Possible Bearish Signals With Xylem Insiders Disposing Stock

Possible Bearish Signals With Xylem Insiders Disposing Stock

Many Xylem Inc. (NYSE:XYL) insiders ditched their stock over the past year, which may be of interest to the company's shareholders. When evaluating insider transactions, knowing whether insiders are buying is usually more beneficial than knowing whether they are selling, as the latter can be open to many interpretations. However, shareholders should take a deeper look if several insiders are selling stock over a specific time period.

许多赛莱默公司(纽交所:XYL)的内部人士在过去一年中抛售了他们的股票,这可能引起公司股东的关注。评估内部交易时,内部人士是否买入往往比知道他们是否卖出更有价值,因为后者可能有多种解读。然而,如果多个内部人士在特定时间段内出售股票,股东应深入分析。

While we would never suggest that investors should base their decisions solely on what the directors of a company have been doing, we would consider it foolish to ignore insider transactions altogether.

虽然我们绝不会建议投资者仅仅依据公司的董事们所做的事情来做决定,但我们认为完全忽视内部交易是愚蠢的。

The Last 12 Months Of Insider Transactions At Xylem

赛莱默过去12个月的内部交易

In the last twelve months, the biggest single sale by an insider was when the Senior VP & President of Water Infrastructure, Hayati Yarkadas, sold US$1.2m worth of shares at a price of US$128 per share. That means that an insider was selling shares at around the current price of US$121. While we don't usually like to see insider selling, it's more concerning if the sales take place at a lower price. We note that this sale took place at around the current price, so it isn't a major concern, though it's hardly a good sign.

在过去十二个月中,内部人士最大的一笔单笔出售是水基础设施高级副总裁兼总裁Hayati Yarkadas以每股128美元的价格出售了价值120万美元的股份。这意味着内部人士是在当前价格约为121美元时出售股份。虽然通常不喜欢看到内部人士的卖出,但如果卖出是在较低价格时进行,就更加令人担忧。我们注意到这笔交易是在与当前价格接近时进行的,因此这不是一个主要问题,但显然也不是一个好迹象。

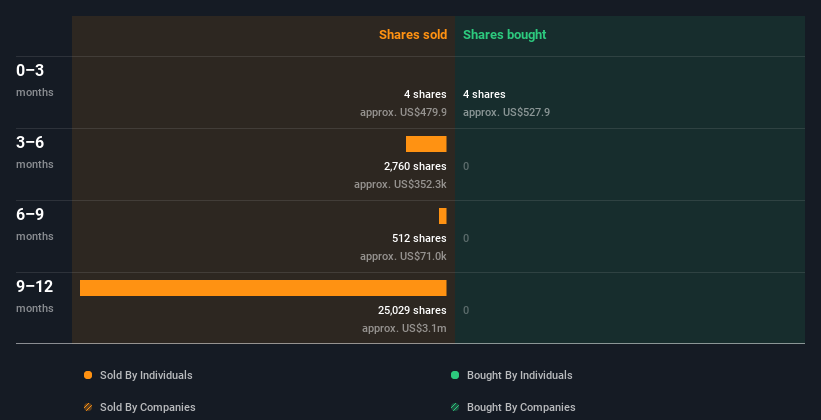

In total, Xylem insiders sold more than they bought over the last year. The chart below shows insider transactions (by companies and individuals) over the last year. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

总的来说,赛莱默的内部人士在过去一年中卖出的股份超过了买入的股份。下面的图表显示了过去一年内部交易(由公司和个人进行)。如果你想准确知道谁出售了、多少,以及何时进行的,只需点击下方图表!

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: Most of them are flying under the radar).

如果你喜欢买入内部人士正在买入而不是卖出的股票,那么你可能会喜欢这份免费的公司名单。(提示:他们中的大多数正处于雷达之外)。

Are Xylem Insiders Buying Or Selling?

赛莱默内部人士是在买入还是卖出?

In the last three months, Independent Director Lila Tretikov bought US$528. But that was only a smidgen more than the US$480 worth of sales. Overall, we don't think these recent trades are particularly informative, one way or the other.

在过去三个月中,独立董事莉拉·特雷提科夫购买了528美元的股票。但这仅比480美元的销售额稍微多一点。总的来说,我们认为这些近期交易在某种程度上并没有特别的信息。

Does Xylem Boast High Insider Ownership?

赛莱默是否拥有高比例的内部人股权?

Many investors like to check how much of a company is owned by insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. Xylem insiders own 0.6% of the company, currently worth about US$187m based on the recent share price. I like to see this level of insider ownership, because it increases the chances that management are thinking about the best interests of shareholders.

许多投资者喜欢查看公司内部人士持有多少股份。高比例的内部拥有权通常让公司领导更关注股东的利益。赛莱默内部人士持有公司0.6%的股份,按最近的股价计算,目前价值约18700万美元。我喜欢看到这样的内部持股比例,因为这增加了管理层考虑股东最佳利益的可能性。

So What Do The Xylem Insider Transactions Indicate?

那么赛莱默内部交易表明了什么?

Insider sales and purchases have netted out over the last three months, so it's hard to draw any conclusion from recent trading. It's heartening that insiders own plenty of stock, but we'd like to see more insider buying, since the last year of Xylem insider transactions don't fill us with confidence. Of course, the future is what matters most. So if you are interested in Xylem, you should check out this free report on analyst forecasts for the company.

在过去三个月内,内部人士的销售和购买相抵消,因此很难从近期交易中得出任何结论。令人欣慰的是,内部人士拥有大量股票,但我们希望看到更多内部买入,因为过去一年赛莱默的内部交易并未让我们感到信心十足。当然,未来才是最重要的。所以,如果你对赛莱默感兴趣,你应该查看这份关于公司分析师预测的免费报告。

But note: Xylem may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

但请注意:赛莱默可能不是最值得买入的股票。因此请浏览这份关于高ROE和低债务的有趣公司免费清单。

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

在本文中,内部人士是指向相关监管机构报告其交易的个人。我们目前仅考虑公开市场交易和直接利益的私人处置,但不包括衍生交易或间接利益。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有反馈?对内容有疑虑?请直接与我们联系。或者,发送电子邮件至 editorial-team (at) simplywallst.com。

这篇来自Simply Wall St的文章是一般性的。我们根据历史数据和分析师预测提供评论,采用无偏见的方法,我们的文章并不旨在提供财务建议。它不构成对任何股票的买入或卖出建议,也未考虑到您的目标或财务状况。我们旨在为您提供以基本数据驱动的长期分析。请注意,我们的分析可能未考虑最新的价格敏感公司公告或定性材料。Simply Wall St在提到的任何股票中均没有持仓。

In total, Xylem insiders sold more than they bought over the last year. The chart below shows insider transactions (by companies and individuals) over the last year. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

In total, Xylem insiders sold more than they bought over the last year. The chart below shows insider transactions (by companies and individuals) over the last year. If you want to know exactly who sold, for how much, and when, simply click on the graph below!