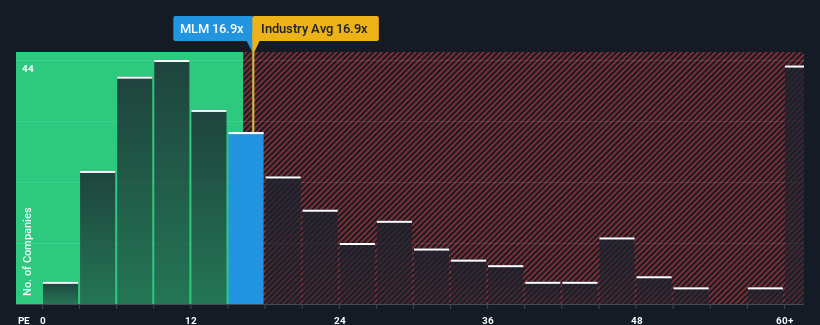

With a price-to-earnings (or "P/E") ratio of 16.9x Martin Marietta Materials, Inc. (NYSE:MLM) may be sending bullish signals at the moment, given that almost half of all companies in the United States have P/E ratios greater than 20x and even P/E's higher than 35x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been advantageous for Martin Marietta Materials as its earnings have been rising faster than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

What Are Growth Metrics Telling Us About The Low P/E?

Martin Marietta Materials' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 82% last year. The strong recent performance means it was also able to grow EPS by 179% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Taking a look back first, we see that the company grew earnings per share by an impressive 82% last year. The strong recent performance means it was also able to grow EPS by 179% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings growth is heading into negative territory, declining 8.5% per annum over the next three years. Meanwhile, the broader market is forecast to expand by 11% each year, which paints a poor picture.

With this information, we are not surprised that Martin Marietta Materials is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Martin Marietta Materials maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Martin Marietta Materials (at least 1 which is a bit unpleasant), and understanding them should be part of your investment process.

Of course, you might also be able to find a better stock than Martin Marietta Materials. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.