European stocks fell on Tuesday, as uncertainty in the political situation in France and Germany depressed market sentiment, while traders prepared for the eurozone inflation data and the USA interest rate decision scheduled for tomorrow.

The Stoxx Europe 600 Index closed down 0.4%, marking its fourth consecutive day of decline, with the Banks, Energy, and Telecom Sectors leading the losses.

The two largest economies in the eurozone are facing a turbulent period. German Chancellor Scholz failed to pass a no-confidence vote on Monday, triggering early elections that may be held on February 23. In France, newly appointed Prime Minister François Bayrou must form a government and quickly develop the budget for 2025.

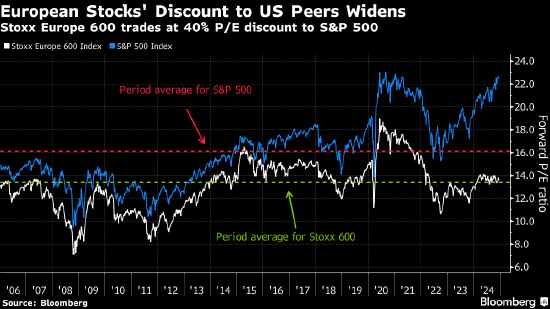

This year, European stocks have underperformed compared to the USA, which has benefited from the high concentration of Technology stocks. The Stoxx 600 Index has only risen 7.2% since 2024, while the S&P 500 Index has increased by 27%.

This year, European stocks have underperformed compared to the USA, which has benefited from the high concentration of Technology stocks. The Stoxx 600 Index has only risen 7.2% since 2024, while the S&P 500 Index has increased by 27%.

Frederique Carrier, head of investment strategy for the British Isles and Asia at RBC Wealth Management, stated that while the macroeconomic and geopolitical challenges in Europe mean it will be necessary to underweight European stocks in the next 6 to 12 months, opportunities still lie ahead.

"Given the currently extreme negative sentiment and low valuations, we believe there may be trading opportunities in European stocks in the coming months," Carrier said.

今年欧洲股市表现不及美国,后者受益于科技股的高集中度。斯托克600指数2024年以来仅上涨了7.2%,而标普500指数则上涨27%。

今年欧洲股市表现不及美国,后者受益于科技股的高集中度。斯托克600指数2024年以来仅上涨了7.2%,而标普500指数则上涨27%。