Financial giants have made a conspicuous bearish move on Oracle. Our analysis of options history for Oracle (NYSE:ORCL) revealed 13 unusual trades.

Delving into the details, we found 38% of traders were bullish, while 46% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $147,774, and 11 were calls, valued at $506,623.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $150.0 to $210.0 for Oracle over the last 3 months.

Analyzing Volume & Open Interest

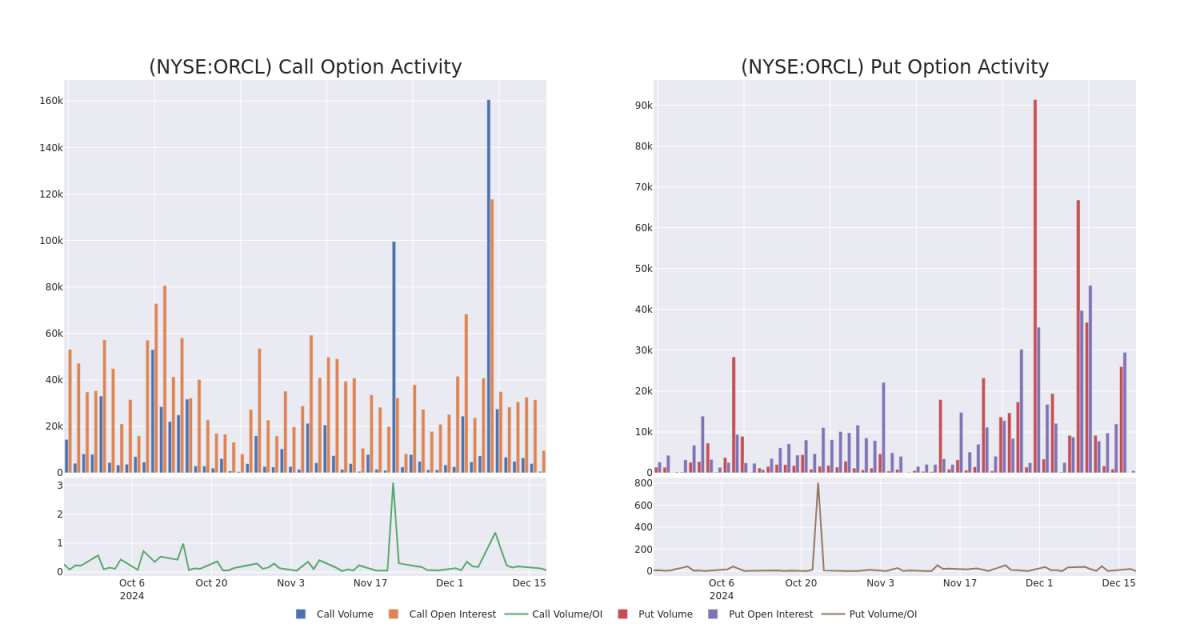

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Oracle's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Oracle's whale activity within a strike price range from $150.0 to $210.0 in the last 30 days.

Oracle Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ORCL | PUT | TRADE | BEARISH | 12/20/24 | $40.2 | $38.8 | $40.07 | $210.00 | $120.2K | 30 | 30 |

| ORCL | CALL | SWEEP | NEUTRAL | 01/15/27 | $41.65 | $41.25 | $41.65 | $160.00 | $91.6K | 52 | 31 |

| ORCL | CALL | SWEEP | BEARISH | 01/10/25 | $4.4 | $4.3 | $4.3 | $170.00 | $68.8K | 471 | 174 |

| ORCL | CALL | SWEEP | BULLISH | 01/10/25 | $2.48 | $2.35 | $2.49 | $175.00 | $59.5K | 478 | 265 |

| ORCL | CALL | SWEEP | BULLISH | 09/19/25 | $17.0 | $15.45 | $17.0 | $180.00 | $51.0K | 342 | 0 |

About Oracle

Oracle provides database technology and enterprise resource planning, or ERP, software to enterprises around the world. Founded in 1977, Oracle pioneered the first commercial SQL-based relational database management system. Today, Oracle has more than 400,000 customers in 175 countries.

Present Market Standing of Oracle

- Trading volume stands at 2,422,985, with ORCL's price up by 0.57%, positioned at $170.68.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 82 days.

Professional Analyst Ratings for Oracle

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $193.8.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from RBC Capital downgraded its action to Sector Perform with a price target of $165. * An analyst from Evercore ISI Group has decided to maintain their Outperform rating on Oracle, which currently sits at a price target of $200. * Consistent in their evaluation, an analyst from BMO Capital keeps a Market Perform rating on Oracle with a target price of $205. * In a cautious move, an analyst from JMP Securities downgraded its rating to Market Outperform, setting a price target of $205. * An analyst from Citigroup persists with their Neutral rating on Oracle, maintaining a target price of $194.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Oracle with Benzinga Pro for real-time alerts.