Offcn Education Technology Co., Ltd. (SZSE:002607) shares have continued their recent momentum with a 38% gain in the last month alone. Notwithstanding the latest gain, the annual share price return of 5.1% isn't as impressive.

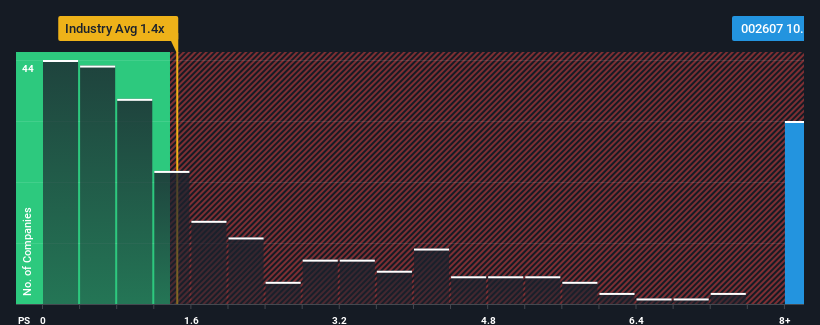

Since its price has surged higher, Offcn Education Technology may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 10.6x, when you consider almost half of the companies in the Consumer Services industry in China have P/S ratios under 4.8x and even P/S lower than 2x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

What Does Offcn Education Technology's P/S Mean For Shareholders?

Offcn Education Technology has been struggling lately as its revenue has declined faster than most other companies. Perhaps the market is predicting a change in fortunes for the company and is expecting them to blow past the rest of the industry, elevating the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Offcn Education Technology.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Offcn Education Technology's to be considered reasonable.

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Offcn Education Technology's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 30%. The last three years don't look nice either as the company has shrunk revenue by 75% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 40% as estimated by the dual analysts watching the company. That's shaping up to be materially higher than the 34% growth forecast for the broader industry.

With this in mind, it's not hard to understand why Offcn Education Technology's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Offcn Education Technology's P/S

The strong share price surge has lead to Offcn Education Technology's P/S soaring as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Offcn Education Technology's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Offcn Education Technology (1 is a bit unpleasant) you should be aware of.

If you're unsure about the strength of Offcn Education Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.