The mid-year fiscal update shows that due to increased government spending, the Australian budget is expected to fall further into deficit in the next few years, and the Australian general election will be held in less than six months.

According to the mid-year economic and fiscal outlook released on Wednesday, although the budget gap for the current fiscal year is expected to narrow slightly to 26.9 billion Australian dollars (17.1 billion US dollars), by 2025-26, it will expand to 46.9 billion Australian dollars, accounting for 1.6% of GDP, and remain at or above 1% of GDP. The Ministry of Finance also slightly lowered the economic growth forecast for this fiscal year and the next fiscal year as rising interest rates drag down private sector activity.

Deteriorating account expectations are a blow to Treasury Secretary Jim Chalmers (Jim Chalmers), who has been trying to establish sound economic management narratives for the Labor government ahead of elections to be held before May 17 next year.

He achieved consecutive surpluses in his first two budgets, the first time in nearly two decades, but increased spending hurt profits.

He achieved consecutive surpluses in his first two budgets, the first time in nearly two decades, but increased spending hurt profits.

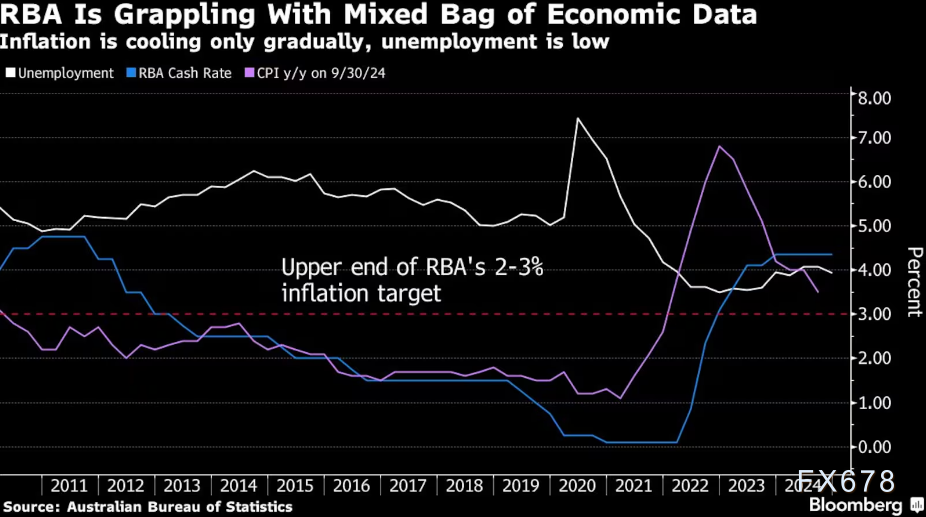

According to opinion polls, voters are becoming increasingly depressed about the state of the country's economy, with interest rates reaching a 13-year high of 4.35%, while prices are still rising. Despite the government's attempts to mitigate the impact through cost-of-living relief and tax cuts, election discontent persists.

Budget updates show that payments are expected to grow faster than previously forecast, reflecting the government's efforts. As a result, net debt as a share of GDP is expected to climb to 22.4% in 2027-28, compared to the May estimate of 21.9%.

Large numbers of immigrants after the pandemic are expected to be a major factor in the 2025 election, and the latest budget shows that the government has failed to achieve the goal of drastically reducing net arrivals.

The number of net overseas immigrants this fiscal year increased from 0.26 million in May to 0.34 million. Growth is expected to slow then, partly due to government crackdowns on international students.

The Treasury expects inflation to remain within the RBA's 2-3% target, reflecting energy rebates and other subsidies driving down electricity and rent prices. As a result, the central bank has turned its focus to core inflation. Currently, the core inflation rate is 3.5%, and it is expected that it will not fall back to this range until the end of next year.

The wider deficit would be a headache for the Reserve Bank of Australia as it tries to cool domestic demand and consumer prices. Economists have repeatedly stated that strong fiscal impulses are a key reason why central banks refuse to join the global easing cycle. Money market pricing means that the first rate cut will only happen in April or May next year.

Despite high interest rates, the unemployment rate remains very low and is expected to climb to 4.5% by June 2025. Last week's data showed that the unemployment rate unexpectedly fell to 3.9% in November, and the labor market is one of the strongest indicators of the government.

他在前两份预算中连续实现盈余,这是近二十年来的第一次,但支出增加损害了利润。

他在前两份预算中连续实现盈余,这是近二十年来的第一次,但支出增加损害了利润。