The buyback is about to complete the preliminary work.

This afternoon, Kweichow Moutai held a performance briefing for the third quarter of 2024.

At the meeting, the company's management responded to market concerns regarding stock splits, buybacks, annual targets, and internationalization.

Value management is important.

Since the beginning of this year, the Baijiu(Chinese Liquor) industry has faced significant performance pressure, and Baijiu stocks have performed poorly.

Since the beginning of this year, the Baijiu(Chinese Liquor) industry has faced significant performance pressure, and Baijiu stocks have performed poorly.

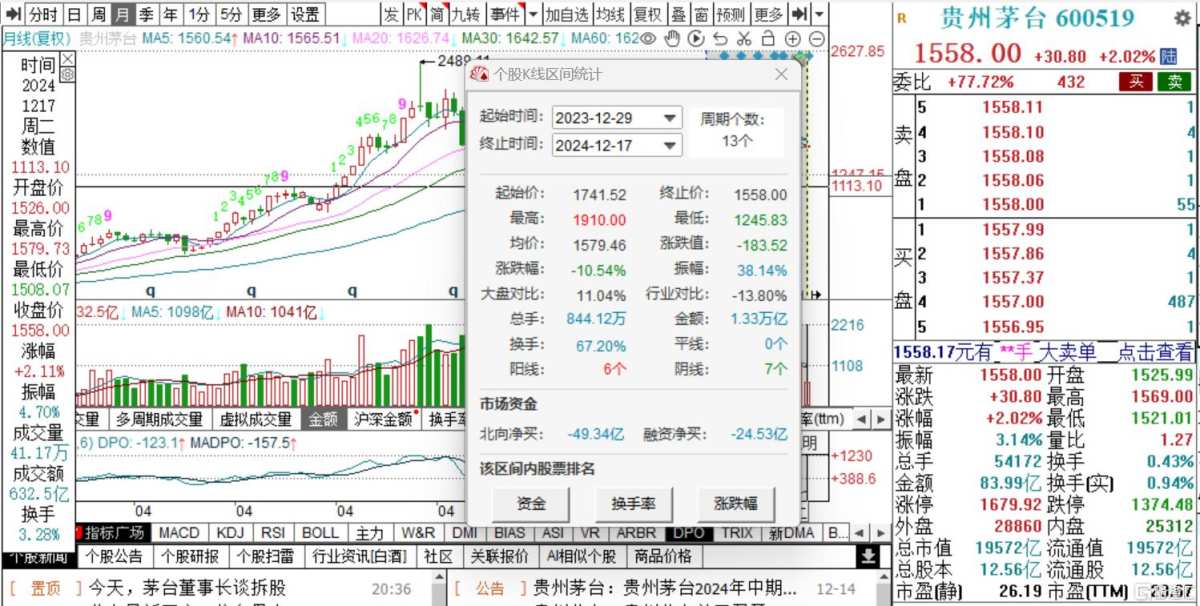

Taking Kweichow Moutai as an example, the company's stock price has fallen by more than 10% since the beginning of this year, last reported at 1558 yuan per share, with a total Market Cap of 1.96 trillion yuan.

Regarding the stock split issue, Kweichow Moutai's Chairman Zhang Deqin responded that opinions among Shareholders on whether Kweichow Moutai should split its stock are not entirely unified; some support it, while others oppose it, all from the perspective of what is best for Kweichow Moutai, with advantages and disadvantages on both sides. There are successful cases to refer to for both splitting and not splitting the stock.

Zhang Deqin stated that the Board of Directors of Kweichow Moutai needs to systematically consider aspects such as the healthy, stable, and sustainable development of the company and the long-term interests of Shareholders when making prudent decisions.

He also emphasized: "Kweichow Moutai has always attached great importance to Market Cap management and has conducted careful analysis and demonstration of various Market Cap management tools."

In addition to stock splits, Kweichow Moutai previously announced plans to repurchase 3 billion to -6 billion yuan of shares for cancellation and reducing registered capital, with a repurchase price not exceeding 1795.78 yuan/share (inclusive), and the repurchase period is within 12 months from the date the repurchase plan is approved at the Shareholders' meeting.

In response, Jiang Yan, Vice General Manager, Chief Financial Officer, and Board Secretary of Kweichow Moutai, stated that this is the first time Kweichow Moutai has implemented a share repurchase plan, and the preliminary work, such as selecting professional intermediary institutions and opening a special repurchase Account, is about to be completed.

Once this work is completed, Kweichow Moutai will disclose the repurchase report in a timely manner according to the relevant regulations of the China Securities Regulatory Commission and the Shanghai Stock Exchange and carry out the related work for share repurchase.

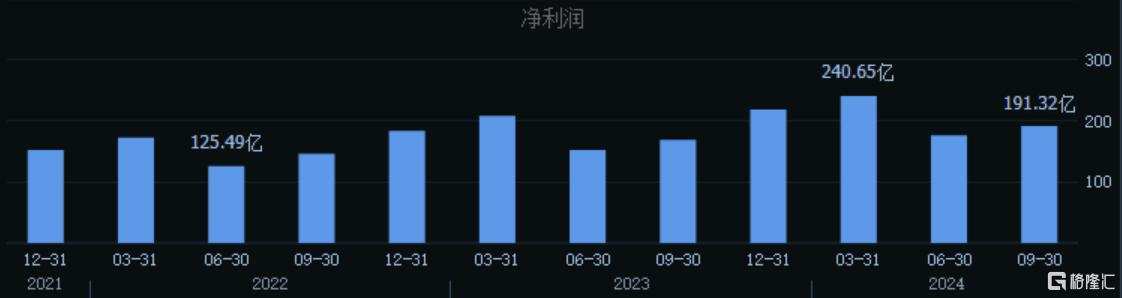

Additionally, Jiang Yan also mentioned that from January to September this year, the net cash flow from operating activities (CFO) of Kweichow Moutai was 44.421 billion yuan, a decrease of 5.581 billion yuan year-on-year, down 11.16%, mainly due to the increase in time deposits that cannot be withdrawn early at the financial company and the increase in the central bank's statutory deposit reserve.

Excluding data from the financial company, the growth rate of cash flow from operating activities (CFO) is basically consistent with the revenue growth rate. Currently, Kweichow Moutai has a rich cash flow and good liquidity.

There is confidence in achieving performance targets.

Regarding this year's performance growth target, Zhang Deqin stated that Kweichow Moutai is confident of achieving a 15% annual revenue growth target. The company's annual operational goals are scientifically formulated based on multiple factors such as production, market, and base liquor.

Last year, Kweichow Moutai achieved a revenue of 150.56 billion yuan, and with a 15% growth target, this year's revenue needs to reach 173.144 billion yuan.

In the first three quarters of this year, Kweichow Moutai achieved a total revenue of 123.123 billion yuan, a year-on-year increase of 16.91%; the net income attributable to shareholders was 60.828 billion yuan, a year-on-year increase of 15.04%.

This means that Kweichow Moutai's revenue in the fourth quarter needs to reach 50.021 billion yuan, which is more than double compared to 21.858 billion yuan in the fourth quarter of last year.

In terms of domestic channel layout, Zhang Deqin stated that the company has currently formed a relatively complete channel ecosystem. From the report's perspective, wholesale channels include social dealers, e-commerce, and supermarkets, while direct sales channels include self-operated companies and iMoutai, etc. In the first three quarters of this year, direct sales channel revenue was 51.989 billion yuan, a year-on-year increase of 12.51%.

Additionally, Moutai is actively pursuing international expansion.

Zhang Deqin stated that internationalization is one of the company's important global strategies. Since the beginning of the year, the company's management has successively visited Europe, North America, Southeast Asia, and other places to conduct research and market promotion.

In 2023, Kweichow Moutai achieved revenue of 4.35 billion yuan overseas, accounting for 2.89% of total revenue; the gross margin was 92.18%, an increase of 0.14 percentage points year-on-year. As of the end of the third quarter this year, Kweichow Moutai had 106 overseas Dealers.

今年以来,白酒行业业绩承压明显,且白酒股股价表现较差。

今年以来,白酒行业业绩承压明显,且白酒股股价表现较差。