Despite an already strong run, SelectQuote, Inc. (NYSE:SLQT) shares have been powering on, with a gain of 37% in the last thirty days. The last month tops off a massive increase of 126% in the last year.

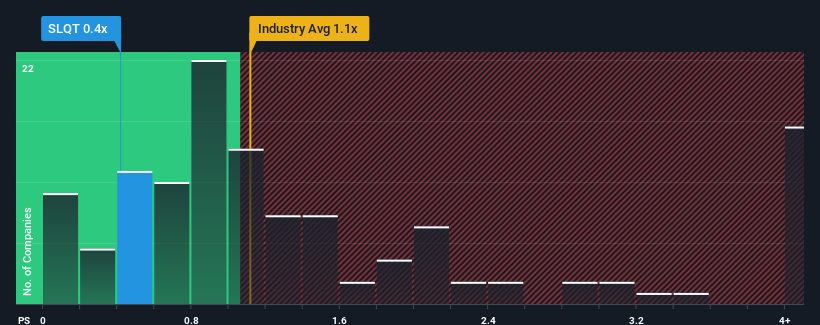

In spite of the firm bounce in price, considering around half the companies operating in the United States' Insurance industry have price-to-sales ratios (or "P/S") above 1.1x, you may still consider SelectQuote as an solid investment opportunity with its 0.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

What Does SelectQuote's Recent Performance Look Like?

Recent times have been advantageous for SelectQuote as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think SelectQuote's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For SelectQuote?

In order to justify its P/S ratio, SelectQuote would need to produce sluggish growth that's trailing the industry.

In order to justify its P/S ratio, SelectQuote would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 29% last year. Pleasingly, revenue has also lifted 43% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 9.5% over the next year. That's shaping up to be materially higher than the 3.9% growth forecast for the broader industry.

With this in consideration, we find it intriguing that SelectQuote's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

Despite SelectQuote's share price climbing recently, its P/S still lags most other companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

To us, it seems SelectQuote currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

And what about other risks? Every company has them, and we've spotted 3 warning signs for SelectQuote you should know about.

If you're unsure about the strength of SelectQuote's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.