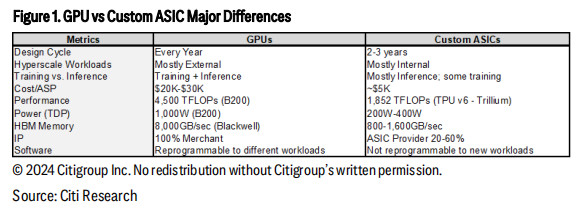

Citigroup believes that NVIDIA's GPUs can be reprogrammed through CUDA to adapt to different workloads, which is NVIDIA's greatest advantage. Citigroup maintains a "Buy" rating on NVIDIA and sets its "Target Price" at $175, indicating that NVIDIA still has about a 34% potential upside.

With the recent performance disclosures from Marvell and Broadcom, which greatly exceeded expectations, investors are starting to worry whether NVIDIA's GPUs will be replaced by customized ASIC chips.

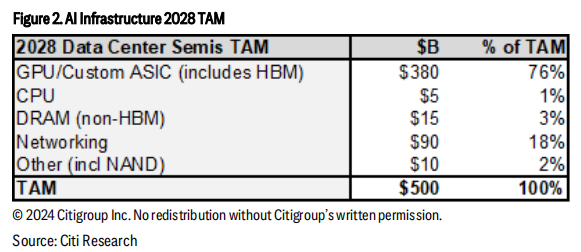

On December 17, Citigroup Analysts Atif Malik and Papa Sylla released a report supporting NVIDIA, reaffirming that "the two types of chips will coexist." Citigroup expects that by 2028, the total market size (TAM) for AI accelerators will reach $380 billion, with AI GPUs taking the dominant position, holding 75% of the share, while ASICs will only account for 25%.

Analysts believe that NVIDIA's GPUs can be reprogrammed through CUDA-supported software and adapt to different workloads, which is NVIDIA's biggest advantage.

Analysts believe that NVIDIA's GPUs can be reprogrammed through CUDA-supported software and adapt to different workloads, which is NVIDIA's biggest advantage.

Citigroup also stated that while the share of ASIC unit combinations might exceed 35% by 2028, the sales share of ASICs could be limited to around 25% due to the higher average selling price (ASP) of AI GPUs.

Additionally, Citigroup's supply chain discussion indicates that NVIDIA's Cowos foundry's capacity allocation is expected to grow from 56% in 2024 to 60% in 2025, showing that GPUs will still maintain strong growth momentum in 2025.

Citi maintained a "Buy" rating on NVIDIA and set its Target Price at $175, which also indicates about a 34% potential upside for NVIDIA. In Post-Market Trading, NVIDIA's stock price increased by 0.53%.

分析师认为,英伟达的

分析师认为,英伟达的