The film market is recovering, but related companies may still need to stimulate more intrinsic growth momentum...

Due to the lack of quality supply and the impact of a high base in the previous year, the upcoming year of 2024 is set to be quite challenging for the China film market.

As of the time of writing, although the China film box office has surpassed 40 billion yuan in 2024, this figure is not only below the same period last year, but with just over ten days remaining until 2025, it also means that this year's annual box office is almost impossible to exceed last year's achievement of 54.953 billion yuan.

In terms of monthly performance, the China film market has experienced a year-on-year decline in box office for seven consecutive months from April to October this year. However, with the ongoing efforts of the New Year slot, the film industry seems to have finally shown signs of marginal improvement this winter. Data indicates that in November, the national film box office reached 1.177 billion yuan, a year-on-year increase of 11.4%, returning to a growth track after more than half a year.

In terms of monthly performance, the China film market has experienced a year-on-year decline in box office for seven consecutive months from April to October this year. However, with the ongoing efforts of the New Year slot, the film industry seems to have finally shown signs of marginal improvement this winter. Data indicates that in November, the national film box office reached 1.177 billion yuan, a year-on-year increase of 11.4%, returning to a growth track after more than half a year.

Entering December, the warmth continues to spread. Taking the well-received film "Good Things" as an example, as of now, the film's cumulative box office has surpassed the 0.6 billion yuan mark, with market predictions suggesting its total box office could reach 0.721 billion yuan, significantly exceeding previous market expectations.

Recent secondary markets have also given positive feedback to the continuously recovering film market. According to Zhizhong Finance APP, MAOYAN ENT (01896) has rebounded by 50% since September 11, while related stocks such as ALI PICTURES and IMAX CHINA (01970) have also performed well.

Has the New Year slot 'ignited' and helped the industry overcome the turning point?

As one of the traditional four major film release periods in the market, the New Year release season is suitable for major blockbusters of various genres, and has always been valued by the market. However, this year's New Year release season may hold even more significance than in previous years.

In the film and television Industry, there is a saying of 'large and small years.' In 2023, benefiting from the concentrated release of quality films that were held back during the pandemic, China's film and television industry is experiencing a wave of 'minor spring.' However, due to the production cycles of the films themselves, as the inventory films have gone through a round of release and stock levels have bottomed out, combined with quality new films not yet completed, the film industry has rapidly 'cooled down' since the second quarter of this year.

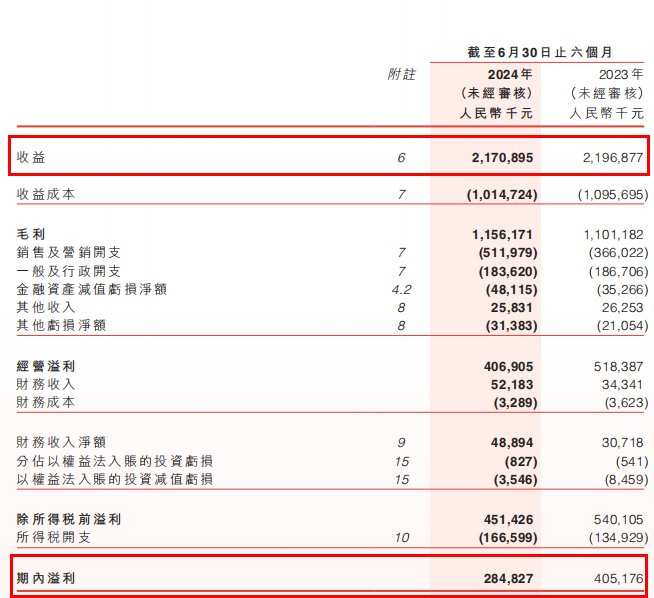

Taking MAOYAN ENT as an example, due to the impact of changes in industry trends, the company's total revenue in the first half of this year fell by 1.2%, while net income plummeted by 29.7%, making the profitability pressure evident.

However, after more than half a year of adjustments, during this transition between the old and new years, the film industry seems to be witnessing many new Bullish Signals.

First, from a policy perspective, according to official news, the National Film Administration launched a 'New Year's Eve celebration welcoming the Spring Festival – National Film Consumer Benefit Season' on December 9, which covers important film release periods such as the New Year, New Year's Day, and Spring Festival, during which relevant Institutions will invest not less than 0.6 billion yuan, benefiting film audiences nationwide.

In addition to stimulating policies, the supply factors that have suppressed industry performance within the year may also usher in positive changes. Driven by 'Good Things,' the total box office (including advance screenings and pre-sales) of this year's New Year season has surpassed 1.4 billion yuan. More critically, there are still more than 20 films scheduled to be released in the upcoming days of this month.

If the timeline is extended, several highly anticipated films, including Xu Ke's directed and adapted martial arts film "The Legend of the Condor Heroes: The Great Hero", Wu Ershan's epic fantasy sequel "Fengshen Part Two: The Battle of Xiqi", and the sequel to the phenomenally successful animated film "Nezha: The Devil's Child Comes to the World" titled "Nezha: The Devil's Child Disturbs the Sea", have announced their release dates for the Spring Festival of 2025, which undoubtedly adds confidence for a good start to the film market next year. Additionally, films waiting to be released such as "Operation Dragon", "Detective Chinatown 1900", and "Welcome to Dragon Restaurant" are also expected to further enrich the supply for the 2025 film market.

Are theater stocks reaching a turning point under stable expectations?

With the approach of 2025, the marginal improvements on the supply side combined with the effects of stimulating policies, the certainty of a recovery in China's film market next year is expected to strengthen due to the low base.

However, even under the industry’s stabilization and recovery expectations, whether the relevant companies can usher in a performance turning point may still require specific analysis of specific issues.

Let's first look at MAOYAN ENT; the online entertainment ticketing business, where film ticket sales are a cornerstone service, can be seen as the key factor determining the overall performance trend of the company. Within this, film ticket sales constitute a major part of MAOYAN's online entertainment ticketing.

Breaking it down, MAOYAN's film ticket revenue primarily depends on the number of moviegoers, online penetration rate, company market share, and service fee per ticket. Among these, the online penetration rate and company market share have remained relatively stable, with minor fluctuations; thus, the main influencing factors for MAOYAN’s business scale lie in the service fee per ticket and the number of moviegoers.

It is understood that raising service fees for film ticketing needs to interface and negotiate with upstream producers and downstream nearly 12,000 cinemas, and considering the current market environment where consumers are more sensitive to prices of commodities and services, the logic for price increases is clearly not as straightforward as in previous years.

Based on the above analysis, it can be basically determined that future moviegoer numbers will be the most significant variable affecting MAOYAN ENT’s film ticketing business. Furthermore, the quality and reputation of the film itself will directly impact the number of moviegoers, which in turn will have an important effect on the company's related business. This is why the company's film ticketing business is expected to still fluctuate with the Large Cap.

As the film market has rebounded since the New Year film season, coupled with a subsequent gathering of blockbuster films, it is expected that the performance of companies such as MAOYAN ENT may recover under low baselines. However, as the logic of ticket price increases has been partially falsified this year, unless there are continuous films that exceed market expectations, the performance of related companies may lack significant upward potential.

Additionally, it is worth mentioning that, beyond traditional film ticketing business, companies such as ALI PICTURES and MAOYAN ENT are also cultivating new growth engines to enhance growth certainty.

Taking ALI PICTURES as an example, the company has currently gathered a product matrix composed of Tao Piao Piao, Phoenix Cloud Intelligence, and Damai for the B and C ends, successfully creating an offline entertainment flagship platform. At the same time, ALI PICTURES is also increasing its investment in innovative technologies such as AI, digital humans, and virtual filming, while proactively developing IP derivatives and innovative businesses. Under the guidance of a long-term "content + technology" strategy, relying on diversified business layouts, it may be expected that ALI PICTURES could cultivate more new growth points beyond its traditional advantages.

In summary, the warming of the film market undoubtedly represents a great bullish signal for companies related to the Industry Chain. However, in the face of an increasingly complex market environment, if these companies want to enhance their growth certainty and resilience, in addition to hoping for the stabilization and rebound of the Large Cap, they also need to stimulate more intrinsic growth momentum.

就月度表现而言,中国电影市场在今年4-10月连续7个月的时间里出现了票房同比下滑。但随着贺岁档的持续发力,电影行业似乎终于在这个冬天露出了边际改善的迹象。数据显示,11月全国电影总票房为11.77亿元,同比增长11.4%,时隔大半年后重回增长轨道。

就月度表现而言,中国电影市场在今年4-10月连续7个月的时间里出现了票房同比下滑。但随着贺岁档的持续发力,电影行业似乎终于在这个冬天露出了边际改善的迹象。数据显示,11月全国电影总票房为11.77亿元,同比增长11.4%,时隔大半年后重回增长轨道。