The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But if you buy shares in a really great company, you can more than double your money. For example, the Shandong Hontron Aluminum Industry Holding Company Limited (SZSE:002379) share price has soared 152% in the last three years. How nice for those who held the stock! It's also good to see the share price up 72% over the last quarter. But this move may well have been assisted by the reasonably buoyant market (up 34% in 90 days).

Since it's been a strong week for Shandong Hontron Aluminum Industry Holding shareholders, let's have a look at trend of the longer term fundamentals.

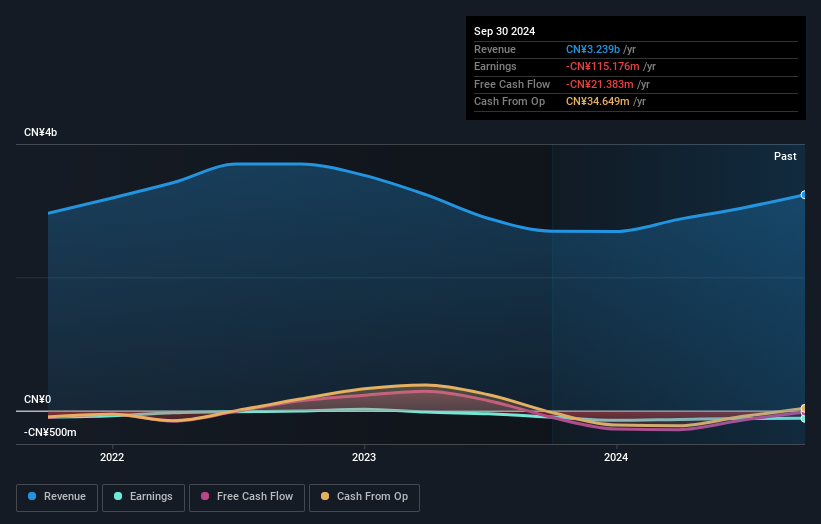

Shandong Hontron Aluminum Industry Holding isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Shandong Hontron Aluminum Industry Holding actually saw its revenue drop by 4.9% per year over three years. So the share price gain of 36% per year is quite surprising. It's a good reminder that expectations about the future, not the past history, always impact share prices.

Shandong Hontron Aluminum Industry Holding actually saw its revenue drop by 4.9% per year over three years. So the share price gain of 36% per year is quite surprising. It's a good reminder that expectations about the future, not the past history, always impact share prices.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling Shandong Hontron Aluminum Industry Holding stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's nice to see that Shandong Hontron Aluminum Industry Holding shareholders have received a total shareholder return of 83% over the last year. That gain is better than the annual TSR over five years, which is 18%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Shandong Hontron Aluminum Industry Holding you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.