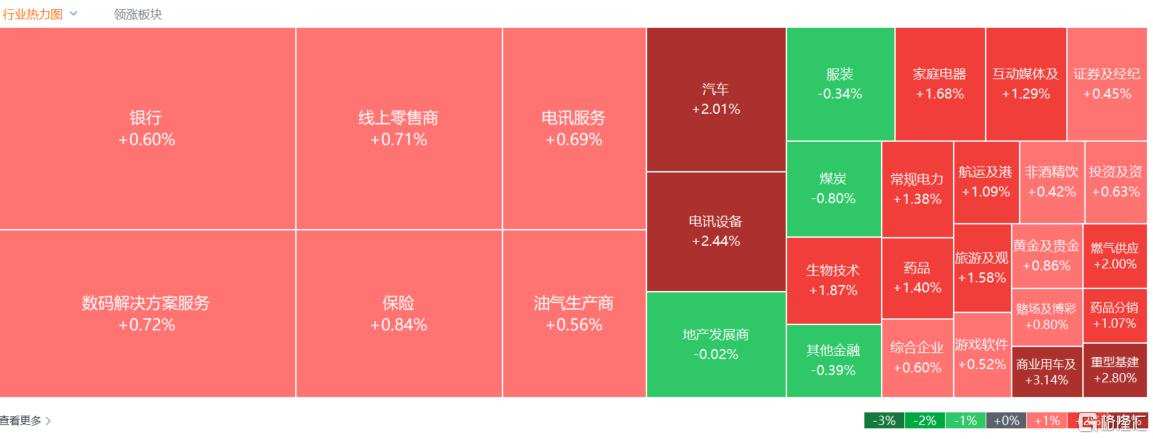

On December 18, the three major indices of Hong Kong stocks rose collectively, stopping their continuous decline, and market sentiment picked up. The Hang Seng Technology Index surged to 2.3% in the afternoon and finally closed up 1.82%. The Hang Seng Index and China Index rose 0.83% and 1.06% respectively.

On the market, large technology stocks rose across the board. Xiaomi rose nearly 3%, Baidu rose nearly 2%, and Jingdong rose more than 1%; the AI-driven industry will be recovering, semiconductor chip stocks will be strong throughout the day, and Hongguang Semiconductor will rise more than 7%; the effects of the automobile trade-in policy continued to show in November, and auto stocks rose significantly. Zero Sports Auto and Brilliance China had the highest gains; and the gas, wind power, and steel sectors rose all at once. On the other hand, paper stocks and aviation stocks bucked the trend, while sporting goods stocks and coal stocks partially declined.

Take a look at it specifically:

The rise in large technology stocks, which are market trends, helped the market recover. Xiaomi rose nearly 3%, Baidu rose nearly 2%, JD rose more than 1%, and Meituan, Kuaishou, Tencent, Alibaba, and NetEase all rose.

The rise in large technology stocks, which are market trends, helped the market recover. Xiaomi rose nearly 3%, Baidu rose nearly 2%, JD rose more than 1%, and Meituan, Kuaishou, Tencent, Alibaba, and NetEase all rose.

The semiconductor sector rose, with Hongguang Semiconductor up 7.64%, SMIC, Huahong Semiconductor, and Shanghai Fudan by more than 2%, and Jingmen Semiconductor up more than 1%.

Auto stocks rose sharply. Zero Sports Auto and Brilliance China rose more than 6%, Ideal Auto rose more than 5%, Geely Auto and Xiaopeng Motors rose more than 4%, and NIO, BYD shares, Guangzhou Automobile Group, and Great Wall Motors followed suit. According to the news, according to data from the China Association of Automobile Manufacturers, passenger car production and sales completed 3.109 million units and 3.01 million units respectively in November, up 14.9% and 9%, respectively, from the previous year, and 14.9% and 15.2%, respectively. The China Automobile Association pointed out that the effects of the automobile trade-in policy continue to show, and promotional activities in various regions and companies continue to gain strength. Coupled with the sprint at the end of the year, it helped the passenger car market continue to strengthen and further release demand for car purchases.

Biotech stocks rallied at the end of the session. Jingtai Holdings-P rose nearly 30%, Goli Pharmaceutical-B rose more than 19%, Shengnuo Pharmaceutical-B rose more than 12%, Lepu Bio-B and Gacos-B rose more than 6%, and Pharmaceutical Kangde, Pharmaceutical Biotech, Zhaoyan New Pharmaceutical, and BeiGe Shenzhou followed suit.

Gas stocks rose. China Resources Gas rose 4.14%, Kunlun Energy rose 3.16%, and China Gas, Xinao Energy, Tianlun Gas, and Hong Kong China Gas rose more than 1%.

The power sector is flourishing. Beijing Energy International rose nearly 6%, Huadian International Power Co., Ltd. and Longyuan Electric Power rose more than 3%, Xintian Green Energy and Datang Power Generation rose more than 2%, and China Resources Electric Power, China Electric Power, and Electric Energy Industries followed suit.

The new market value management regulations for central enterprises plus dividend dividends will be cut in half. High-speed rail infrastructure stocks with Chinese characters are showing active performance. China Communications Construction rose 4.28%, China Railway, CRRC, and China Railway Construction rose more than 3%, and China Express and Times Electric rose more than 2%.

Paper stocks were the first to decline. Nine Dragons Paper fell 3.52%, while Sunshine Paper and Liwen Paper fell slightly.

Airlines stocks bucked the trend. Cathay Pacific and Air China fell more than 2%, while China Southern Airlines shares and China Eastern Airlines shares fell more than 1%.

Coal stocks partially fell, with Mongolian Energy falling 4.69%, China's Shenhua and Yancoal Australia falling more than 1%, and South Gobi and Shougang resources falling.

Today, Southbound Capital made net purchases of HK$2.07 billion, of which Hong Kong Stock Connect (Shanghai) made a net purchase of HK$2.693 billion and Hong Kong Stock Connect (Shenzhen) net sold HK$0.623 billion.

Looking ahead to the future market, Cathay Pacific Jun An pointed out that Hong Kong stocks will remain volatile, but investors need to pay attention to structural industry opportunities. The positive adjustment of macroeconomic policy is conducive to improving Hong Kong stock profit expectations and increasing market risk appetite. The gradual decline in overseas interest rates is still the main theme, and the suppression on the denominator side will continue to ease. The Hong Kong stock market is dominated by “N” type fluctuations. There is no shortage of flexible opportunities during this phase, but emphasis should be placed on actively seeking structural industry opportunities.

Suggestions in terms of industry allocation: 1) Hong Kong stock Internet leaders with improved EPS; corporate profit margins and return on investment increased after early industry pattern optimization; 2) consumer industries that benefit from policy support, recovery or resilience, including electronics, automobiles, etc.; 3) high-dividend industries with stable profits, including utilities, finance, real estate chains, telecommunications, etc. As the overall risk-free interest rate in the country falls, in particular, high-dividend enterprises benefiting from mergers, acquisitions and restructuring of central and state-owned enterprises and localized bonds are still favored by domestic investors.

作为市场风向标的大型科技股拉升助力大市回暖,小米涨近3%,百度涨近2%,京东涨超1%,美团、快手、腾讯、阿里巴巴、网易皆上涨。

作为市场风向标的大型科技股拉升助力大市回暖,小米涨近3%,百度涨近2%,京东涨超1%,美团、快手、腾讯、阿里巴巴、网易皆上涨。