① At 3 a.m. on Thursday, Beijing time, the Federal Reserve is about to announce the December interest rate decision, which has attracted the attention of thousands of investors; ② Currently, the industry generally anticipates that the Fed will cut interest rates by another 25 basis points at this week's meeting, with almost no major suspense; ③ However, this week's interest rate cut may be the “end of the first phase of the two-stage interest rate cut cycle” by the Federal Reserve.

Finance Association, December 18 (Editor: Xiaoxiang) As the Federal Reserve's interest rate cut journey gradually shifts from the “fast track” to the “slow lane,” are investors in the global market ready to face the “bumps” of the journey?

At 3 a.m. Beijing time on Thursday, the Federal Reserve is about to announce the December interest rate decision, which has attracted the attention of thousands of investors. Federal Reserve Chairman Powell will, as usual, deliver a speech at the regular press conference half an hour later (3:30). Currently, the industry generally anticipates that the Federal Reserve will cut interest rates by another 25 basis points at this week's meeting, so there is almost no major suspense.

This will also be the third consecutive meeting of the Federal Reserve after September and November to announce interest rate cuts, and the cumulative rate cuts for the whole year are expected to reach 100 basis points.

This will also be the third consecutive meeting of the Federal Reserve after September and November to announce interest rate cuts, and the cumulative rate cuts for the whole year are expected to reach 100 basis points.

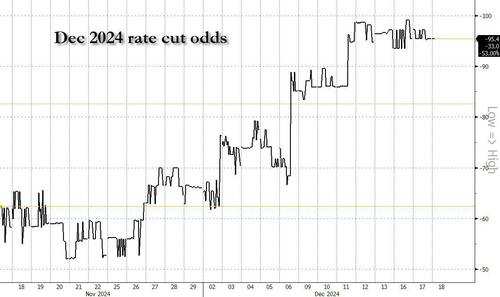

As shown in the chart below, the pricing in the interest rate swap market shows that the probability that the Federal Reserve will cut interest rates tonight has reached more than 95% — usually, such a high probability estimate is unlikely to cause an accident. Meanwhile, media surveys also showed that as many as 93 of the 103 economists surveyed expect the Federal Reserve to cut interest rates this week.

However, although tonight's interest rate cut by the Federal Reserve is almost certain, which is hardly surprising, it is likely that this will still be an unusual night of discussion. In fact, in addition to tonight's interest rate cut being the Fed's last cut in 2024, there are also some “special labels” behind it — for example, Nick Timiraos, a famous journalist known as the “New Federal Reserve News Agency,” mentioned in a recent column on Tuesday that many Fed officials have recently hinted that this week's interest rate cut may be “the end of the first phase of the two-stage interest rate cut cycle.”

What is obvious is that the prominent features of the “first phase” of the current round of the Federal Reserve's interest rate cut cycle so far are: high frequency and low threshold. Federal Reserve officials didn't start cutting interest rates “long overdue” until September this year, but as soon as they took action, it was “remarkable” — cutting interest rates by 50 basis points in one fell swoop. Interest rates were cut again last month, by 25 basis points. Meanwhile, in this so-called “first phase,” the threshold for officials to cut interest rates is relatively low because they have kept borrowing costs at a very high level before.

But now, Federal Reserve officials are facing a potential turning point — there are signs that the stability of the US labor market has improved compared to September, and inflation has also risen slightly. Under these circumstances, Powell is trying to find a more appropriate level of policy easing. He faced doubts from some colleagues about continuing to cut interest rates, and those colleagues who strongly supported the previous two interest rate cuts also weakened their confidence in continuing to cut interest rates. Meanwhile, Trump's proposed trade, immigration, regulatory, and tax policy reforms are likely to reshape America's economic growth, employment, inflation, and even debt prospects over the next few years.

As a result, many industry insiders now believe that entering the “second phase” of the Fed's interest rate cut cycle after next year: the “pace of the Fed's interest rate cut will be slower, and the threshold will also be raised.” If you want to achieve an uninterrupted “triple drop” like the end of this year, it may not be something that can be easily achieved...

Highlights of tonight's Fed resolution ①: Will it suggest suspending interest rate cuts in January?

Judging from tonight's interest rate decision, one point that investors are quite concerned about is undoubtedly whether the Federal Reserve will hint at suspending interest rate cuts in January.

If it feels necessary, it is entirely possible that the Federal Reserve will make some subtle hints in its policy statement after the meeting. Of course, Federal Reserve Chairman Powell may also actively or passively (be asked by reporters) about this topic at the press conference after the meeting.

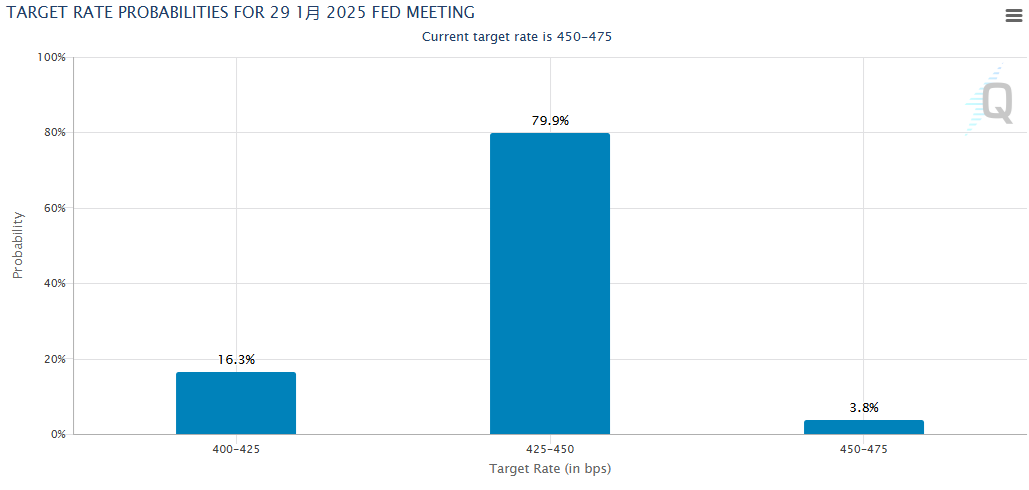

According to CME's US Federal Reserve's observation tool, traders currently expect only a 16.3% chance that the Fed will cut interest rates further to 4.00%-4.25% in January.

Obviously, there are currently not a few Wall Street institutions that think the Federal Reserve may use this interest rate meeting as an opportunity to release a signal to suspend or slow down the pace of interest rate cuts. Yardeni Research believes in a report last Sunday that Federal Reserve Chairman Powell may use the press conference after the meeting to convey to investors the message that the next interest rate decision will be to suspend interest rate cuts. The agency said, “Since September 18, after cutting interest rates by a full 100 basis points, we expect Powell to send a signal at the press conference after the December meeting that the Federal Reserve will temporarily suspend further easing.”

Goldman Sachs chief economist Jan Hatzius shared a similar view. In a report last Sunday evening, he said, “The main message we expect from the December meeting is that the FOMC expects to slow down the pace of interest rate cuts in the future.” Hatzius has removed the expectation that the Fed will cut interest rates in January next year, and expects the Fed to cut interest rates three times in March, June, and September next year.

Danske Bank, on the other hand, believes that Powell's speech will seek to remain neutral, but he may still verbally open the door to slowing down the pace of easing.

Recently, some Federal Reserve officials have actually begun to suggest that they need to see more specific evidence that inflation is improving or the labor market is deteriorating before they can continue to reduce borrowing costs.

Cleveland Federal Reserve Chairman Beth Hammack (Beth Hammack) said earlier this month: “We have reached or are close to the point where we should slow down the pace of interest rate cuts.” She mentioned with appreciation the two interest rate cuts in the 90s of the last century. At that time, the Federal Reserve cut interest rates rapidly. The cumulative rate cut was 0.75 percentage points, then wait-and-see.

Highlights of tonight's Fed decision ②: How many times can interest rates be cut next year?

Apart from whether to suggest that interest rate cuts will be suspended in January, another place in tonight's Federal Reserve resolution that directly reflects the “hawk pigeon” attitude of officials is undoubtedly the US Federal Reserve interest rate bitmap published every quarter. This famous key chart may answer two topics that the market is particularly concerned about: How many times will the Federal Reserve cut interest rates next year? Where does the Federal Reserve currently consider the ideal neutral interest rate?

The so-called neutral interest rate refers to an interest rate level that neither stimulates nor inhibits economic activity; it is the interest rate level that officials dream of. But determining the level of neutral interest rates is not an easy task, and economists have a range of estimates. The closer the Federal Reserve is to a neutral interest rate estimate, the less sufficient reason to cut interest rates if inflation is strong and the labor market does not weaken.

However, the ideal neutral interest rate in the eyes of the Federal Reserve will also directly influence the judgments of officials on how many times interest rates should be cut next year. Federal Reserve Chairman Powell said earlier this month that a strong economy means that the Fed doesn't have to “rush” to cut interest rates without ###, but there are few details about the pace of interest rate cuts. He also stressed that the Federal Reserve is not sure where the “neutral” interest rate actually is; “it can only be known through practice.”

At the time of the September meeting this year, the median predictions of the Federal Reserve's policy path in the interest rate bitmap showed that interest rate cuts this year and next will each reach 100 basis points. However, after a series of stubborn inflation readings and careful comments from Federal Reserve officials, the current forecast of the rate cut in 2025 has clearly been questioned.

Many major Wall Street banks have recently begun to anticipate that the Federal Reserve may cut interest rates one less time next year (compared to the September estimate) — in other words, it may only cut interest rates by 75 basis points in total. Some even predict that the Federal Reserve may eventually cut interest rates by only 50 basis points — a level roughly comparable to current swap market pricing.

Former Cleveland Federal Reserve Chairman Meister also recently stated that the Federal Reserve's previous forecast of cutting interest rates “must be reconsidered” and predicted that the pace would “slow down” in 2025. She thought, “Cutting interest rates two to three times seems appropriate to me.”

Danske Bank, on the other hand, predicts that the median federal funds rate may rise 25 basis points from the September bitmap to 3.625% by the end of 2025. At the same time, the bank said that in view of recently released data and the latest statements from some members of the committee, the possibility of a 50 basis point increase cannot be ignored. Long-term interest rate estimates may rise to more than 3.0% from 2.9% in September.

Goldman Sachs, on the other hand, predicts that tonight's median value of the Fed's bitmap will show three interest rate cuts in 2025 (to 3.625%), two interest rate cuts in 2026 (to 3.125%), and interest rates remain flat at 3.125% in 2027. These estimates are all 25 basis points higher than the September bitmap. Furthermore, Goldman Sachs expects the median long-term or neutral interest rate to rise 0.125 percentage points to 3%.

(Goldman Sachs's prediction of changes in the bitmap)

Overall, one basic judgment we can draw from these investment bank predictions is that if the Fed's bitmap reduces the estimated number of interest rate cuts next year to three, it is actually roughly in line with expectations. If it were to shrink further to two, it would be an even more hawkish result. Another detail worth noting is that the Federal Reserve's estimate of long-term interest rates may rise further to 3%.

What else do investors need to keep in mind tonight?

In terms of other details, Goldman Sachs believes that the key question of the Federal Reserve's policy statement is whether officials will put more emphasis on slowing down the pace of interest rate cuts, or whether they will still make decisions based on data from each meeting. Goldman Sachs expects that the Federal Reserve will simultaneously convey these two messages and add related hints to the statement.

The US Federal Reserve's Quarterly Economic Outlook (SEP), which covers interest rate bitmaps, will also show the Fed's latest forecast for the economy, inflation, unemployment rate, and interest rates tonight. This will also be important in judging the future direction of the Fed's monetary policy.

According to the Wells Fargo report, the Federal Reserve's latest forecast will show the extent to which the US economy is stronger than expected in the near future. The median forecast for real gross domestic product (GDP) growth in 2025 and 2026 will be 0.1 or 0.2 percentage points higher than the September forecast, and the unemployment rate forecast may fall 0.1 percentage points. Inflation forecasts for 2025 and 2026 will be revised by 0.1 or 0.2 percentage points in the face of increased price pressure recently.

The Dutch International Group believes that the Federal Reserve's current economic growth and inflation forecast for the end of 2024 will be slightly raised, and the unemployment rate forecast will drop slightly, but the agency does not expect the Federal Reserve to drastically change its forecast for 2025.

Furthermore, Goldman Sachs expects the Federal Reserve's forecast for next year's unemployment rate to remain the same as this year (both 4.2%), while the forecast for next year's inflation rate will reach 2.4%, up from 2.1% in September.

It is worth mentioning that the minutes of the Federal Reserve's November meeting also showed that some policymakers thought it would be valuable to consider making “technical adjustments” to the quoted interest rate of the overnight reverse repurchase agreement (ON RRP) to match the bottom of the federal funds rate target range. Whether the Federal Reserve will implement relevant changes in tonight's resolution is also worth the attention of investors.

The overnight reverse repurchase agreement interest rate plays a role in the three important components of the Federal Reserve's short-term interest rate. The other two are the excess reserve interest rate (IOER) and the US federal funds rate (FER). The overnight reverse repurchase agreement interest rate usually represents the lower limit of the federal funds rate corridor.

“Battle of the Old Enemy”: Will Powell Mention Trump 2.0 Influence?

Finally, tonight's US Federal Reserve resolution actually has a rather interesting suspense. That is, as the last interest rate meeting before Trump comes to power, will Powell express his views on the impact of Trump's 2.0 policy?

“New Federal Reserve News Agency” Nick Timiraos mentioned on Tuesday that trade, immigration, regulatory, and tax policy reforms proposed by Trump may reshape economic growth, employment, and inflation prospects in the next few years. Federal Reserve officials will probably start thinking about dealing with these changes at this week's meeting.

For example, deporting illegal immigrants and reversing loose immigration policies may push up wages but dampen demand. Tariffs may drive up prices, but they can also reduce profit margins, push up the dollar, or dampen business confidence. Any increase in energy production could help offset price increases in other sectors.

Powell has said that the Federal Reserve should not speculate or risk speculating on the impact of these policies. In a speech earlier this month, Powell listed a series of unknowns about tariffs, including which products and countries will face tariffs, the size of tariffs, how much warning companies will receive, and how other countries will respond. “We'll have to wait and see what changes,” he said.

However, some former Federal Reserve officials have argued that the Federal Reserve should include potential immigration and trade changes in their predictions because these policies do not require congressional approval.

Eric Rosengren (Eric Rosengren), who was the chairman of the Boston Federal Reserve from 2007 to 2021, said, “If you want to make predictions in mid-December, it's hard to ignore what is expected to happen on January 20 (Trump takes office).”

这也将是美联储继9月和11月之后,连续第三次会议宣布降息,全年的累计降息幅度则料将就此达到100个基点。

这也将是美联储继9月和11月之后,连续第三次会议宣布降息,全年的累计降息幅度则料将就此达到100个基点。