Databricks has reached a valuation of 62 billion dollars in the new round of financing; this round was led by Thrive, with funding coming from Andreessen Horowitz and DST.

According to Zhito Finance APP, Databricks Inc., known as a 'super unicorn', is raising 10 billion dollars in new funding, a massive cash injection that will immediately elevate the valuation of this new generation software company, focused on data analysis and AI, benefiting significantly from the unprecedented global wave of enterprises deploying AI, to an astonishing 62 billion dollars, highlighting the influx of global funds into software companies, especially those focused on Big Data and AI, amidst the AI wave. Databricks is committed to providing enterprises with one-stop efficient solutions in the fields of data engineering, data science, machine learning, and AI model through its cloud platform ecosystem.

Statistics compiled by institutions show that this startup software company is now one of the highest valued private companies in the world. A statement released by Databricks on Tuesday indicated, 'The company intends to use this funding for new AI suite products, acquisitions, and significant expansion into international markets.' Additionally, this funding will also be used to buy back shares held by current and former employees.

It is understood that the lead investor in this round of Databricks financing is the venture capital giant Thrive Capital, with participation from venture capital firms like Andreessen Horowitz and DST Global. 'These guys are execution machines. They are ready to become a public company,' said Thrive Capital partner Vince Hankes in a media interview. 'Raising a fund and providing liquidity for employees can alleviate the pressure faced by startups.'

It is understood that the lead investor in this round of Databricks financing is the venture capital giant Thrive Capital, with participation from venture capital firms like Andreessen Horowitz and DST Global. 'These guys are execution machines. They are ready to become a public company,' said Thrive Capital partner Vince Hankes in a media interview. 'Raising a fund and providing liquidity for employees can alleviate the pressure faced by startups.'

Earnings reports show that for the fiscal year ending in January 2025, Databricks expects its annual benchmark revenue scale to exceed 3 billion dollars. In the most recent statistical quarter ending in October, Databricks' total revenue growth rate exceeded 60%, a pace that is extraordinarily rapid, leading the entire software industry at a time when traditional software companies are struggling to achieve performance growth.

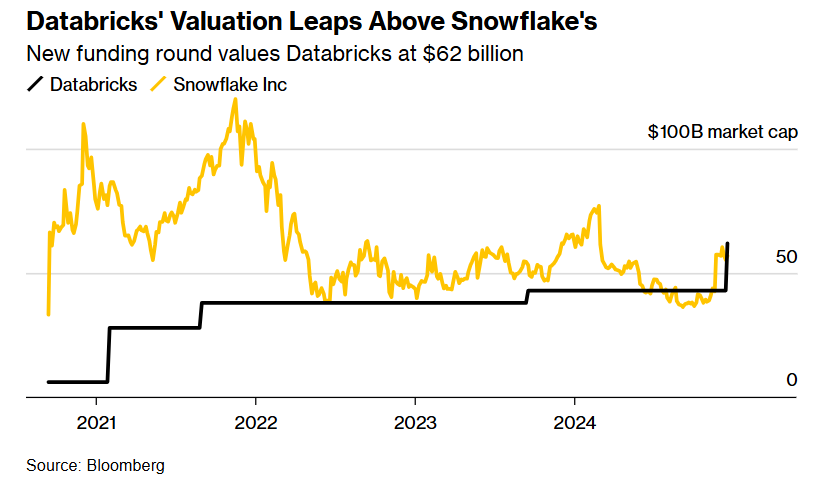

Databricks is riding the AI wave together with Snowflake, but Databricks' valuation has already far surpassed.

Databricks' latest valuation of 620 billion dollars means that this startup's valuation has surpassed its long-standing 'strong competitor' in data platforms and Big Data analysis — the publicly traded company Snowflake (SNOW.US), which had a total market capitalization of about 56.3 billion dollars as of Tuesday's close in the US stock market.

Databricks, as a data and AI platform company, focuses its core competencies on Big Data processing (based on Apache Spark), data science, machine learning, AI, and more. It aims to provide an integrated, one-stop efficient workflow for business data analysis departments, data scientists, data engineers, and corporate machine learning teams. Snowflake is one of the main competitors of Databricks. Although the products and services they offer differ, there is a significant overlap in their target markets. Both provide cloud-based data platforms to help businesses manage data storage, processing, analysis, and machine learning workflows.

Compared to Snowflake, Databricks Lakehouse emphasizes combining the advantages of data lakes and data warehouses, integrating complex data structures that are difficult to process in traditional data lakes with efficient query and analysis capabilities, supporting ACID transactions and stream processing. Snowflake, on the other hand, focuses more on achieving seamless integration of data lakes and data warehouses on a single platform, supporting structured and semi-structured data storage, and providing efficient query capabilities, though its architecture does not particularly emphasize transactional support and stream processing, leaning more towards efficient batch processing and analysis.

Databricks' valuation surpasses that of Snowflake - the new round of financing values Databricks at 62 billion dollars.

Snowflake focuses on cloud data warehousing, aiming to provide a high-performance, distributed data storage and query platform, especially adept at storing, querying, and analyzing structured and semi-structured data, and also offers powerful data sharing and multi-cloud support. Databricks similarly focuses on data storage as well as processing and analysis, but with the generative AI wave led by ChatGPT sweeping the globe, both software companies concentrating on data platforms are shifting their business focus towards new generative AI products that integrate the data platform ecosystem. This shift is also a core logic behind Snowflake's strong performance in the latest quarterly results and the recent significant rise in stock prices.

Databricks provides a highly integrated cloud platform that not only helps enterprises efficiently call Databricks' data processing and analysis modules through a generative AI chatbox, offering a convenient operation path for non-IT professionals, but also supports the development, training, and deployment of generative AI large models (such as OpenAI GPT, Transformer models, etc.). By integrating with OpenAI and MLflow, Databricks assists enterprises in realizing the application of generative AI, simplifying the workflows of data science, model training, and deployment.

Snowflake provides several convenient data solutions based on generative AI for data storage, processing, and Big Data analysis, helping users directly utilize ready-made AI models and services on its platform. These services include text generation, NLP analysis, image generation, etc., and are already integrated with the Snowflake cloud data warehouse, allowing enterprises to quickly access the platform's ecosystem within the Snowflake cloud platform, simplifying workflows in data science and analysis.

Under the wave of AI, the valuation of new generation software companies like Databricks is expected to continue expanding.

Databricks CEO Ali Ghodsi stated in a media interview that maintaining such an exceptionally strong growth rate requires expanding Databricks' market promotion and talent in AI engineering. Regarding potential acquisitions, Ghodsi mentioned that he is looking for startups focused on AI applications to acquire key technologies and talent.

Ghodsi emphasized in the interview, "There are many very smart people out there with lots of good ideas, but maybe their monetization plans haven't gone according to plan, and we might be able to help."

Databricks focuses on developing data processing Software and has recently shifted its business focus to processing, extracting, and analyzing extremely complex data from various sources to build AI-based applications. Its main competitors are generally considered to be Snowflake, as well as similar services offered by some cloud infrastructure providers, such as Microsoft’s Fabric.

Some institutional investors and hedge funds have been waiting for Software leader Databricks' initial public offering (IPO), but the company's strong ability to continuously raise large amounts of money from private markets allows it to keep postponing its schedule for listing on the US stock market, and its valuation is likely to continue to expand significantly before the IPO. Ultimately, benefiting greatly from the AI wave, the probability of Databricks' valuation exceeding $100 billion before its listing is very high.

"Theoretically, we would go public as early as next year," Ghodsi stated. "This gives us some flexibility in providing liquidity opportunities for our employees."

It is understood that in the latest round of financing, other supporters include Singapore's sovereign wealth fund GIC Pte Ltd., as well as Insight Partners and WCM Investment Management. According to insiders, Lightspeed Venture Partners also participated in the deal. One insider stated that the company invested $0.2 billion in this round of financing and requested anonymity due to the discussion involving private information. Representatives from Lightspeed and Databricks declined to comment on the details of this round of financing.

The company stated that its most direct competitor in the data warehouse product segment, Databricks SQL, generated revenue of $0.6 billion, with a year-on-year growth rate of over 150%. The company reported that over 500 customers spend more than $1 million annually on the Databricks data warehouse platform.

This funding will also be used to help pay taxes related to employee stock sales. Last week, Bloomberg reported that Databricks is seeking about $2.5 billion in debt from private credit institutions to help offset the associated tax burden.

Thrive has participated in other major employee stock buyout offers or significant transactions allowing employees to sell their shares, including companies like the AI industry’s strongest unicorn OpenAI, valued at up to 159 billion USD, and the payment sector unicorn Stripe.

"This has become the expectation of employees, as the alternative is to go to Google or Meta to obtain highly liquid stocks," said Hanks from Thrive. "These are indeed very unique situations that enable these startups to compete with large technology companies."

According to CB Insights, Databricks' latest valuation has dramatically expanded from about 50 billion USD in November to 62 billion USD, second only to a few non-public private companies like OpenAI and SpaceX.

Looking ahead, Analysts widely expect that Databricks, along with software companies like the 'strongest AI unicorn' OpenAI, will see continued expansion in valuation. Analysts anticipate that under the epic AI boom, software companies will have stronger revenue data as a core pillar for valuation increases, and software companies are expected to continue leading the AI investment wave, which is the core logic behind the recent surge in stock prices for software giants such as Snowflake, Amazon, Salesforce, ServiceNow, Palantir, and AppLovin.

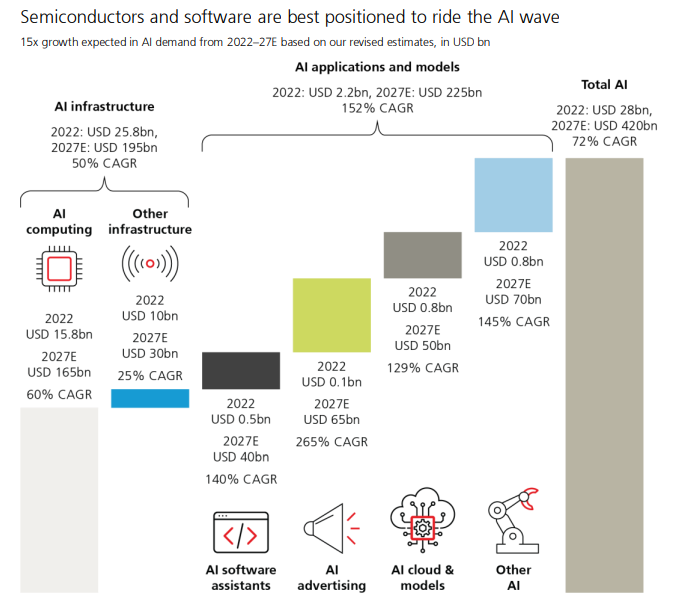

A research report released by international banking giant ubs group shows that the global technology industry has just begun a large-scale performance growth cycle. ubs expects that by 2027, ai technology will achieve extremely widespread application in various industries across major economies, thereby pushing the ai large models and ai software applications to become a segmented market valued at 225 billion dollars, a massive leap compared to only 2.2 billion dollars in 2022, with a compound annual growth rate expected to reach 152%. ubs also predicts that the total revenue scale of the ai industry will increase 15-fold, rising from approximately 28 billion dollars in 2022 to 420 billion dollars in 2027.

据了解,此轮Databricks融资的领投方为风险投资界巨头Thrive Capital,参投方包括Andreessen Horowitz和DST Global等风投公司。“这些家伙都是执行机器。他们已经准备好成为一家上市公司了,”Thrive Capital合伙人汉克斯(Vince Hankes)在接受媒体采访时表示。“筹集一笔资金,并且为员工提供流动性,可以减轻初创企业面临的压力。”

据了解,此轮Databricks融资的领投方为风险投资界巨头Thrive Capital,参投方包括Andreessen Horowitz和DST Global等风投公司。“这些家伙都是执行机器。他们已经准备好成为一家上市公司了,”Thrive Capital合伙人汉克斯(Vince Hankes)在接受媒体采访时表示。“筹集一笔资金,并且为员工提供流动性,可以减轻初创企业面临的压力。”