Tech giants were removed from the Nasdaq 100 Index due to their large scale, and now, with the rebalancing of this benchmark index, these giants may once again face the fate of being adjusted.

According to the Zhitong Finance APP, just a year ago, the world’s leading technology companies were excluded from the Nasdaq 100 Index due to their oversized scale, and this week, with the rebalancing of the benchmark index, these giants may face the fate of being adjusted again. The root of the problem lies in the rules aimed at limiting the influence of the largest members in the index, which have faced severe challenges after the market caps of companies like Apple (AAPL.US) and Microsoft (MSFT.US) have ballooned. Although Nasdaq has already restored compliance by reducing the weight of seven companies in July 2023, the rapid growth of these companies has once again led to an imbalance in the index, potentially triggering a new round of adjustments.

The specific way Nasdaq handles this issue is specified in the index rules, but there is still room for interpretation. The rebalancing in 2023 was triggered by a regulation: an adjustment must be made when the total weight of all companies accounting for 4.5% or more of the benchmark reaches or exceeds 48%. Recently, the skyrocketing stock price of Broadcom (AVGO.US) has triggered this regulation again.

More complicatedly, the annual rebalancing scheduled for Friday, although following less stringent weight rules, will reportedly address the issue of weight imbalance, according to a Nasdaq spokesperson.

More complicatedly, the annual rebalancing scheduled for Friday, although following less stringent weight rules, will reportedly address the issue of weight imbalance, according to a Nasdaq spokesperson.

As of Monday's close, eight companies, including NVIDIA (NVDA.US), Amazon (AMZN.US), Meta Platforms (META.US), Tesla (TSLA.US), and Google (GOOGL.US), had weights exceeding 4.5% in the Nasdaq 100 Index, with a total weight close to 52%. However, according to Nasdaq's methodology document, this proportion could fall to 40%.

This adjustment means that index-tracking funds like Invesco QQQ Trust must adjust their holdings, complicating the addition of new members like MicroStrategy (MSTR.US), Palantir (PLTR.US), and Axon Enterprise (AXON.US), as well as the replacement of Illumina (ILMN.US), Super Micro Computer (SMCI.US), and Moderna (MRNA.US).

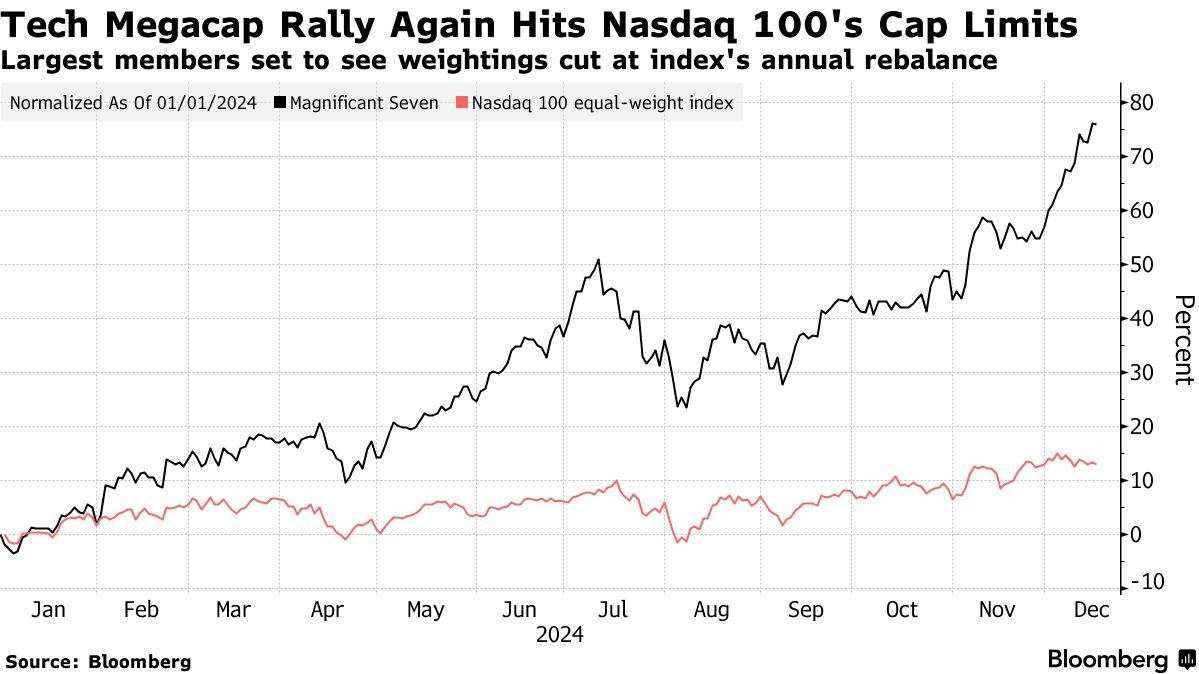

This change is the result of the optimism driven by AI that has fueled the rise of technology stocks. So far this year, the average increase for these stocks has reached 79%, about four times the average increase of other components in the NASDAQ 100 Index.

The market seems to be challenging the deeply entrenched index rules that have existed for decades and forcing index providers to re-examine how to manage the complexities involving trillions of dollars in Market Cap," noted Todd Sohn, an ETF strategist at Strategas Securities. "After a brief adjustment over the summer, the dominance of large-cap stocks has once again become evident."

The continued dominance of tech giants has created trouble for index providers, compelling them to rethink the rules to comply with diversification principles and protect investors from concentrated portfolios.

Earlier this year, FTSE Russell adopted new rules to curb the influence of the largest stocks in its U.S. growth and value Indicators, while S&P Dow Jones also revised its capped process approach for major industry benchmarks.

NASDAQ decided to shift its former special rebalancing to regular rebalancing, which again highlights the human factors in passive investing and the opportunities for professional hedge funds to profit from this event. Sohn pointed out that these rules blurred the lines between active and passive investing, bringing new challenges and opportunities to the market.

更为复杂的是,周五即将进行的年度重新平衡虽然遵循较不严格的权重规则,但纳斯达克发言人表示,此次重新平衡将解决权重不平衡的问题。

更为复杂的是,周五即将进行的年度重新平衡虽然遵循较不严格的权重规则,但纳斯达克发言人表示,此次重新平衡将解决权重不平衡的问题。