Innosecco, a leading company in the global gallium nitride (GaN) industry, which has successfully passed the Hong Kong Stock Exchange hearing, uploaded and published an H share prospectus on December 18. The H shares issued by the company this time are CICC and CMB International as co-sponsors of the IPO. The shares are expected to start trading on the Stock Exchange on December 30, 2024.

The company has entered into cornerstone investment agreements with Cornerstone investors STMicroelectronics Limited (“STHK”, a wholly-owned subsidiary of STMicroelectronics), Jiangsu State-owned Enterprise Mixed Ownership Reform Fund (“Jiangsu State-owned Enterprise Mixed Reform Fund”), Jiangsu Suzhou High-end Equipment Industry Special Parent Fund (limited partnership) (“High-end Suzhou Equipment”), and Suzhou Oriental Chuanglian Investment Management Co., Ltd. (“Oriental Chuanglian”). Among them, STHK's parent company is STMicroelectronics, a world-renowned and leading IDM semiconductor company. Its innovations include advanced technologies such as microcontroller MCU, microprocessor MPU, silicon carbide SiC, and gallium nitride GaN.

Specifically, STHK subscribed for 50 million US dollars, the Jiangsu State-owned Enterprise Mixed Reform Fund subscribed for 25 million US dollars, and Dongfang Chuanglian and Suzhou High-end Equipment each subscribed for 12.5 million US dollars. The support of these cornerstone investors provided significant financial security and market confidence for Innosecco's listing.

According to the prospectus, the prospectus for H shares is from December 18 to December 23, 2024. The prospectus for Innosecco H shares ranges from HK$30.86-33.66 per share. The company plans to sell 45.364 million H shares globally, 4.5364 million shares in Hong Kong, China, 40.8276 million shares, and an additional 15% overallotment rights; Innosecco plans to raise up to HK$1.527 billion through this IPO.

According to the prospectus, the prospectus for H shares is from December 18 to December 23, 2024. The prospectus for Innosecco H shares ranges from HK$30.86-33.66 per share. The company plans to sell 45.364 million H shares globally, 4.5364 million shares in Hong Kong, China, 40.8276 million shares, and an additional 15% overallotment rights; Innosecco plans to raise up to HK$1.527 billion through this IPO.

According to information, Innosecco is a leader in the global gallium nitride chip manufacturing field, and is also a leader in the global power semiconductor revolution. It has been on the Hurun Research Institute's “Global Unicorn List” for two consecutive years. The company adopted the IDM full-industry chain business model and was the first in the world to achieve an advanced process for mass production of 8-inch gallium nitride. So, what is the reason why Innosecco is focusing on the gallium nitride circuit?

Since this year, multiple factors, such as the recovery in demand for traditional consumer electronics and AI-driven industry innovation, have formed a strong driving force, prompting the global semiconductor market to show vitality and enter a strong upward boom cycle. Some brokerage agencies clearly state that the semiconductor industry, as the foundation of modern information technology, plays an extremely critical role in the development of new quality productivity. Among them, segments such as semiconductor materials are on the cusp of new investment opportunities.

And where will the core strengths and highlights of Innoseco, which are in the offering period? Let's find out next.

The 10 billion gold track has sufficient potential for development

Looking at industry development from a macro perspective, the field where Innosecco is based is in a golden period of rapid industry growth. It has a broad range of applications and shows great potential.

As a leader in third-generation semiconductor materials, gallium nitride (GaN) stands out from traditional semiconductor materials with its excellent performance advantages. Gallium nitride not only has a wider band gap, but also has characteristics such as high electron mobility, high switching frequency, low on-resistance, etc., and is also resistant to high voltage and high temperature. These comprehensive advantages provide strong support for its application in various fields. It is worth mentioning that the wide bandgap characteristics of gallium nitride enable it to work stably in a higher voltage environment, while its high electron mobility greatly enhances its current driving capacity and response speed, significantly reduces heat loss, thereby improving overall power efficiency.

Figure 1: Main characteristics and advantages of gallium nitride

Data source: Company prospectus, compiled by Gelonghui

Looking at application scenarios, gallium nitride power semiconductor products are widely adopted in various application scenarios such as fast charging for smart devices, automotive-grade charging applications, and data centers due to their high frequency, low loss, and high cost performance. This has also brought the gallium nitride industry into a golden age of exponential growth.

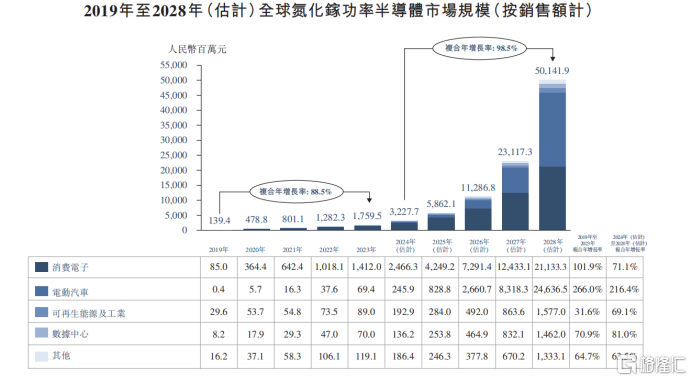

According to Frost & Sullivan data, the global gallium nitride power semiconductor market has experienced impressive growth, rapidly rising from RMB 0.139 billion in 2019 to RMB 1.8 billion in 2023, with a compound annual growth rate of 88.5%. As the penetration rate of gallium nitride continues to increase in various application scenarios, the market size is expected to break the 50 billion yuan mark in 2028, and the compound annual growth rate from 2024 to 2028 will reach 98.5%. The share of gallium nitride power semiconductors in the global power semiconductor market is expected to increase to 10.1% by 2028.

Among the segments of the gallium nitride power semiconductor market, the consumer electronics and electric vehicle sectors are expected to be the main drivers of future growth.

Taking consumer electronics as an example, as the widespread application and penetration rate of gallium nitride power semiconductors in the field of fast charging and adapters for electronic products continues to rise, the market size in this field is expected to reach 21.133 billion yuan by 2028, and the compound growth rate from 2024 to 2028 will reach 71.1%.

In the field of electric vehicles, the application of gallium nitride power semiconductors is also showing a rapid growth trend. As the penetration rate of gallium nitride in the electric vehicle sector continues to increase, and the value of gallium nitride power semiconductors required for each electric vehicle increases, the market size in this field is expected to soar to 24.637 billion yuan in 2028, and the compound growth rate from 2024 to 2028 will reach an astonishing 216.4%.

Figure 2: Global GaN Power Semiconductor Market Size

Data source: Company prospectus, compiled by Gelonghui

Global leader, made in China

Gallium nitride semiconductor products are attracting attention for their broad application prospects, yet entering this field did not happen overnight.

Looking at the top five power semiconductor companies in the world, they all generally use the IDM model. This model gives companies control over the entire process from design, manufacturing to testing. However, this model is also accompanied by high upfront investment costs, stringent technical requirements, and high entry barriers to the industry.

Among these, Innosecco, as a leader in the semiconductor industry in China, has chosen the IDM model since its inception and is committed to building a gallium nitride production base integrating design, R&D, production and sales.

Today, Innosecco has not only achieved a historic breakthrough in third-generation semiconductors in China, but has also become the leader in the global gallium nitride power semiconductor market. Its market share is as high as 33.7% (based on 2023 revenue), making it the “light of domestic products”.

Figure 3: Innosecco's competitive landscape among global gallium nitride power semiconductor companies

Data source: Company prospectus, compiled by Gelonghui

At present, Innosecco has launched a series of product solutions in various fields, such as lidar, data centers, 5G communication, high-density and efficient fast charging, wireless charging, car chargers, and LED lighting drivers, etc., and has established deep cooperative relationships with many top domestic enterprises and entered the mass production stage.

From a production capacity perspective, Innosecco has a significant first-mover advantage with its efficient production efficiency, low production costs, and relatively high wafer yield. Compared with the traditional 6-inch production process, Innosecco pioneered large-scale production using the most advanced 8-inch production process, increasing the number of wafer grains produced by 80% and reducing the cost of a single device by 30%. At the same time, the company's wafer yield exceeds 95% (data as of June 30, 2024). This figure is also higher than the average product yield of about 90% to 95% of other gallium nitride power semiconductor manufacturing companies.

According to public information, the company has two 8-inch silicon-based gallium nitride production sites in Suzhou and Zhuhai, China. As of June 30, 2024, the monthly production capacity has increased from 10,000 wafers per month at the end of 2023 to 12,500 wafers per month, continuing to strengthen its position as the manufacturer with the highest production capacity of gallium nitride devices in the world.

From the perspective of commercial layout, while continuing to develop business in China, the company is also targeting the global market. While the company is building a factory in mainland China, it has also set up subsidiaries in Silicon Valley, Seoul, Belgium, etc. According to the prospectus, the company's overseas sales revenue in 2023 was nearly RMB 58 million, accounting for nearly 10% of the total revenue for the same period. In mid-2024, this figure has further increased to 10.5%. The global business layout helps to rapidly increase the company's popularity and global influence, and promote the continuous rapid development of the company's business.

Summarize

In recent years, top-level design has paid more and more attention to the development of the third-generation semiconductor industry, and the industry represented by gallium nitride is ushering in a golden period of development under the policy spring.

Among them, as a leading global gallium nitride company, Innosecco's strength should not be underestimated. Whether in R&D, production or commercialization, the company is in a leading position in the industry, with remarkable comprehensive competitive advantages and strong development momentum.

Currently, InnoSec has entered the H share recruitment period, and the probability that it will complete the Stock Exchange listing transaction within the year is increasing. Investors are advised to pay more attention to avoid missing out on this opportunity.

据招股书,英诺赛科H股招股日为2024年12月18日至12月23日,英诺赛科H股的招股价介乎30.86-33.66港元/每股,公司拟全球发售4536.4万股H股,中国香港发售股份453.64万股,国际发售股份4082.76万股,另有15%的超额配股权;英诺赛科计划通过此次IPO募集最多15.27亿港元。

据招股书,英诺赛科H股招股日为2024年12月18日至12月23日,英诺赛科H股的招股价介乎30.86-33.66港元/每股,公司拟全球发售4536.4万股H股,中国香港发售股份453.64万股,国际发售股份4082.76万股,另有15%的超额配股权;英诺赛科计划通过此次IPO募集最多15.27亿港元。