316.

一位擁有20年經驗的專業期權交易員透露了他的單行圖技術,顯示何時買入和賣出。複製他的交易,這些交易每20天平均獲得27%的利潤。點擊此處獲取訪問權限。* 來自摩根大通的分析師仍然對聯邦快遞保持增持評級,目標價維持在366美元。* 伯恩斯坦的分析師將其評級下調爲市場表現,目標價爲316美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest FedEx options trades with real-time alerts from Benzinga Pro.

期權交易帶來更高的風險和潛在的收益。精明的交易員通過持續學習、調整策略、監控多個因子以及密切關注市場動態來管理這些風險。通過Benzinga Pro的實時提醒,保持對最新聯邦快遞期權交易的信息更新。

In terms of liquidity and interest, the mean open interest for FedEx options trades today is 1280.86 with a total volume of 1,653.00.

In terms of liquidity and interest, the mean open interest for FedEx options trades today is 1280.86 with a total volume of 1,653.00.