Booking Holdings stated that the impact of inflation is still suppressing travel demand in the USA, with price-sensitive consumers taking longer to plan their vacations.

According to Zhitong Finance, Booking Holdings (BKNG.US) indicated that the impact of inflation continues to suppress travel demand in the USA, and price-sensitive consumers are waiting longer to plan their vacations. The company's Chief Financial Officer, Ewout Steenbergen, stated in an interview: "Recently, we have not seen much change in booking windows in the USA." The booking window is an indicator measuring how far in advance consumers book travel. A shorter booking window means consumers are delaying their vacations for a longer time.

Meanwhile, tourists from Europe are booking earlier, such as for ski trips and Easter trips planned for February. He told investors last week that stable demand from continental Europe has improved the company’s outlook.

The executive's comments highlight that after the initial travel boom post-pandemic, growth in the travel industry is slowing. As the largest online travel company by Market Cap, Booking often leads its peers. Steenbergen remarked that although the recent quarterly earnings show that the economic slowdown is not as severe as some investors were concerned about, demand in the USA remains below that in other regions where Booking operates.

The executive's comments highlight that after the initial travel boom post-pandemic, growth in the travel industry is slowing. As the largest online travel company by Market Cap, Booking often leads its peers. Steenbergen remarked that although the recent quarterly earnings show that the economic slowdown is not as severe as some investors were concerned about, demand in the USA remains below that in other regions where Booking operates.

He noted that this is due to the emergence of "diversification" in the USA market, where luxury travel demand remains strong while lower-income groups feel greater pressure from inflation. Some consumers in the USA are opting for lower-rated hotels or shortening their trips.

Nevertheless, Steenbergen expects trends in the USA to eventually improve as consumers still prioritize weekend trips over other discretionary items like new clothing. Speaking about the US market, he stated: "We anticipate that at some point, the market will begin to normalize and become stronger, especially after the effects of inflation play out in the economy."

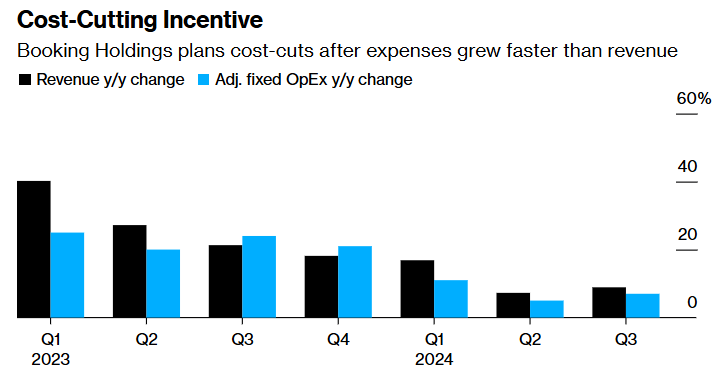

Cost-cutting plan.

Internally, Booking is also considering the changes brought about by growth after the pandemic, during which it established new services such as flight bookings, car rentals, and a travel activities platform.

Steenbergen said this led to fixed operating expenses, such as personnel, administrative, and technology costs, growing faster than revenue. The company announced a cost-cutting plan last month to 'simplify the organization.' The plan will include layoffs, reducing Real Estate, and modernizing various internal processes and systems. The company stated in a filing to the USA Securities and Exchange Commission this month that these measures will help cut annual expenses by approximately $0.4 billion to $0.45 billion.

The company recently laid off about 60 employees, including technical support and marketing positions at Chicago's Rocket Travel. Rocket Travel is the B2B subsidiary of its Asian travel brand Agoda. Steenbergen stated that the company decided to move operational and technical support positions to Asia, closer to Agoda's offices in Bangkok and Singapore, while keeping customer-facing positions in the USA. He mentioned that layoffs may continue over the next two to three years, with changes in Europe occurring more slowly than in other regions due to labor laws.

Booking intends to reinvest the savings into growth plans, such as activities targeting travelers, new geographic markets, and integrating generative AI into customer service operations and Other Products. Steenbergen told investors that they can expect the benefits of these investments to begin appearing in the second half of 2025, especially in 2026 and beyond.

这位高管的言论突显出,在疫情后最初的旅游热潮之后,旅游业的增长正在放缓。作为市值最大的在线旅游公司,Booking也经常成为同行的领头羊。Steenbergen表示,尽管其最近的季度收益显示,经济放缓并不像一些投资者担心的那样严重,但美国的需求仍低于Booking运营的其他地区。

这位高管的言论突显出,在疫情后最初的旅游热潮之后,旅游业的增长正在放缓。作为市值最大的在线旅游公司,Booking也经常成为同行的领头羊。Steenbergen表示,尽管其最近的季度收益显示,经济放缓并不像一些投资者担心的那样严重,但美国的需求仍低于Booking运营的其他地区。