Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Zhejiang Haikong Nanke Huatie Digital Intelligence and Technology Co., Ltd. (SHSE:603300) does use debt in its business. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

What Is Zhejiang Haikong Nanke Huatie Digital Intelligence and Technology's Net Debt?

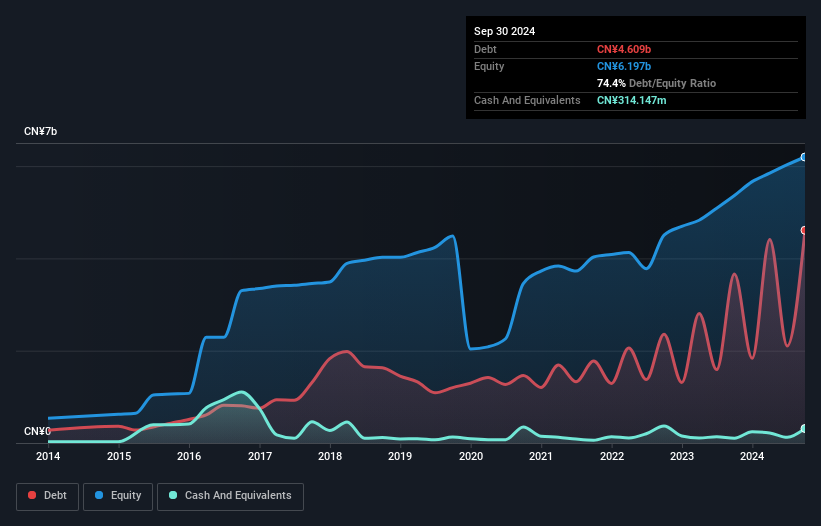

You can click the graphic below for the historical numbers, but it shows that as of September 2024 Zhejiang Haikong Nanke Huatie Digital Intelligence and Technology had CN¥4.61b of debt, an increase on CN¥3.66b, over one year. However, it does have CN¥314.1m in cash offsetting this, leading to net debt of about CN¥4.30b.

How Strong Is Zhejiang Haikong Nanke Huatie Digital Intelligence and Technology's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Zhejiang Haikong Nanke Huatie Digital Intelligence and Technology had liabilities of CN¥7.18b due within 12 months and liabilities of CN¥8.31b due beyond that. Offsetting these obligations, it had cash of CN¥314.1m as well as receivables valued at CN¥4.51b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥10.7b.

Zooming in on the latest balance sheet data, we can see that Zhejiang Haikong Nanke Huatie Digital Intelligence and Technology had liabilities of CN¥7.18b due within 12 months and liabilities of CN¥8.31b due beyond that. Offsetting these obligations, it had cash of CN¥314.1m as well as receivables valued at CN¥4.51b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥10.7b.

This is a mountain of leverage relative to its market capitalization of CN¥11.1b. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While Zhejiang Haikong Nanke Huatie Digital Intelligence and Technology has a quite reasonable net debt to EBITDA multiple of 2.5, its interest cover seems weak, at 2.1. This does have us wondering if the company pays high interest because it is considered risky. Either way there's no doubt the stock is using meaningful leverage. Zhejiang Haikong Nanke Huatie Digital Intelligence and Technology grew its EBIT by 7.1% in the last year. That's far from incredible but it is a good thing, when it comes to paying off debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Zhejiang Haikong Nanke Huatie Digital Intelligence and Technology can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the most recent three years, Zhejiang Haikong Nanke Huatie Digital Intelligence and Technology recorded free cash flow worth 75% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Neither Zhejiang Haikong Nanke Huatie Digital Intelligence and Technology's ability to cover its interest expense with its EBIT nor its level of total liabilities gave us confidence in its ability to take on more debt. But its conversion of EBIT to free cash flow tells a very different story, and suggests some resilience. Looking at all the angles mentioned above, it does seem to us that Zhejiang Haikong Nanke Huatie Digital Intelligence and Technology is a somewhat risky investment as a result of its debt. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. We've identified 2 warning signs with Zhejiang Haikong Nanke Huatie Digital Intelligence and Technology (at least 1 which is concerning) , and understanding them should be part of your investment process.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.