The Federal Reserve gives traders a reason to expect only one rate cut in 2025, leading to a violent spike in yields on US Treasury bonds across all maturities, while the USD reaches its highest point since 2022.

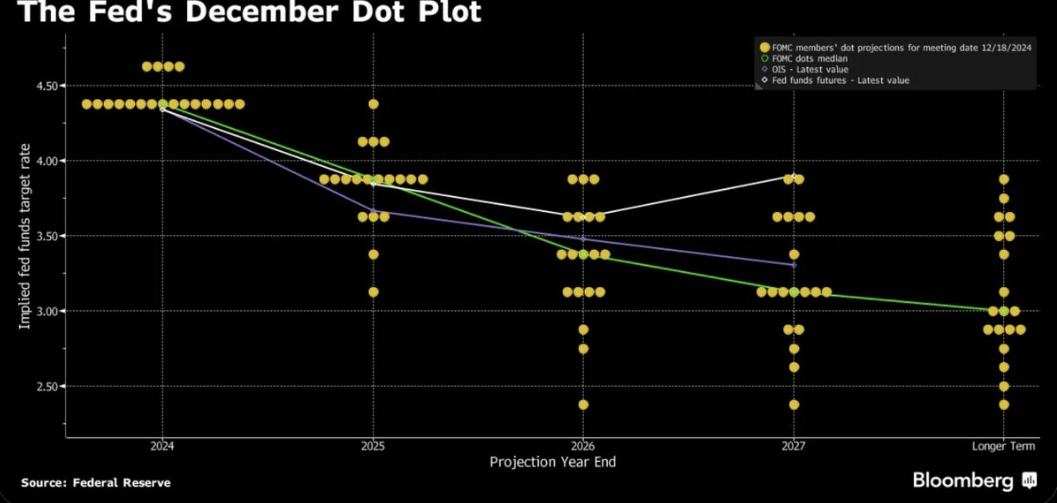

According to Zhizhong Finance APP, after the Federal Reserve's interest rate decision played out as the market expected with a "hawkish rate cut" script, the Federal Reserve's forward guidance officially entered a new phase, indicating that it is at or near the moment of slowing down rate cuts. The highly anticipated "dot plot" shows that Federal Reserve officials generally expect only two rate cuts in 2025, down from the four rate cuts indicated in September, while the long-term median federal funds rate is adjusted to 3%. Following the hawkish policy statement and Powell's hawkish remarks, the US Treasury market crashed, with yields on US Treasury bonds soaring, and the 10-year Treasury yield breaking through 4.5%. The USD jumped to its highest level since 2022, with traders viewing the revised predictions from the Fed as the core reason for the market's significant downward adjustment of rate cut expectations for next year.

The so-called "hawkish rate cut" refers to the Federal Reserve announcing a rate cut in December, but the policy statement and Powell's remarks at the press conference reflect a strong hawkish stance. As expected, the revised policy statement wording indicates that the Federal Reserve is about to slow down the pace of rate cuts. Fed Chair Powell, at the press conference following the rate cut announcement, showcased "hawkish expectations management language," emphasizing the persistent nature of inflation and that decision-makers can be more cautious while considering further interest rate adjustments. Any rate cut decision by the Federal Reserve in 2025 will be based on forthcoming data.

The large-scale sell-off of US Treasuries has caused the short-term Treasury yield, which is more sensitive to changes in Fed policy, to generally rise by more than 10 basis points, reaching its highest level in several weeks. Regarding the USD, the "Bloomberg Dollar Spot Index" surged by 1% on Wednesday, marking a long time since a gain of such magnitude for the index. This index measures the strength of the dollar and surged to its highest point since 2022. The strengthening USD has led to declines in other major currencies. On that day, the Euro, British Pound, and Swiss Franc all fell by 1% against the dollar. The USD index has risen by more than 7% so far this year and appreciated significantly against all currencies of developed countries, likely achieving its best annual performance since 2015.

The large-scale sell-off of US Treasuries has caused the short-term Treasury yield, which is more sensitive to changes in Fed policy, to generally rise by more than 10 basis points, reaching its highest level in several weeks. Regarding the USD, the "Bloomberg Dollar Spot Index" surged by 1% on Wednesday, marking a long time since a gain of such magnitude for the index. This index measures the strength of the dollar and surged to its highest point since 2022. The strengthening USD has led to declines in other major currencies. On that day, the Euro, British Pound, and Swiss Franc all fell by 1% against the dollar. The USD index has risen by more than 7% so far this year and appreciated significantly against all currencies of developed countries, likely achieving its best annual performance since 2015.

As expected by the market, the Federal Reserve on Wednesday cut interest rates three times in a row and hinted that the pace of rate cuts next year may slow significantly. Traders responded to the Fed's new expectations management model and widely lowered rate cut expectations for 2025. The "CME FedWatch Tool" shows that interest rate futures traders generally bet on only one rate cut by the Federal Reserve next year, in contrast to the expectations before the Fed's interest rate decision, where bets were concentrated around three rate cuts.

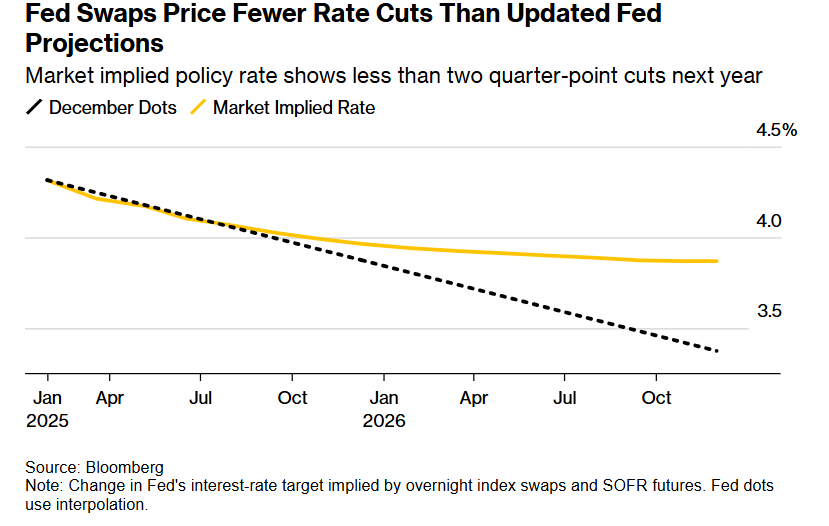

Priya Misra, a portfolio manager at JPMorgan's Asset Management division, stated after Powell's remarks: "This is absolutely a hawkish style rate cut from the Federal Reserve." The Federal Reserve's forecasts show that officials now generally expect only two rate cuts next year, each by 25 basis points. The Federal Reserve even gives traders a reason to see only one rate cut in 2025. Swap market traders expect even fewer rate cuts; they are betting on only one rate cut in 2025.

The interest rate cut implied by the Fed's swap pricing is fewer than the Fed's latest forecast - the market-implied policy rate indicates that the cut next year will be less than two times.

In Wednesday's policy statement, the Fed conveyed its monetary policy signals and a cautiously hawkish 'expectations management tone,' announcing a reduction in the target range for the federal funds rate to 4.25%-4.5%. At the press conference, Chairman Powell pointed out that the recent rise in inflation is the primary reason for the rate hike guidance.

The revised 'quarterly median forecast for the federal funds rate' from the Fed shows that officials widely expect the rate to be 3.875% by the end of 2025 and 3.375% by the end of 2026. Both of these medians are a full 50 basis points higher than the median in September. The latest median expectation for the long-term neutral rate (the theoretical level that neither stimulates nor restricts economic expansion) has been raised from 2.90% to 3%.

Ed Hosseini, an interest rate strategist from Columbia Threadneedle Investment, stated that the so-called dot plot and related economic forecasts indicate that a significant number of Federal Open Market Committee voters (i.e., members of the Fed's FOMC) no longer believe that the current policy path is restrictive.

After announcing a cut of 25 basis points on Wednesday Eastern Time, the benchmark rate set by the Fed is now a full percentage point lower than the most recent peak level - the highest rate in over twenty years. Powell mentioned that after the latest measures, the policy rate is 'closer to a neutral level.'

The latest rate forecasts in the dot plot from Fed officials are closer to investor expectations prior to the meeting, even more 'hawkish' than the majority of investors expected. Since mid-September, based on economic growth and inflation data, investors' expectations for the neutral rate have risen significantly. Before the announcement of the rate decision, swap contracts related to future Fed decisions priced in a cut of 25 basis points today and another 50 basis points next year, with very little chance of a cut in January. After the release of the dot plot and Powell's press conference, the pricing for next year's rate cuts was significantly reduced, with even pricing starting to suggest no cuts next year. A recent report from Deutsche Bank indicated that the bank expects the Fed to pause rate cuts for the entire year and believes the Fed's easing cycle is essentially stalled.

US bond yields surged, with the 'global asset pricing anchor' breaking through 4.5%.

In the US Treasury market, the yield on the two-year US Treasury bond, which is most sensitive to interest rate expectations, rose by 11 basis points to 4.35%, surpassing the three-month US Treasury yield for the first time since March 2023. The increase in yields on longer-term bonds was relatively smaller. Nevertheless, the 10-year US Treasury yield, known as the 'anchor of global asset pricing,' broke through the important threshold of 4.5%, and is expected to set the largest post-rate meeting increase since the Federal Reserve meeting in June 2013, triggered by signals that central bank asset purchases would soon slow, which led to a collapse in the US Treasury market at that time.

The policy rate set by the Federal Reserve is a key influence on Treasury yields. Since September, traders' expectations for further rate cuts have gradually diminished, pushing the 10-year US Treasury yield back above 4%, reaching its highest level since July. The 10-year US Treasury yield, seen as a benchmark for risk-free returns, remains hovering above 4.5%, having risen over 85 basis points since mid-September, causing losses for investors who bought at lower yield levels.

The latest revised economic forecast summary from Federal Reserve officials indicates that US economic growth will be faster than what they projected in September, while they also expect the pace of unemployment to decline more rapidly. However, inflation is expected to be higher than the projections made in September.

Bond investors are also noting that the tax and tariff policies advocated by the incoming president Donald Trump, who will be inaugurated next month, could significantly spur economic growth. However, the potential for the resurgence of inflation has greatly expanded, and the increasing size of the US government deficit may continuously drive up the yield curve of the 10-year US Treasury bonds.

Top US asset management firm T. Rowe Price believes that as the fiscal difficulties in the USA worsen and Donald Trump's policies lead to rising inflation, the 10-year US Treasury yield could reach 6% for the first time in over 20 years. T. Rowe's Chief Investment Officer for fixed income, Arif Husain, stated in a report that the benchmark 10-year US Treasury yield could first reach 5% in the first quarter of 2025, and then potentially rise further. Husain further raised the forecast for US Treasury yields due to Trump's tax cuts during his second presidential term, which could sustain the US budget deficit, and potential tariff and immigration policies that will keep US price pressures persistent.

As traders begin to worry that Trump's policies will stimulate inflation and increase US fiscal pressure, the outlook for US Treasury bonds has become increasingly bleak. T. Rowe Price's expectation of a 10-year yield of up to 6% seems more pessimistic than some of its peers, as ING Groep believes that the 10-year US Treasury yield may reach 5% to 5.5% next year, while Franklin Templeton and JPMorgan Asset Management believe it could reach 5%.

From a theoretical perspective, the yield on 10-year US Treasuries corresponds to the risk-free interest rate indicator r in the important valuation model in the stock market - the DCF valuation model. If other indicators (especially cash flow expectations on the numerator side) do not show significant changes, a higher denominator level or sustained operation at historical highs will lead to a contraction in valuations of risk assets such as US technology stocks, high-risk corporate bonds, and Cryptos, which are currently at historical high valuations.

Gregory Farinello, head of US rate trading and strategy at AmeriVet Securities, stated: "We even believe that the Federal Reserve has completed its tasks for next year. The Trump administration will take action, and the Federal Reserve is the goalkeeper."

The Federal Reserve's anti-inflation ambition aims to reduce the inflation rate to the long-term average of 2% or even below year-on-year. However, the inflation rate rose to 2.3% in October. The PCE inflation indicator for November to be released on Friday is expected to show a year-on-year increase of 2.5%, with core PCE possibly rising to 2.9%.

"It was expected that US Treasury yields would rise after Trump was elected in November," said Bridger Kularna, a portfolio manager at Wellington Management. "I expect that if inflation remains at current levels, the Federal Reserve may remain inactive throughout next year."

The dollar skyrocketed to the highest level in two years and is expected to continue to rise substantially in 2025.

After the Federal Reserve hinted that monetary easing would slow significantly next year, the dollar index rebounded to its highest level in over two years. The "Bloomberg Dollar Spot Index" surged 1% on Wednesday Eastern Time, the highest level since 2022. This surge caused a significant decline in other sovereign currencies' Exchange Rates; on that day, the Euro, British Pound, and Swiss Franc all fell by more than 1% against the dollar.

So far this year, the dollar index has risen significantly by over 7%, increasing against all sovereign currencies of developed countries, and is expected to be the best-performing year since 2015.

Skyler Montgomery Coning, a Forex strategist at Barclays, stated after the Federal Reserve meeting that with strong economic data, the Fed's expectations have become more hawkish, supporting the rise of the dollar.

Helen Givens, a Forex trader at Monex, stated, "Given the changes in the median inflation forecast, the Fed seems to be starting to anticipate the potential inflation impacts of Trump's new trade policies." "This is the secret to the dollar index strengthening at least before the monetary policy meeting in January next year, or at least not experiencing substantial weakness."

President-elect Donald Trump vowed to impose strict tariffs on many American trading partners, which contributed to a significant rebound of the dollar before Trump's official inauguration. The rebound continues as the performance of the USA economy and the level of Treasury yields outperform many other countries. Meanwhile, many global central banks will have to significantly lower borrowing costs to help boost weak economic data.

"Every detail of the Fed's policy statement and Powell's speech is undeniably hawkish," stated Paresh Upadhya, head of fixed income and Forex strategy at Amundi US. "All of this implies that the dollar will strengthen significantly as it continues to amplify the 'growth exception' narrative of the USA economy under Trump’s leadership."

On Wednesday, a benchmark indicator measuring emerging market currencies against the dollar fell by 0.4% to its lowest level since August. The Brazilian Real's exchange rate against the dollar dropped by about 3% that day, hitting a historic low as investors grew increasingly concerned about the country's fiscal crisis.

"With the divergence in monetary policy paths and other factors continuing to emerge, we expect the dollar to strengthen significantly by 2025," said Brendan McKenna, an emerging markets economist and Forex strategist at Wells Fargo & Co in New York, prior to the Fed's interest rate decision. Wells Fargo predicts that the dollar will rise by an average of about 5% to 6% against the major sovereign currencies of the Group-of-10 next year.

However, Wall Street strategists are beginning to forecast that the world reserve currency, the dollar, will peak in mid-next year at the earliest, and then start to decline significantly against other sovereign currencies later in 2025, as the rate cut cycle in other parts of the world begins to recover, and economic growth in countries outside the USA starts to outperform that of the USA. From Morgan Stanley to JPMorgan, about six renowned sell-side strategists are now predicting that the dollar will peak no earlier than mid-next year and then start to decline, with Société Générale expecting the ICE dollar index to drop by about 6% before the end of next year, stating recently, "The strength of the dollar is nauseating, and we are pushing the price of an asset to levels that are unsustainably high in the long term."

此次美债大举抛售使得对于美联储政策变化更为敏感的短期美债收益率普遍上涨超过10个基点,达到数周以来的最高水平。美元方面,“彭博美元现货指数”周三大涨1%,对于该指数来说有很长一段时间未出现类似幅度涨幅,这一衡量美元强弱的指数一举升至2022年以来的最高点。美元走强导致其他主要货币走低。当日,欧元、英镑和瑞士法郎兑美元汇率均下跌1%,美元指数今年迄今已上涨超过7%,相对于发达国家的所有货币均大幅升值,有望创下自2015年以来的最佳年度表现。

此次美债大举抛售使得对于美联储政策变化更为敏感的短期美债收益率普遍上涨超过10个基点,达到数周以来的最高水平。美元方面,“彭博美元现货指数”周三大涨1%,对于该指数来说有很长一段时间未出现类似幅度涨幅,这一衡量美元强弱的指数一举升至2022年以来的最高点。美元走强导致其他主要货币走低。当日,欧元、英镑和瑞士法郎兑美元汇率均下跌1%,美元指数今年迄今已上涨超过7%,相对于发达国家的所有货币均大幅升值,有望创下自2015年以来的最佳年度表现。