On December 19, China Cargo Airlines (001391.SZ) began the subscription. The issue price was 2.30 yuan/share, and the subscription limit was 0.396 million shares, with a price-earnings ratio of 25.56 times. It belongs to the Shenzhen Stock Exchange, and CITIC Securities is the sponsor (lead underwriter).

The Zhitong Finance App learned that on December 19, China Cargo Airlines (001391.SZ) began the subscription. The issue price was 2.30 yuan/share. The maximum purchase price was 0.396 million shares, with a price-earnings ratio of 25.56 times. It belongs to the Shenzhen Stock Exchange, and CITIC Securities is the sponsor (lead underwriter).

According to the prospectus, China Cargo Airlines carries China Aviation Group's deep air transport development accumulation, provides professional and reliable solutions for air cargo transportation needs, and has now developed into one of the major domestic aviation logistics service providers. According to the specific content and form of the services provided, Air China Cargo's main business can be divided into three segments: air cargo services, air cargo terminal services, and integrated logistics solutions.

In terms of market share, after more than 20 years of development, China Cargo Airlines has become one of the major domestic aviation logistics service providers and is representative of the industry.

In terms of market share, after more than 20 years of development, China Cargo Airlines has become one of the major domestic aviation logistics service providers and is representative of the industry.

As of June 30, 2024, Air China has 20 freighters, including 13 freighters in operation. Three additional freighters have been added since July 2024. 4 have been decommissioned and are awaiting transfer. The company's cargo and mail traffic volume and cargo and mail turnover have an advantage among domestic aviation logistics companies.

As of June 30, 2024, Air China has 6 air cargo terminals in Beijing, Chengdu, Chongqing, Tianjin and Hangzhou, providing international and domestic airlines with ground cargo handling services including air cargo and mail storage, storage area operation, platform security, document processing, and information exchange. From 2021-2023 and January-June 2024, the total ground operating cargo volume at the five cargo terminals of China Cargo Airlines was 1.2065 million tons, 0.919 million tons, 0.947 million tons, and 595,400 tons, respectively.

China Cargo Airlines focuses on developing comprehensive logistics solutions such as contract logistics and freight forwarding based on civil aviation express delivery. By the end of the reporting period, Civil Aviation Express had established branches in 42 domestic cities. Through its own network and external procurement network, the domestic logistics service network of Civil Aviation Express had covered large and medium-sized cities across the country. In addition, Civil Aviation Express has established 4 production and operation distribution centers in Beijing, Guangzhou, Shanghai, and Chengdu. It has a green express channel at some airports, which can provide express delivery and rapid delivery services.

In summary, since the establishment of China Cargo Airlines, after more than 20 years of development, it has formed a stable and mature business model, stable business performance, and has now developed into one of the major domestic aviation logistics service providers.

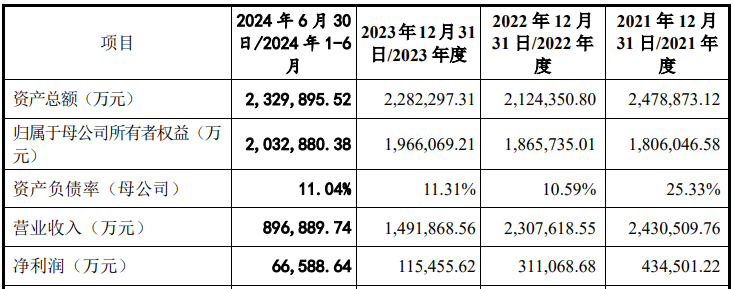

On the financial side, in 2021, 2022, 2023, and January-June 2024, Air China achieved operating income of approximately RMB 24.305 billion, RMB 23.076 billion, RMB 14.919 billion, and RMB 8.969 billion, respectively. Net profit for the same period was approximately RMB 4.345 billion, RMB 3.111 billion, RMB 1.155 billion, and RMB 0.666 billion, respectively.

在市场占有率方面,国货航公司经过20余年的发展,已经成为国内主要的航空物流服务提供商之一,具有行业代表性。

在市场占有率方面,国货航公司经过20余年的发展,已经成为国内主要的航空物流服务提供商之一,具有行业代表性。