High-rolling investors have positioned themselves bearish on Rivian Automotive (NASDAQ:RIVN), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in RIVN often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 11 options trades for Rivian Automotive. This is not a typical pattern.

The sentiment among these major traders is split, with 45% bullish and 54% bearish. Among all the options we identified, there was one put, amounting to $44,850, and 10 calls, totaling $707,653.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $10.0 to $20.0 for Rivian Automotive over the recent three months.

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $10.0 to $20.0 for Rivian Automotive over the recent three months.

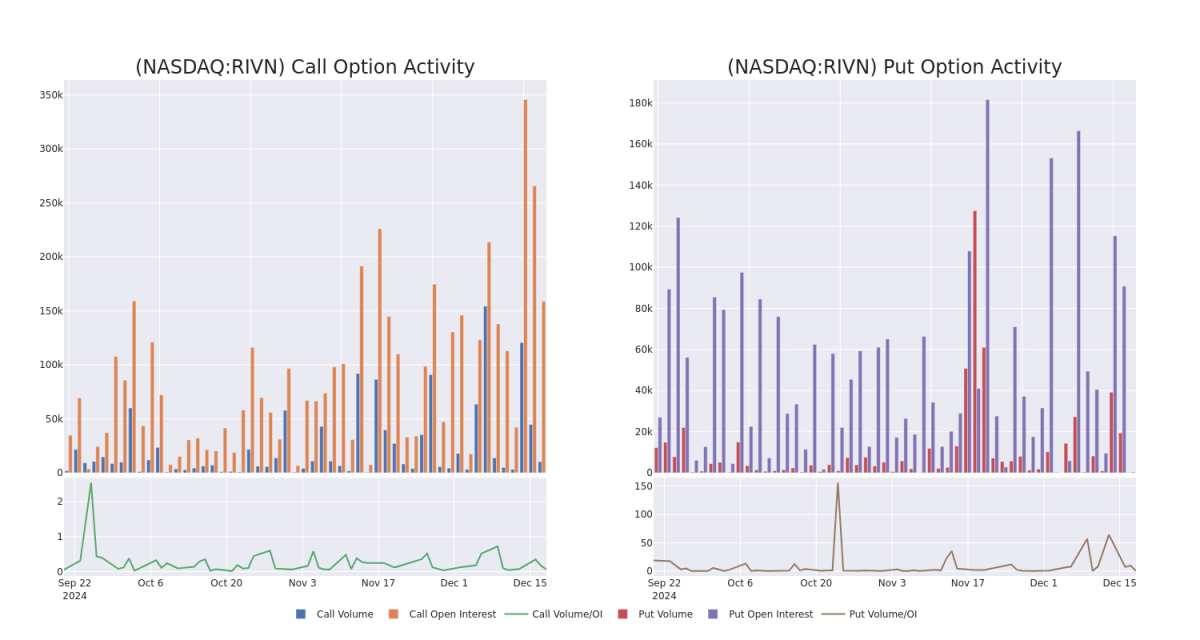

Insights into Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Rivian Automotive's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Rivian Automotive's significant trades, within a strike price range of $10.0 to $20.0, over the past month.

Rivian Automotive Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RIVN | CALL | SWEEP | BEARISH | 02/21/25 | $1.04 | $1.0 | $1.0 | $18.00 | $283.5K | 19.0K | 2 |

| RIVN | CALL | SWEEP | BULLISH | 12/20/24 | $0.4 | $0.38 | $0.39 | $14.50 | $121.3K | 4.2K | 3.4K |

| RIVN | CALL | TRADE | BEARISH | 01/17/25 | $0.37 | $0.29 | $0.29 | $20.00 | $64.8K | 34.6K | 20 |

| RIVN | PUT | SWEEP | BULLISH | 02/21/25 | $3.95 | $3.85 | $3.9 | $17.00 | $44.8K | 403 | 145 |

| RIVN | CALL | TRADE | BULLISH | 09/19/25 | $4.45 | $4.45 | $4.45 | $12.50 | $44.5K | 7.2K | 158 |

About Rivian Automotive

Rivian Automotive Inc designs, develops, and manufactures category-defining electric vehicles and accessories. In the consumer market, the company launched the R1 platform with the first generation of consumer vehicles: the R1T, a two-row, five-passenger pickup truck, and the R1S, a three-row, seven-passenger sport utility vehicle (SUV).

After a thorough review of the options trading surrounding Rivian Automotive, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Rivian Automotive

- With a volume of 22,259,019, the price of RIVN is down -3.91% at $14.12.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 63 days.

Expert Opinions on Rivian Automotive

In the last month, 1 experts released ratings on this stock with an average target price of $16.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from Baird has revised its rating downward to Neutral, adjusting the price target to $16.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Rivian Automotive with Benzinga Pro for real-time alerts.