Tandem Diabetes Care, Inc. (NASDAQ:TNDM) shareholders are no doubt pleased to see that the share price has bounced 25% in the last month, although it is still struggling to make up recently lost ground. Taking a wider view, although not as strong as the last month, the full year gain of 19% is also fairly reasonable.

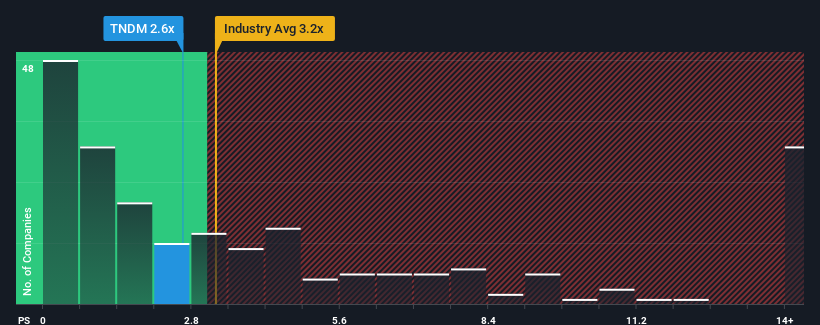

In spite of the firm bounce in price, it's still not a stretch to say that Tandem Diabetes Care's price-to-sales (or "P/S") ratio of 2.6x right now seems quite "middle-of-the-road" compared to the Medical Equipment industry in the United States, where the median P/S ratio is around 3.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

How Has Tandem Diabetes Care Performed Recently?

Tandem Diabetes Care's revenue growth of late has been pretty similar to most other companies. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

Keen to find out how analysts think Tandem Diabetes Care's future stacks up against the industry? In that case, our free report is a great place to start.How Is Tandem Diabetes Care's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Tandem Diabetes Care's is when the company's growth is tracking the industry closely.

The only time you'd be comfortable seeing a P/S like Tandem Diabetes Care's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company managed to grow revenues by a handy 11% last year. The solid recent performance means it was also able to grow revenue by 29% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 12% each year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 9.5% per annum, which is noticeably less attractive.

With this in consideration, we find it intriguing that Tandem Diabetes Care's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

Tandem Diabetes Care's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Looking at Tandem Diabetes Care's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Tandem Diabetes Care you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.