Shenzhen Zowee Technology Co., Ltd. (SZSE:002369) shares have continued their recent momentum with a 46% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 68%.

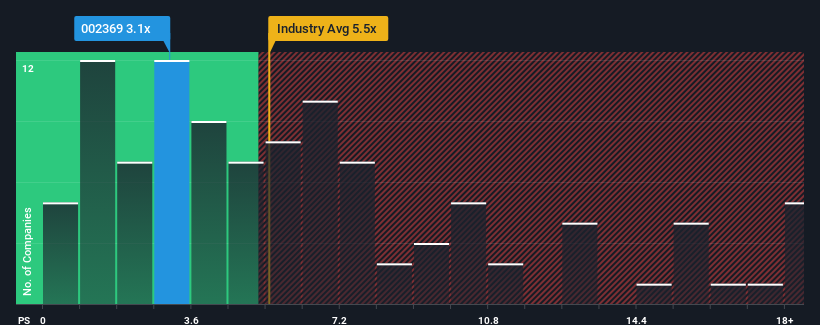

In spite of the firm bounce in price, Shenzhen Zowee Technology's price-to-sales (or "P/S") ratio of 3.1x might still make it look like a buy right now compared to the Communications industry in China, where around half of the companies have P/S ratios above 5.5x and even P/S above 9x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

How Has Shenzhen Zowee Technology Performed Recently?

Revenue has risen at a steady rate over the last year for Shenzhen Zowee Technology, which is generally not a bad outcome. It might be that many expect the respectable revenue performance to degrade, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Shenzhen Zowee Technology, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Shenzhen Zowee Technology's is when the company's growth is on track to lag the industry.

The only time you'd be truly comfortable seeing a P/S as low as Shenzhen Zowee Technology's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 6.1%. However, this wasn't enough as the latest three year period has seen an unpleasant 37% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 37% shows it's an unpleasant look.

In light of this, it's understandable that Shenzhen Zowee Technology's P/S would sit below the majority of other companies. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

What Does Shenzhen Zowee Technology's P/S Mean For Investors?

The latest share price surge wasn't enough to lift Shenzhen Zowee Technology's P/S close to the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's no surprise that Shenzhen Zowee Technology maintains its low P/S off the back of its sliding revenue over the medium-term. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

Before you take the next step, you should know about the 2 warning signs for Shenzhen Zowee Technology (1 is a bit concerning!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.