It is a pleasure to report that the Henan Huaying Agricultural Development Co., Ltd. (SZSE:002321) is up 90% in the last quarter. But that doesn't change the fact that the returns over the last five years have been less than pleasing. In fact, the share price is down 40%, which falls well short of the return you could get by buying an index fund.

While the stock has risen 23% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

Given that Henan Huaying Agricultural Development didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over half a decade Henan Huaying Agricultural Development reduced its trailing twelve month revenue by 4.3% for each year. While far from catastrophic that is not good. The share price decline at a rate of 7% per year is disappointing. But it doesn't surprise given the falling revenue. Without profits, its hard to see how shareholders win if the revenue keeps falling.

Over half a decade Henan Huaying Agricultural Development reduced its trailing twelve month revenue by 4.3% for each year. While far from catastrophic that is not good. The share price decline at a rate of 7% per year is disappointing. But it doesn't surprise given the falling revenue. Without profits, its hard to see how shareholders win if the revenue keeps falling.

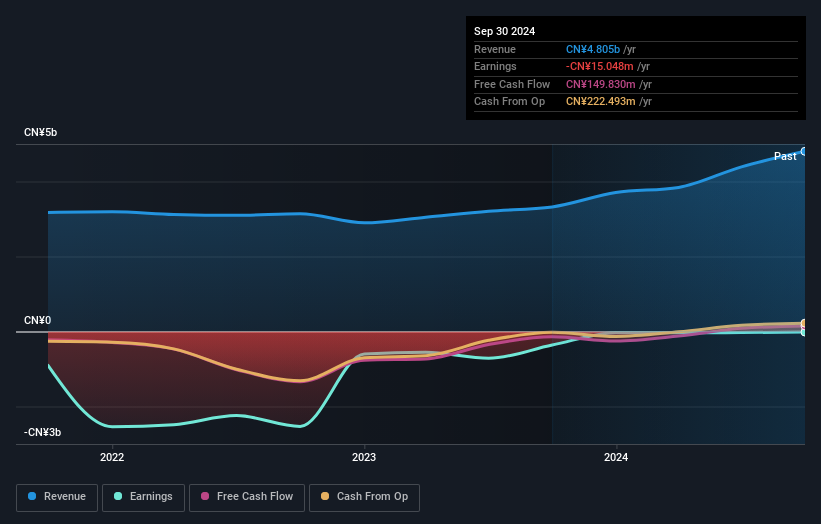

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Henan Huaying Agricultural Development's earnings, revenue and cash flow.

A Different Perspective

It's good to see that Henan Huaying Agricultural Development has rewarded shareholders with a total shareholder return of 35% in the last twelve months. That certainly beats the loss of about 7% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.