Despite an already strong run, Ningbo ZhongDa Leader Intelligent Transmission Co., Ltd. (SZSE:002896) shares have been powering on, with a gain of 30% in the last thirty days. Looking further back, the 13% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

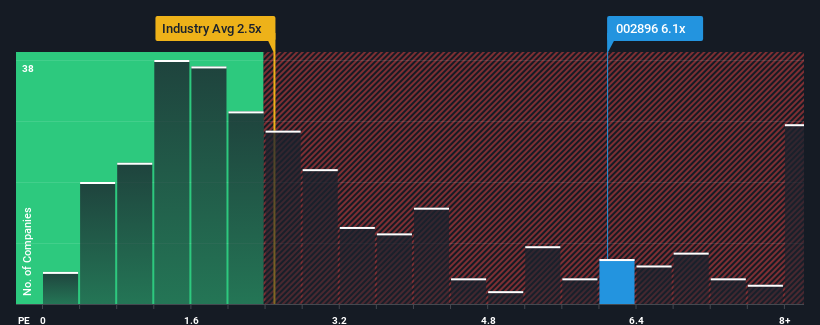

Following the firm bounce in price, given around half the companies in China's Electrical industry have price-to-sales ratios (or "P/S") below 2.5x, you may consider Ningbo ZhongDa Leader Intelligent Transmission as a stock to avoid entirely with its 6.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

What Does Ningbo ZhongDa Leader Intelligent Transmission's Recent Performance Look Like?

Ningbo ZhongDa Leader Intelligent Transmission hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ningbo ZhongDa Leader Intelligent Transmission.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as Ningbo ZhongDa Leader Intelligent Transmission's is when the company's growth is on track to outshine the industry decidedly.

The only time you'd be truly comfortable seeing a P/S as steep as Ningbo ZhongDa Leader Intelligent Transmission's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 4.3% decrease to the company's top line. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, revenue is anticipated to climb by 46% during the coming year according to the two analysts following the company. With the industry only predicted to deliver 25%, the company is positioned for a stronger revenue result.

With this information, we can see why Ningbo ZhongDa Leader Intelligent Transmission is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Ningbo ZhongDa Leader Intelligent Transmission's P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Ningbo ZhongDa Leader Intelligent Transmission shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Having said that, be aware Ningbo ZhongDa Leader Intelligent Transmission is showing 1 warning sign in our investment analysis, you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.