Analysts point out that Micron was the first among comparable companies to release its Earnings Reports this quarter, playing an important role in the outlook for Technology stocks. Despite being affected by the decline in traditional DRAM Memory Chip prices, the high bandwidth memory used in AI Chips continues to boost profit margins, with Datacenter revenue growing over 400% year-on-year to a new high, and for the first time accounting for over 50% of total revenue, also setting a new record for overall revenue.

On December 18, Wednesday, after Post-Market Trading, Micron Technology, a Memory Chip manufacturer among the "AI hot camp," released its earnings for the first fiscal quarter of fiscal year 2025 ending November 28.

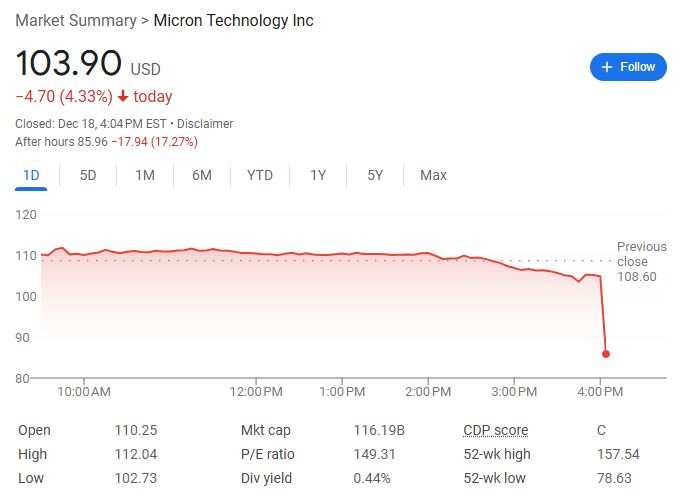

Although the company turned profitable year-on-year with a revenue surge of 84% hitting a record high in line with expectations, Datacenter revenue surpassed 50% of total revenue for the first time, and Datacenter revenue increased over 400% year-on-year and 40% quarter-on-quarter hitting a new high, the revenue guidance for the next quarter was noticeably weak, causing a drop of over 17% in after-hours trading.

Here are the key points from Micron Technology's earnings report for the first fiscal quarter of fiscal year 2025:

Here are the key points from Micron Technology's earnings report for the first fiscal quarter of fiscal year 2025:

1) Key Financial Data

Revenue: Increased by 84.1% year-on-year to $8.71 billion, and increased by 12.4% quarter-on-quarter, fully in line with market expectations.

Net income: $1.87 billion under GAAP, $2.04 billion under non-GAAP, the latter increased by 52% quarter-on-quarter, compared to a loss of $1.05 billion in the same period last year.

EPS: The adjusted non-GAAP diluted EPS is $1.79, higher than the Analyst's expectation of $1.77, compared to a loss of $0.95 per share in the same period last year.

Cash situation: The operating cash flow for the quarter was $3.24 billion, weaker than last quarter's $3.41 billion, and $1.4 billion in the same period last year. The net capital expenditure for the quarter was $3.13 billion, resulting in an adjusted free cash flow of $0.112 billion.

Shareholder returns: The Board of Directors announced a quarterly dividend of $0.115 per share, which will be paid in cash on January 15, 2025, to shareholders registered as of the market close on December 30, 2024.

2) Business data

Compute and Networking Business Segment: Revenue increased by 46% quarter-on-quarter to $4.4 billion, setting a new quarterly record and accounting for more than half of total revenue, benefiting from the demand for cloud computing service DRAM and HBM revenue, which has doubled quarter-on-quarter for two consecutive quarters.

Mobile Business Segment: Revenue decreased by 19% quarter-on-quarter to $1.5 billion, as mobile customers focused on inventory destocking, and the company adjusted supply to meet Datacenter demand.

Embedded Business Segment: Revenue decreased by 10% quarter-on-quarter to $1.1 billion, as Automotive, Industrial, and Consumer clients continued to reduce inventory.

Storage Business Department: Revenue increased by 3% quarter-on-quarter to $1.7 billion, setting a new quarterly high, driven by record revenue from Datacenter SSDs.

3) Performance guidance

Revenue: For the second fiscal quarter of fiscal year 2025 ending in February of next year, revenue is expected to be between $7.7 billion and $8.1 billion, significantly weaker than the Analyst expectation of $8.99 billion.

Profit: The adjusted EPS for the next fiscal quarter is expected to be between $1.33 and $1.53, significantly weaker than the Analyst expectation of $1.91.

Gross Margin: The adjusted gross margin for the next fiscal quarter is expected to be between 37.5% and 39.5%.

Capital Expenditure: Expected to be $3 billion.

The high-bandwidth memory (HBM) used in AI Chips continues to enhance profits, with Datacenter revenue increasing over 400% to a new high.

Micron Technology's President and CEO Sanjay Mehrotra emphasized in the Earnings Reports statement that the company achieved record revenue in the first fiscal quarter, with Datacenter revenue surpassing 50% of total revenue for the first time. Additionally, Datacenter revenue grew over 400% year-on-year and 40% quarter-on-quarter, hitting a new high.

Despite the consumer-oriented market performing weakly in the short term, it is expected to resume growth in the second half of the company's fiscal year 2025.

The company continues to gain market share in areas with the highest margins and strategic importance, and is in a very favorable position to leverage AI-driven growth to create significant value.

The company is expected to continue achieving record revenue, with significant improvements in profit margins, realizing positive free cash flow in fiscal year 2025.

Analysis of the Earnings Reports shows that Micron Technology's revenue growth in the first fiscal quarter significantly exceeded last year's 15.7% increase, but fell short of the previous quarter's 93.3% growth rate. The revenue for the first fiscal quarter met the company's expectations, and the EPS was higher than the official guidance of 1.74 dollars.

The adjusted non-GAAP gross margin for the first fiscal quarter was 39.5%, fully in line with the company's guidance of a 3 percentage point increase, compared to only 0.8% for the same period last year, partly due to the high stock price, high profit, and increased sales of high-bandwidth memory (HBM) used in AI Chips.

Micron Technology previously estimated that total revenue for the 2025 fiscal year would grow by 52% year-over-year to 38 billion USD, with EPS surging from last fiscal year's 1.30 USD to 8.78 USD.

Wall Street has high expectations for this Earnings Report, as there is optimism about strong demand for Micron Technology's HBM products from AI leaders like NVIDIA, and analysts generally expect Micron Technology to maintain good momentum in profits and revenue growth.

Elazar Advisors analyst Chaim Siegel pointed out that Micron Technology is the first mainstream company in its sector to release an Earnings Report this quarter, which could predict the trend of Semiconductors stocks and plays an important role in the near-term outlook for the Technology market.

Micron Technology fell over 4% on Thursday, with a cumulative rise of nearly 22% this year, lagging behind the benchmark NASDAQ, which has seen a cumulative increase of 29% in the same period. Before the Earnings Report was released, analysts had an average Target Price of 145.92 USD for Micron Technology, indicating there is still at least a 30% upside potential.

Micron is being dragged down by declining DRAM Memory Chip prices, with the company optimistically predicting a HBM market size exceeding 100 billion USD by 2030.

Another analysis indicated that Micron Technology's Earnings Report is primarily affected by falling prices of DRAM Memory Chips used in Smart Phones and personal computers. Due to weak Consumer demand and oversupply, this memory market remains sluggish, contributing to more than half of Micron's revenue (accounting for 75% of Q1 revenue). The statement from Micron's CEO also acknowledged that "the consumer-oriented market has shown weak performance in the short term."

Citigroup analyst Christopher Danely reaffirmed a Buy rating on the company and a high Target Price of 150 USD on Monday, but also anticipated that "due to the weak performance of the traditional DRAM market, Micron Technology's performance and guidance will slightly fall short of market expectations."

However, he remains optimistic about the recovery of the DRAM Memory market, citing supply-demand dynamics for the year 2025 as the reason.

Although there is an oversupply of DRAM inventory in the personal computer and mobile terminal market, which accounts for a total of 50% of Micron Technology's sales in fiscal year 2024, this situation is expected to be resolved by spring 2025, offset by strong growth in the datacenter terminal market, where datacenter revenue accounts for 35% of Micron's sales in fiscal year 2024.

Currently, investors are betting on Micron Technology's strategic advantage in the high-bandwidth memory chip (HBM) market, which is commonly used in AI chips to enhance performance and reduce power consumption in AI systems.

For example, Micron Technology's HBM products are being integrated into NVIDIA's H200 AI chip and the newly developed most powerful Blackwell system, making Micron one of the few companies directly participating in the rapidly growing AI market worldwide.

The CEO of Micron was optimistic in his expectations that the global market size for HBM chips will grow to approximately $25 billion by 2025, significantly higher than $4 billion in 2023, which will also boost the market size for memory chips to $204 billion in 2025.

The company's latest projections indicate that the total addressable market (TAM) for HBM will quadruple from $16 billion in 2024 to over $100 billion by 2030.

The U.S. investment research website The Motley Fool reported that Micron Technology is growing at an astonishing rate, and this trend seems likely to continue, driven by AI-powered growth and attractive valuations that entice investors, even though 'this memory expert' has seen a decline of 34% from the 52-week high reached in mid-June.

This year, the memory industry has entered a turning point. Catalysts such as AI are driving a surge in memory consumption across multiple fields, including datacenters, smart phones, and personal computers (PCs), particularly with the usage of high-bandwidth memory HBM in AI chips growing at an amazing pace.

At the same time, new catalysts such as the upcoming PC upgrade cycle and growth in the smart phone market may provide additional growth momentum for Micron.