Behind the divergence between performance and stock price, has Kanzhun encountered a growth ceiling, and how will it break through?

Thanks to the catchy phrase 'Find a job, talk to the boss,' Kanzhun-W (02076) has gained popularity across the country. In the third quarter of 2024, it reported impressive results: Net income increased by 8.9% year-on-year to 0.464 billion yuan, setting a new record for a single quarter. Previously, the adjusted net income in the second quarter also reached a historic high, showcasing a smooth growth momentum.

However, at the same time, the capital markets reacted coldly to this 'report card': after releasing the interim results at the end of August, the company's Hong Kong stock price experienced three consecutive declines, dropping over 10% to reach a historical low of 43 Hong Kong dollars on September 2; following the announcement of the third quarter results last week, the stock price also reversed its upward trend from the beginning of the month, showing a decrease for several days.

Looking back at the stock price since the company's listing, the current price of 53.55 Hong Kong dollars is nearly halved compared to the historical high of 98 Hong Kong dollars, and there is still a gap from the range of 57-58 Hong Kong dollars at the beginning of the year.

Looking back at the stock price since the company's listing, the current price of 53.55 Hong Kong dollars is nearly halved compared to the historical high of 98 Hong Kong dollars, and there is still a gap from the range of 57-58 Hong Kong dollars at the beginning of the year.

Behind the divergence between performance and stock price, has Kanzhun encountered a growth ceiling, and how will it break through?

The net income performance is impressive, but the growth of B-end paying users is slowing.

Since turning losses into profits in 2022, Kanzhun has frequently announced good news, achieving an unexpected revenue of 5.95 billion yuan for the entire year in 2023, and the performance in 2024 remains excellent.

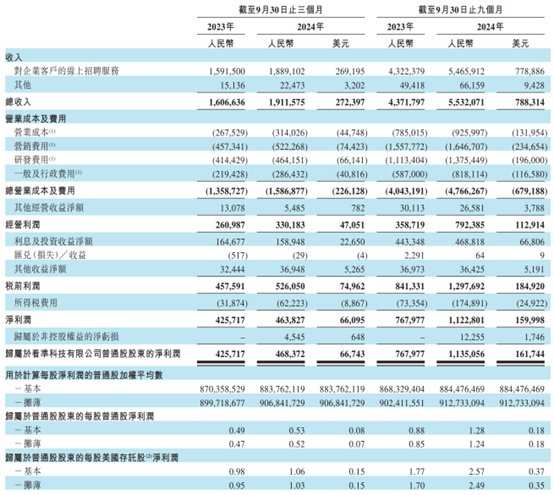

According to Zhituo Finance APP, in the first half of 2024, the company recorded a year-on-year revenue increase of 30.9% and a profit increase of 92.5%, with operating profit growing by 372.9% compared to the same period last year; in the third quarter, the company's performance continued to grow steadily, with quarterly revenue increasing by 19% to approximately 1.912 billion yuan, net income increasing by 8.9% to 0.464 billion yuan, and adjusted net income growing by 3.5% to about 0.739 billion yuan.

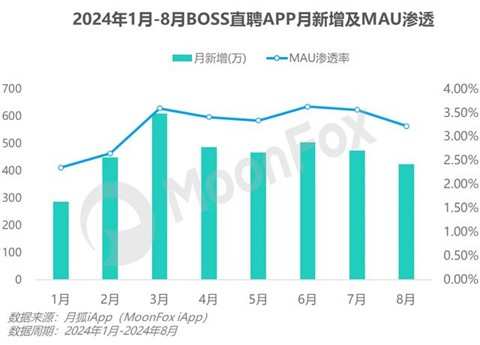

In terms of core operational data, as of September 30, 2024, the number of corporate clients who paid for Kanzhun's services was 6 million, a year-on-year increase of 22.4%; the average monthly active users for the third quarter reached 58 million, a 30% year-on-year growth; in the third quarter, the number of new job postings on the platform increased by 18% year-on-year; from January to September 2024, the total number of newly registered and completed users exceeded 40 million.

Behind the rapid growth in performance is the unique charging model of Kanzhun's services. According to reports, Kanzhun adopts a dual charging model for job seekers and recruiters; on one hand, the platform provides various service packages at different price points and paid tools such as 'Talent Bomb' and 'Exposure Refresh Card' to companies with recruitment needs, while on the other hand, job seekers can purchase VIP packages to enhance resume rankings and exposure or buy job-related services such as competitive analysis and occupational personality assessments.

Public information shows that Kanzhun's 618 VVIP package is available in different price tiers such as standard and premium versions, priced between 0.015 million yuan and 0.022 million yuan, with differences in job posting duration, industry characteristics, exposure level, and other aspects across price tiers.

The diverse paid services allow Kanzhun to cover a wide range of large, medium, and small companies with different recruitment needs and willingness to pay. The more companies that use the platform, the more job seekers can be attracted, enabling more efficient and precise matching, facilitating both sides in the job market.

According to data from Yuehu iAPP, in July, the average monthly active users (MAU) for Zhaopin and 51Job were 25 million and 15.6 million respectively, while Kanzhun alone reached an MAU of 58 million in the third quarter, far exceeding its competitors, establishing a relatively leading market position.

However, from the current income structure, Kanzhun's revenue mainly comes from the B-end, which refers to the businesses posting job vacancies. In Kanzhun's nearly 2 billion yuan revenue in the third quarter, the online recruitment service revenue from corporate clients reached 1.889 billion yuan, accounting for 98.8%. Although the various value-added paid revenues contributed by the 58 million monthly active users grew by 49% compared to the same period last year, the revenue scale of 22.5 million yuan is still significantly lower than that of the former.

In addition, the slowdown in the growth of paid corporate users is also a potential negative factor. In the second quarter, the company had 5.9 million paid corporate users on its platform, netting an increase of 0.2 million users; in the third quarter, the number of paid corporate users reached 6 million, with a net increase of 0.1 million users, showing a clear decline in growth rate.

Looking ahead, the company currently expects total revenue for the fourth quarter of 2024 to be between 1.795 billion yuan and 1.81 billion yuan, an increase of 13.6% to 14.6% year-on-year. This figure is a significant "shrinkage" compared to the 46% revenue growth in the fourth quarter of 2023.

Is the increasingly competitive job market dragging down business growth?

Beyond the fundamentals, the increasingly severe employment situation may also cast a shadow on Kanzhun's prospects.

According to data from the Ministry of Education, the number of graduates from universities in China in 2022, 2023, and 2024 were 10.76 million, 11.58 million, and 11.79 million respectively, while the number of graduates from general universities across the country in 2025 is expected to reach 12.22 million, an increase of 0.43 million year-on-year.

However, as the number of graduates continues to rise, the decrease in job positions has also made it increasingly "competitive" for fresh graduates to find jobs. Some media have reported that the total number of job openings among 25 major Internet Plus-Related companies decreased by 242 compared to the data from 2023, with roles in functions and marketing shrinking by over 20%.

The market is not performing well, and the most affected are undoubtedly small and medium-sized enterprises with lower risk resilience, which make up the "core group" of Kanzhun. According to Zhito Finance APP, in the 3.58 billion yuan online recruitment service revenue of Kanzhun in the first half of the year, over 3 billion yuan came from small and medium-sized enterprises (clients contributing 0.05 million yuan or below per year). The reduction in expense budgets and weakened willingness to pay by businesses will undoubtedly have a negative impact on the company's performance.

Signs of growth reaching a peak are already evident in the Earnings Reports. Previously, Kanzhun's management stated that cash receipts in the second quarter were slightly lower than expected due to reduced recruitment demand and Consumer desire on the client side in the latter half of the second quarter, with fewer consumers and many job seekers, while demand for blue-collar jobs was better than white-collar jobs.

In this situation, Kanzhun also has to seek new Business growth points, and the areas the company is focusing on are the blue-collar market, which has previously been rarely ventured into by Internet Plus-Related recruitment platforms.

Can testing the blue-collar market break through?

Blue-collar groups such as migrant workers, factory workers, welders, foundry workers, and couriers have long faced many pain points in the employment market, including information asymmetry and low employment efficiency.

According to the "Employment Research Report of China's Blue-Collar Group (2022)" released by the New Employment Forms Research Center of China, in 2021, the scale of blue-collar laborers in China exceeded 0.4 billion, accounting for 69.4% of the employment population in the secondary and tertiary sectors, and exceeding 53% of the total employment population of 0.747 billion in China.

However, this massive group, which occupies more than half of the employment population, is more accustomed to finding jobs through recommendations from acquaintances or directly applying in person. Although platforms like 58.com provide some job opportunities online, the employment market has long lacked authoritative platforms and information, making it more challenging for job seekers to gather and compare information across platforms, leading many to discover after starting a job that the compensation differs significantly from their expectations, resulting in higher employee turnover.

According to Zhitong Finance APP, in order to enter the blue-collar recruitment market, Kanzhun has launched the "Hailuo Selection" service, claiming to conduct in-depth verification of details such as salary, benefits, and treatment for the jobs of partner companies, and regularly visit selected positions offline to ensure the authenticity and accuracy of recruitment information. In addition, the company is helping the blue-collar workforce seek jobs online by simplifying registration procedures, optimizing algorithms, and using map positioning. In the second quarter, Kanzhun's "Hailuo Selection" revenue exceeded 40 million yuan, achieving rapid growth compared to the first quarter.

However, in the blue-collar online recruitment sector, the short video and live streaming platforms that have already established a presence in the lower market will be strong competitors to Kanzhun. Public information shows that as early as 2022, the proportion of job seekers using short video and live streaming platforms exceeded that of online recruitment websites/App, and in the same year, the monthly active users of a leading live streaming platform's recruitment sector reached 0.25 billion, with over 5 million job-related live streaming sessions held throughout the year, and the total number of companies providing jobs reaching 0.24 million.

In the face of competitors that already have a massive blue-collar user base, it remains unknown how much market share the "latecomer" Kanzhun can capture. Multiple adverse factors are dragging down future growth expectations, and if Kanzhun wants to convince investors to put real money on the table, it may need to provide more persuasive arguments.

回顾公司上市以来股价,不仅目前的53.55港元相比历史高点98港元已近乎腰斩,相比年初57-58港元的区间也还有一定距离。

回顾公司上市以来股价,不仅目前的53.55港元相比历史高点98港元已近乎腰斩,相比年初57-58港元的区间也还有一定距离。