Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Eternal Asia Supply Chain Management Ltd. (SZSE:002183) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

How Much Debt Does Eternal Asia Supply Chain Management Carry?

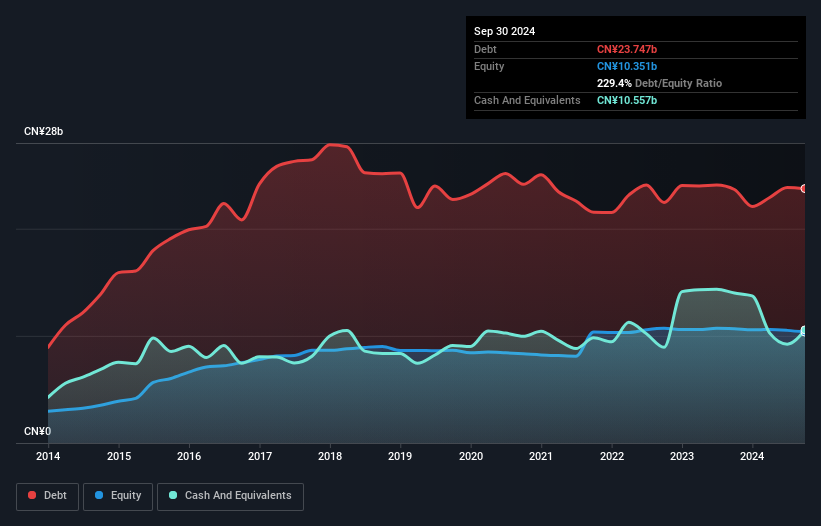

As you can see below, Eternal Asia Supply Chain Management had CN¥23.7b of debt, at September 2024, which is about the same as the year before. You can click the chart for greater detail. On the flip side, it has CN¥10.6b in cash leading to net debt of about CN¥13.2b.

How Healthy Is Eternal Asia Supply Chain Management's Balance Sheet?

According to the last reported balance sheet, Eternal Asia Supply Chain Management had liabilities of CN¥38.2b due within 12 months, and liabilities of CN¥3.17b due beyond 12 months. Offsetting this, it had CN¥10.6b in cash and CN¥19.6b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥11.2b.

According to the last reported balance sheet, Eternal Asia Supply Chain Management had liabilities of CN¥38.2b due within 12 months, and liabilities of CN¥3.17b due beyond 12 months. Offsetting this, it had CN¥10.6b in cash and CN¥19.6b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥11.2b.

This deficit is considerable relative to its market capitalization of CN¥13.3b, so it does suggest shareholders should keep an eye on Eternal Asia Supply Chain Management's use of debt. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Weak interest cover of 1.2 times and a disturbingly high net debt to EBITDA ratio of 12.5 hit our confidence in Eternal Asia Supply Chain Management like a one-two punch to the gut. This means we'd consider it to have a heavy debt load. Even more troubling is the fact that Eternal Asia Supply Chain Management actually let its EBIT decrease by 7.2% over the last year. If that earnings trend continues the company will face an uphill battle to pay off its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Eternal Asia Supply Chain Management's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Considering the last three years, Eternal Asia Supply Chain Management actually recorded a cash outflow, overall. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Our View

To be frank both Eternal Asia Supply Chain Management's net debt to EBITDA and its track record of covering its interest expense with its EBIT make us rather uncomfortable with its debt levels. And even its level of total liabilities fails to inspire much confidence. After considering the datapoints discussed, we think Eternal Asia Supply Chain Management has too much debt. While some investors love that sort of risky play, it's certainly not our cup of tea. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Be aware that Eternal Asia Supply Chain Management is showing 3 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.