December 16, 2024

NTT DATA CORPORATION

NTT DATA, Inc. (President and CEO: Yutaka Sasaki, hereinafter “NTT DATA”) will begin providing “C-Turtle FE (C-Turtle FE)”, a greenhouse gas (GHG) emissions calculation solution targeting financial institutions and their investors and loan recipients to the 33 Bank (hereinafter “the 33 Bank”) from 2025/1.

Starting with the provision of “C-Turtle FE,” NTT DATA will support the reduction of GHG emissions related to investment and loans through understanding GHG emissions (hereinafter “financed emissions”) of investment and loan recipients and through engagement support, etc.

backgrounds

Utilizing know-how that has been providing systems to financial institutions over many years, NTT DATA has promoted efficient visualization of GHG emissions through cooperation with financial institution systems, with the provision of C-Turtle FE as the main axis, and has provided support for reducing GHG emissions, including financial institutions and their investors. Through this initiative, we aim to contribute to achieving carbon neutral across the entire supply chain and region.

Utilizing know-how that has been providing systems to financial institutions over many years, NTT DATA has promoted efficient visualization of GHG emissions through cooperation with financial institution systems, with the provision of C-Turtle FE as the main axis, and has provided support for reducing GHG emissions, including financial institutions and their investors. Through this initiative, we aim to contribute to achieving carbon neutral across the entire supply chain and region.

The 33 Bank regards “climate change response and environmental conservation” as one of its materialistic issues in its sustainability policy, and is proceeding with efforts aimed at reducing climate change risks through environmental conservation activities and provision of environmentally friendly financial products and services. In addition to setting a target of “cumulative execution amount of 150 billion yen for sustainable finance” over the three years from fiscal 2024 to fiscal 2026, we are aiming for carbon neutral in 2050 in Scopes 1 and 2. Furthermore, in response to climate change issues, financial institutions are required to calculate and disclose the financed emissions of investment and loan recipients, and it was decided to introduce C-Turtle FE from January 2025 for the purpose of calculating and improving accurate and highly reliable financed emissions.

features

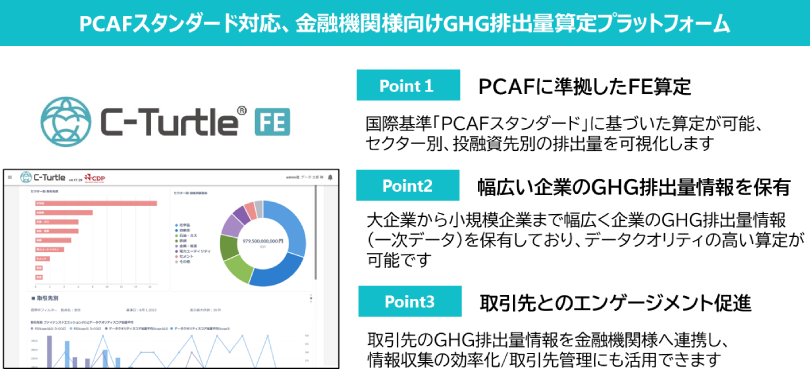

C-Turtle FE is a platform that supports visualization and reduction of financed emissions that conforms to the international standard “PCAF Standard” of financial institutions as a new service for the GHG visualization platform “C-Turtle,” which employs the “Total Emissions Allocation Method Note 2,” which can incorporate the reduction efforts of suppliers as the company's Scope 3 Note 1 emission reduction effect. With the introduction of C-Turtle FE, it is possible to calculate Scope3 emissions with high data quality reflecting GHG emissions related to investment and loans and their reduction efforts by utilizing primary data from investment and loan recipients. As a domestically produced tool, we are adding functions and providing coefficient data, etc. in a timely manner in response to the latest regulatory trends and trends. This year, we are developing collaboration functions, etc. with portal sites for each financial institution corporation to facilitate the use of C-Turtle at investment and loan destinations.

Figure: C-Turtle FE Overview

Looking to the future

NTT DATA will use this initiative as a trigger to support 33 Financial Group activities aimed at achieving carbon neutral. Furthermore, we will contribute to the realization of a sustainable society by expanding the provision of solutions aimed at reducing GHG emissions across all of our investment and loan recipients.

About C-Turtle

C-Turtle is a GHG emissions visualization platform that realizes Scope3 calculations that can be reduced. Generally, Scope 3 calculations are often calculated by “amount of activity (scale of activity of a company)” x “emission source unit (market average value),” and there is an issue where it is difficult to reflect a company's reduction efforts. C-Turtle uses a “total emissions allocation method” that allows supplier reduction efforts to be incorporated into in-house emissions by utilizing measured values (primary data) of supplier emissions for Scope 3 calculations. As a result, the visualization status of emissions from investors and suppliers becomes clear, and it is possible to calculate and promote reduction of GHG emissions through the supply chain.

notes

- Note 1 In the GHG protocol, greenhouse gas emissions are classified into three categories, “Scope 1 (direct emissions of the company),” “Scope 2 (indirect emissions of the company),” and “Scope 3 (other emissions from the company's business activities),” depending on the method and emission entity, and the sum of these three is considered “emissions of the entire supply chain.”

- Note 2 The total emissions allocation method is a method of calculating emissions by “activity volume (transaction value by supplier)” x “emission source unit by supplier (ratio of emissions per sales by supplier)” without using industry average values.

- “C-Turtle” is a registered trademark of NTT DATA CORPORATION in Japan.

- Other product names, company names, and organization names are trademarks or registered trademarks of their respective companies.

- This release is one of the initiatives of the GX solution brand “NTT G×Inno (NTT G×Inno)” developed by the NTT Group.

- “NTT G×Inno” is a registered trademark of Nippon Telegraph and Telephone Corporation.

It is an abbreviation of “NTT GX (Green Transformation) × Innovation,” and it is an effort for the NTT Group to innovate (transform) in the GX field by providing solutions to society and contribute to the realization of carbon neutrality in 2050.

Contact information for inquiries regarding this matter

Financial Innovation Division

Global Customer Success Office

Kurosaki, Arai, Ide, Kubota

E-mail: fih-cs-g@hml.nttdata.co.jp

Consulting Business Division

Sustainability Service & Strategy Promotion Office

Mochizuki, Amano

E-mail: mis-mfg3-green@kits.nttdata.co.jp

NTTデータは、長年にわたり金融機関へシステム提供を行ってきたノウハウを活用し、C-Turtle FEの提供を主軸として、金融機関システムとの連携による効率的なGHG排出量可視化を推進し、金融機関とその投融資先を含めたGHG排出量削減に向けた支援を行ってきました。本取り組みを通じ、サプライチェーン全体・地域全体のカーボンニュートラル達成に貢献することを目指しています。

NTTデータは、長年にわたり金融機関へシステム提供を行ってきたノウハウを活用し、C-Turtle FEの提供を主軸として、金融機関システムとの連携による効率的なGHG排出量可視化を推進し、金融機関とその投融資先を含めたGHG排出量削減に向けた支援を行ってきました。本取り組みを通じ、サプライチェーン全体・地域全体のカーボンニュートラル達成に貢献することを目指しています。